Lightspeed’s board authorized share repurchase to return up to $400 million to shareholders

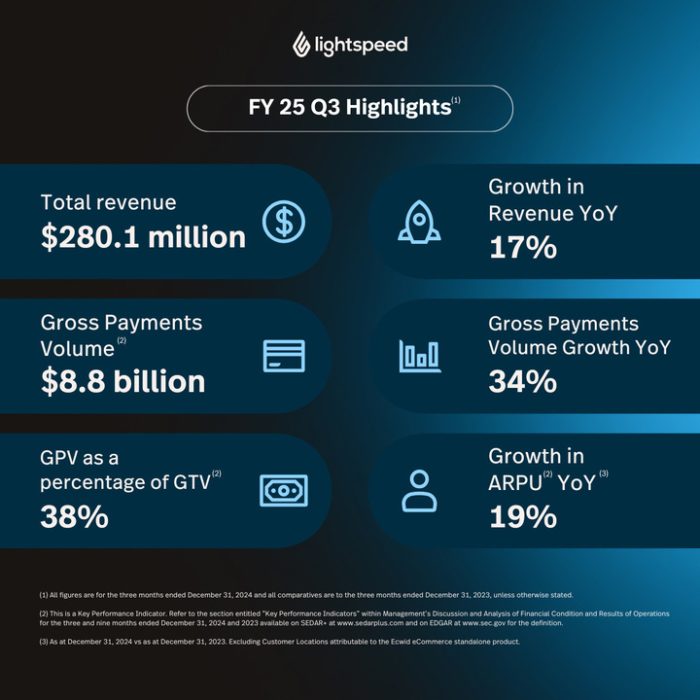

Total revenue of $280.1 million, up 17% year-over-year

Subscription revenue grew 9% year-over-year

Net loss improved to ($26.6) million and positive Adjusted EBITDA1 of $16.6 million exceeded outlook of ~$14 million

Monthly ARPU2 in the quarter grew 19% year-over-year to ~$533

Lightspeed reports in US dollars and in accordance with IFRS.

Lightspeed Commerce Inc. , today announced the results of its previously-disclosed strategic review and its financial results for the three and nine months ended December 31, 2024. Lightspeed is the unified POS and payments platform for ambitious entrepreneurs to accelerate growth, provide the best customer experiences and become a go-to destination in their space.

Strategic Review

The Board of Directors, a committee of independent directors, and executive leadership have unanimously determined that executing a full transformation plan as a public company presents the best available path to maximizing value for the Company and its shareholders. As part of its previously-announced strategic review, the Company conducted an in-depth evaluation of its portfolio, including market attractiveness, competitive dynamics, and its right-to-win as well as evaluating the best ownership structure to navigate Lightspeed through a transformation. The Company has already set its transformation plan in motion, focusing on growth in retail in North America and hospitality in Europe, both leading growth engines, with a strategic focus on expanding locations and increasing software and payments ARPU, with the other business areas optimized for efficiency and aimed at driving a maximum profitability for the whole business.

The Company-wide transformation to deliver on the new strategy will focus on:

- Go-to-market: enhancing Lightspeed’s go-to-market strategy with targeted outbound efforts, field sales and local marketing expansion, and verticalized execution to maximize efficiency and improve win rates, including deepening supplier integration in focus verticals and deploying AI-driven customer acquisition across retail in North America;

- Product & Technology: investments focused on key growth areas—enhancing inventory management, forecasting, and supplier integration for retail in North America, while optimizing operations, guest experience, and analytics for hospitality in Europe;

- Capital Allocation: transformation initiatives to free up capital for investment in growth areas; and

- Share Repurchase: a share repurchase program to return up to $400 million in cash to shareholders, including the immediate execution of approximately $100 million3 under our current authorization, plus an additional $300 million, in each case subject to market conditions.

“The Company’s robust strategic review process was initiated by the Board in response to feedback from shareholders and overseen by a committee of independent board members,” said Patrick Pichette, Chair of Lightspeed’s Board and of the committee that oversaw the strategic review. “We received a high level of interest in Lightspeed and had extensive discussions with several process participants. After this review, our board, committee and executive management team unanimously concluded that executing on our full transformation plan as a public company offers the best available path to maximize value for the company and its shareholders.”

“We’ve continued to grow the Company since announcing the strategic review, having launched several new key initiatives which have already made a significant impact on our results – such as our software revenue growth of 9% year-over-year, the highest in the last nine quarters and raising our Adjusted EBITDA outlook for this fiscal year to over $53 million, more than 30% higher than the initial outlook of a minimum of $40 million at the start of the fiscal year,” said Dax Dasilva, Founder and CEO. “We have begun a process of transformation that will reshape the Company, and I look forward to presenting the full details of the plan at our upcoming Capital Markets Day.”

Management also announced that it will hold a Capital Markets Day on March 26, 2025, at the New York Stock Exchange, to provide a comprehensive update on the Company’s transformation plan, its operational and financial impact, products, go-to-market efforts, and a long-term financial outlook.

Read CEO Dax Dasilva’s letter to shareholders: https://investors.lightspeedhq.com/CEO-Letter

Third Quarter Financial Results

“Positioning the Company for profitable growth continues to be our top priority coming out of our strategic review,” said Dax Dasilva. “In the past year, we have accelerated software growth, dramatically improved payments penetration, established a solid foundation for profitability, maintained a very strong balance sheet, accelerated our innovation and focused the business on the areas where we have a proven right to win.”

