Lightspeed Announces Second Quarter 2025 Financial Results and Raises Adjusted EBITDA Outlook for Fiscal 2025

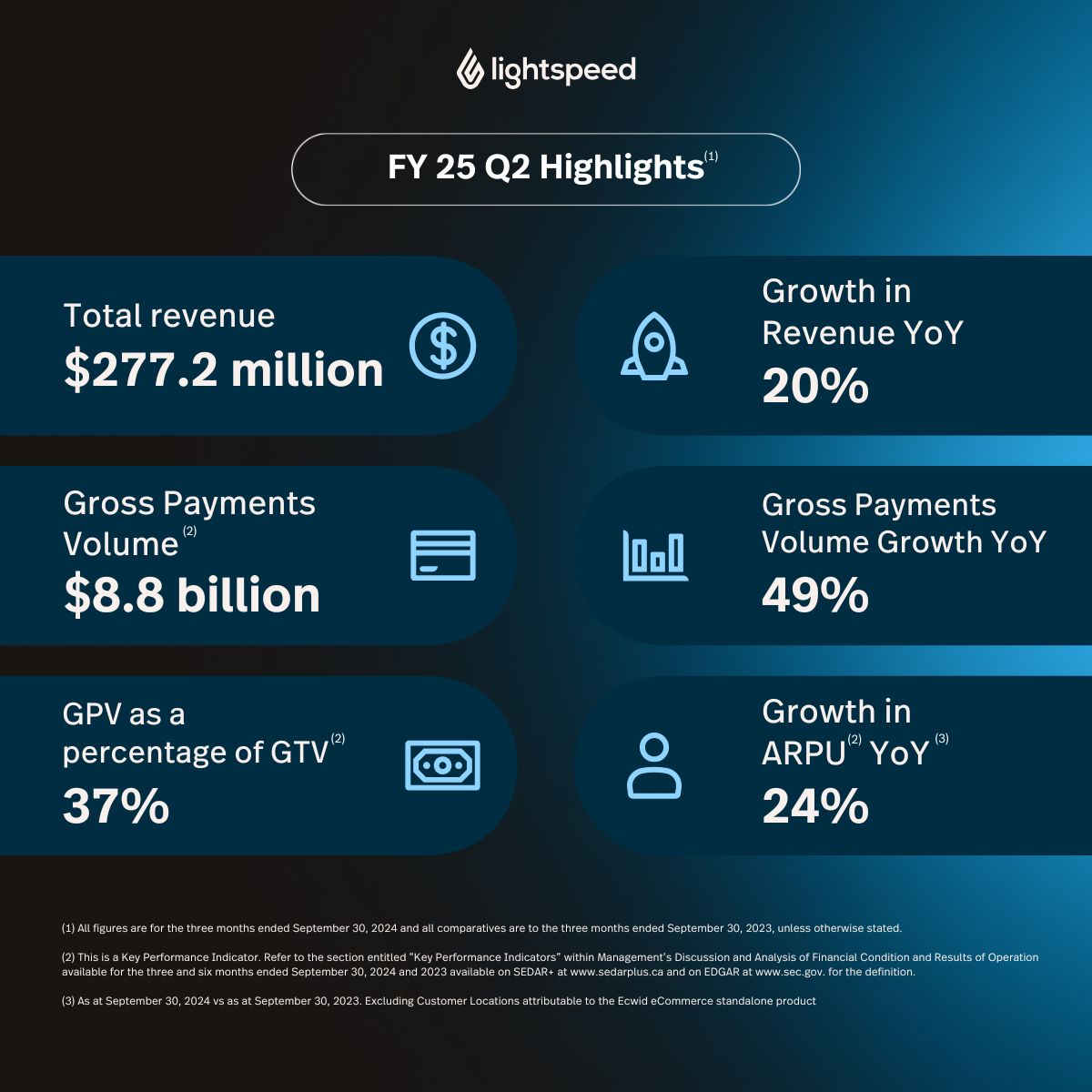

Total revenue of $277.2 million grew 20% year-over-year and exceeded outlook

Net loss improved to ($29.7) million and positive Adjusted EBITDA1 of $14.0 million exceeded outlook of $12 million

The monthly ARPU2 in the quarter grew 24% year-over-year to ~$527

Gross profit of $114.3 million, increased by 19% year-over-year

Lightspeed raises Fiscal 2025 Adjusted EBITDA1 outlook3 to a minimum of $50 million from a minimum of $45 million

Lightspeed reports in US dollars and in accordance with IFRS.

Lightspeed Commerce today announced financial results for the three and six months ended September 30, 2024. Lightspeed is the unified POS and payments platform for ambitious entrepreneurs to accelerate growth, provide the best customer experiences and become a go-to destination in their space.

“I am proud to announce that on a trailing twelve month basis, Lightspeed now exceeds $1 billion in revenue. And we continued our rapid pace of product innovation, releasing dozens of new features in the quarter aimed at helping complex, high-volume SMBs to manage and grow their businesses,” said Dax Dasilva, Founder and CEO. “Our differentiated product offerings have enabled us to develop a strong competitive position, particularly for retail in North America and hospitality in Europe. These are areas where we have a proven right to win and where we will be prioritizing our efforts in the future.”

“Our initiatives aimed at expanding payments adoption and controlling costs are working, with Lightspeed delivering record Adjusted EBITDA and positive Adjusted Free Cash Flow,” said Asha Bakshani, CFO. “While continuing to invest in product and go-to-market to help fuel software growth, we also remain focused on continuing to improve Adjusted EBITDA which we now expect to come in at a minimum of $50 million in Fiscal 2025.”

Second Quarter Financial Highlights

(All comparisons are relative to the three-month period ended September 30, 2023 unless otherwise stated):

- Total revenue of $277.2 million, an increase of 20% year-over-year.

- Transaction-based revenue of $183.8 million, an increase of 33% year-over-year.

- Subscription revenue of $85.5 million, an increase of 6% year-over-year.

- Net loss of ($29.7) million, or ($0.19) per share, as compared to a net loss of ($42.5) million, or ($0.28) per share, and Adjusted Income1 of $19.9 million, or $0.13 per share 1 , as compared to Adjusted Income 1 of $6.4 million, or $0.04 per

share. - Adjusted EBITDA1 of $14.0 million versus Adjusted EBITDA1 of $0.2 million.

- Cash flows used in operating activities of $11.3 million as compared to cash flows used in operating activities of $24.8 million, and Adjusted Free Cash Flow1 of $1.6 million as compared to Adjusted Free Cash Flow1 used of $17.2 million.

- As at September 30, 2024, Lightspeed had $659.0 million in cash and cash equivalents.

_________________________________________

1 Non-IFRS measure or ratio. See the section entitled “Non-IFRS Measures and Ratios" and the reconciliation to the most directly comparable IFRS measure or ratio.. |

2 Excluding Customer Locations attributable to the Ecwid eCommerce standalone product. |

3 Financial outlook. See the section entitled “Financial Outlook Assumptions” in this press release for the assumptions, risks and uncertainties related to Lightspeed’s outlook, and the section entitled “Forward-Looking |

Second Quarter Operational Highlights

- Lightspeed delivered several new product releases in the quarter including:

- Retail Insights globally, providing retailers with a comprehensive set of data-driven tools to better understand their sales and inventory.

- Multi-Location Ordering, enabling merchants to create one purchase order for multiple locations and automatically distribute stock based on inventory plans.

- Instant Payouts expanded to retailers in the UK.

- Custom sections for Instant Site, enabling merchants to create and design customized websites and app sections for their eCommerce sites.

- Benchmarks & Trends in the U.S. for hospitality customers, leveraging machine learning to transform data into actionable insights for restaurateurs, with planned release in EMEA in Fiscal 2026.

- New Sales Summary page, allowing hospitality customers to spot trends faster using improved data visualizations.

- Happy Hour to Order Anywhere, our online ordering module, allowing restaurants to dynamically adjust online pricing during promotional periods.

- ARPU2,4 increased to ~$527 from ~$425 in the same quarter last year representing an increase of 24% driven by our focus on our unified POS and payments offering and high GTV customer adoption.

- Gross profit of $114.3 million increased 19% year over year. Overall gross margin was 41%, compared to 42% in the same quarter last year, reflecting a higher portion of customers adopting Lightspeed Payments. Subscription gross margin grew to 79% in the quarter from 75% in the same quarter last year driven by a dedicated effort at controlling costs. Transaction-based gross margin was 27%, compared to 28% last year.

- GTV generated by Lightspeed’s flagship platforms increased by 26% compared to the same period last year, demonstrating that for its ideal customer profile and with its flagship products, Lightspeed continues to gain traction. Total GTV4 was $23.6 billion.

- An increasing portion of GTV is being processed through the Company’s payments solutions. GPV increased 49% to $8.8 billion in the quarter from $5.9 billion in the same period last year, largely due to the Company’s unified POS and payments initiative.

- Customer Locations with GTV exceeding $500,000/year5 and $1 million/year5 increased 1% and 2% year-over-year, respectively.

- Lightspeed Capital showed strong growth with revenue increasing 121% year-over-year.

_________________________________________

| 4Key Performance Indicator. See the section entitled “Key Performance Indicators.” |

5 Excluding Customer Locations and GTV attributable to the Ecwid eCommerce standalone product, Lightspeed Golf and NuORDER by Lightspeed product. A Customer Location's GTV per year is calculated by annualizing the GTV for the months in which the Customer Location is actively processing in the last twelve months. |

Notable customer wins include:

- From California, Barebones Workwear, signed on their 10 location work apparel, footwear and accessories business for Lightspeed Retail;

- Mavi Jeans, the premium denim retailer came to Lightspeed via a NuORDER co-sell deal;

- Wayne’s Boot Shop in Wyoming switched to Lightspeed Retail thanks to the NuORDER integration;

- Columbia Sportswear, J.Lindeberg, and Bugatti Group were part of dozens of new brands that were added to our Supplier Network;

- Nathalie, with two locations in the heart of central London, has signed up for Lightspeed Restaurant;

- 4PM Entertainment in Amsterdam selected Lightspeed Restaurant for over 20 locations; and

- Hospitality powerhouse, J’adore, in Paris, France has begun to power their restaurants, clubs, and bars with Lightspeed Restaurant.

Capital Markets Day

In light of the Company’s ongoing strategic review, Lightspeed will postpone its Capital Markets Day previously scheduled for November 20. The Company notes that there can be no assurances given, at this time, as to the outcome of its strategic review and that no further announcements or comments in respect of this matter will be made except as required under our regulatory obligations.

Financial Outlook6

The following outlook supersedes all prior statements made by the Company and is based on current expectations. Lightspeed’s year-to-date results have been encouraging with both revenue and Adjusted EBITDA coming in ahead of the Company’s outlook. As a result, the Company is increasing its Adjusted EBITDA1 outlook for the year from at least $45 million to at least $50 million. For the third quarter, Lightspeed expects subscription revenue growth rates to improve over the levels seen in the second quarter as the Company expands outbound teams, the majority of account managers return to upselling software, and targeted price increases take effect. In addition, the Company expects to see strong growth rates in transaction-based revenue as more customers adopt its payments solutions.

The Company’s outlook is as follows:

Third Quarter 2025

- Revenue of approximately $280 million to $285 million.

- Adjusted EBITDA 1 of approximately $14 million

Fiscal 2025

- Revenue growth of at least 20%.

- Adjusted EBITDA 1 of a minimum of $50 million.

_________________________________________ |

5 The financial outlook is fully qualified and based on a number of assumptions and subject to a number of risks described under the heading “Forward-Looking Statements” and “Financial Outlook Assumptions” of this press release. |

Financial Outlook Assumptions

When calculating the Adjusted EBITDA included in our financial outlook for the quarter ending December 31, 2024 and full year ending March 31, 2025, we considered IFRS measures including revenues, direct cost of revenues, and operating expenses. Our financial outlook is based on a number of assumptions, including assumptions related to inflation, changes in interest rates, consumer spending, foreign exchange rates and other macroeconomic conditions; that the jurisdictions in which Lightspeed has significant operations do not impose strict measures like those put in place in response to pandemics like the COVID-19 pandemic; requests for subscription pauses and churn rates owing to business failures remain in line with planned levels; our Customer Location count remaining in line with our planned levels (particularly in higher GTV cohorts); quarterly subscription revenue growth gradually ramping up throughout the year to ~10% growth; revenue streams resulting from certain partner referrals remaining in line with our expectations (particularly in light of our decision to unify our POS and payments solutions, which payments solutions have in the past and may in the future, in some instances, be perceived by certain referral partners to be competing with their own solutions); customers adopting our payments solutions having an average GTV at our planned levels; continued uptake of our payments solutions in line with our expectations in connection with our ongoing efforts to sell our POS and payments solutions as one unified platform; gross margins reflecting a trend towards more transaction-based revenue in our revenue mix; our ability to price our payments solutions in line with our expectations and to achieve suitable margins and to execute on more optimized pricing structures; our ability to manage default risks of our merchant cash advances in line with our expectations; seasonal trends of our key verticals being in line with our expectations and the resulting impact on our GTV and transaction-based revenues; continued success in module adoption expansion throughout our customer base; our ability to selectively pursue strategic opportunities and derive the benefits we expect from the acquisitions we have completed including expected synergies resulting from the prioritization of our flagship Lightspeed Retail and Lightspeed Restaurant offerings; market acceptance and adoption of our flagship offerings; our ability to attract and retain key personnel required to achieve our plans, including outbound and field sales personnel in our key markets; our ability to execute our succession planning; our expectations regarding the costs, timing and impact of our reorganizations and other cost reduction initiatives; our ability to manage customer churn; and our ability to manage customer discount requests. Our financial outlook does not give effect to the potential impact of acquisitions, divestitures or other strategic transactions that may be announced or closed after the date hereof. Our financial outlook, including the various underlying assumptions, constitutes forward-looking information and should be read in conjunction with the cautionary statement on forward-looking information below. Many factors may cause our actual results, level of activity, performance or achievements to differ materially from those expressed or implied by such forward-looking information, including the risks and uncertainties related to: macroeconomic factors affecting small and medium-sized businesses, including inflation, changes in interest rates and consumer spending trends; instability in the banking sector; exchange rate fluctuations; any pandemic or global health crisis; the Russian invasion of Ukraine and reactions thereto; the Israel-Hamas war and reactions thereto; uncertainty and changes as a result of elections in the U.S. and Europe; our inability to attract and retain customers, including among high GTV customers; our inability to increase customer sales; our inability to implement our growth strategy; our inability to continue to increase adoption of our payments solutions, including our initiative to sell our POS and payments solutions as one unified platform; our ability to successfully execute our pricing and packaging initiatives; risks relating to our merchant cash advance program; our ability to continue offering merchant cash advances and scaling our merchant cash advance program in line with our expectations; our reliance on a small number of cloud service suppliers and suppliers for parts of the technology in our payments solutions; our ability to manage and maintain integrations between our platform and certain third-party platforms; our ability to maintain sufficient levels of hardware inventory; our inability to improve and enhance the functionality, performance, reliability, design, security and scalability of our platform; our ability to prevent and manage information security breaches or other cyber-security threats; our ability to compete against competitors; strategic relations with third parties; our reliance on integration of third-party payment processing solutions; compatibility of our solutions with third-party applications and systems; changes to technologies on which our platform is reliant; our ability to effectively incorporate artificial intelligence solutions into our business and operations; our ability to obtain, maintain and protect our intellectual property; risks relating to international operations, sales and use of our platform in various countries; our liquidity and capital resources; pending and threatened litigation and regulatory compliance; changes in tax laws and their application; our ability to expand our sales, marketing and support capability and capacity; our ability to execute on our reorganizations and cost reduction initiatives; our ability to successfully make future investments in our business through capital expenditures; our ability to successfully execute our capital allocation strategies; our ability to execute on our business and operational strategy, including as a result of our pending strategic review; and maintaining our customer service levels and reputation. The purpose of the forward-looking information is to provide the reader with a description of management’s expectations regarding our financial performance and may not be appropriate for other purposes.