“This quarter’s results are proof that our strategic pivot to focus on growth in our key markets and on efficiency everywhere else is working. Adjusted EBITDA grew over 350% year over year, to $16.6 million, ahead of our previously-established outlook,” said Asha Bakshani, CFO. “In addition, our product innovation and increases in our pricing plans helped software ARPU2 grow 11%. We expect this strong momentum to continue into FY26.”

Third Quarter Financial Highlights

(All comparisons are relative to the three-month period ended December 31, 2023 unless otherwise stated):

- Total revenue of $280.1 million, an increase of 17% year-over-year.

- Transaction-based revenue of $181.7 million, an increase of 23% year-over-year.

- Subscription revenue of $88.1 million, an increase of 9% year-over-year.

- Net loss of ($26.6) million, or ($0.17) per share, as compared to a net loss of ($40.2) million, or ($0.26) per share, and Adjusted Income1 of $18.5 million, or $0.12 per share1, as compared to Adjusted Income1 of $11.8 million, or $0.08 per share1.

- Adjusted EBITDA1 of $16.6 million versus Adjusted EBITDA1 of $3.6 million.

- Cash flows from operating activities of $2.7 million as compared to cash flows used in operating activities of ($18.2) million, and Adjusted Free Cash Flow1 used of ($0.5) million as compared to Adjusted Free Cash Flow1 used of ($14.8) million.

- As at December 31, 2024, Lightspeed had $661.6 million in cash and cash equivalents.

Third Quarter Operational Highlights

- Lightspeed delivered several new product releases in the quarter including:

- An expanded Lightspeed Scanner – now available on the Lightspeed iOS app – to enable purchases directly from the retail floor using mobile payments;

- We expanded Lightspeed Payments to allow our Supplier Network in Australia, the UK, the Netherlands and Belgium to accept certain payments, in addition to Canada and the U.S.;

- The addition of over 1 million new products to the Lightspeed’s Supplier Network across key verticals such as pet, home & garden, and golf;

- For golf, Integrated Scheduling tools to enable operators to maximize bookings and revenue.

- Lightspeed delivered several new product releases for hospitality in Europe as well:

- The new Kitchen Display System, which seamlessly connects front- and back-of-house operations by facilitating order flow between POS and Tableside to the kitchen;

- Lightspeed Pulse, which provides mobile access to actionable insights and key metrics, such as sales and live orders, for restaurateurs to access anywhere;

- The expansion of Instant Payouts to eligible hospitality merchants, facilitating access to funds within 30 minutes of a transaction even on weekends.

- ARPU2,4 increased to ~$533 from ~$447 in the same quarter last year representing an increase of 19% driven by our focus on our unified POS and payments offering and growing subscription ARPU2, which increased 11%.

- Gross profit of $115.9 million increased 14% year over year. Overall gross margin was 41%, compared to 42% in the same quarter last year, reflecting a higher portion of customers adopting Lightspeed Payments. Subscription gross margin grew to 79% in the quarter from 76% in the same quarter last year driven by a dedicated effort at controlling costs. Transaction-based gross margin was 28% compared to 30% last year.

- GTV generated by Lightspeed’s flagship platforms increased by 23% compared to the same period last year, demonstrating that for its ideal customer profile and with its flagship products, Lightspeed continues to gain traction. Total GTV4 was $23.5 billion.

- An increasing portion of GTV is being processed through the Company’s payments solutions. GPV4 increased 34% to $8.8 billion in the quarter from $6.6 billion in the same period last year, largely due to the Company’s unified POS and payments initiative.

- Customer Locations with GTV exceeding $500,000/year5 and $1 million/year5 increased 1% and 3% year-over-year, respectively.

- Lightspeed Capital showed strong growth with revenue increasing 96% year-over-year.

- Notable customer wins for retail in North America include:

- Soccer Master and Epoxy Depot; both of which are multi-location merchants with a need for omni-channel capabilities. High GTV merchants continue to choose Lightspeed over other solutions given our differentiated ability to handle complex inventory management needs, and our ability to support omni-channel in a multi-location environment;

- In our Supplier Network, we renewed contracts with three of the largest North American department stores. We also signed multiple new brands including Caspari, Anine Bing and ASW Group which is a distributor for Tommy Hilfiger and Calvin Klein.

- In golf, we signed the legendary St Andrews Links Trust — the home of The Open.

- Notable customer wins for hospitality in Europe include:

- Three Michelin star restaurant AM par Alexandre Mazzia in Marseille, and Chefdag, a chain of Belgium-based restaurants with seven locations;

- In the hotel-adjacent restaurant space, we signed Hôtel de Beaune, a five star luxury hotel in the heart of Burgundy due to Lightspeed’s product market fit for full-service restaurants.

- During the quarter, Lightspeed announced a strategic reorganization impacting approximately 200 positions. This effort is a result of the Company’s renewed strategy to focus its efforts on retail in North America and hospitality in Europe.

Financial Outlook6

The following outlook supersedes all prior statements made by the Company and is based on current expectations.

Lightspeed is encouraged by its results to date with strong revenue growth and an Adjusted EBITDA performance that is on track to surpass our most recent outlook for Fiscal 2025. There are two short-term headwinds on revenue, including the surging US dollar which is putting pressure on non-US dollar revenue and the meaningful reduction of go-to-market positions in the restructuring last quarter. The Company plans to use these savings from the restructuring to hire in its growth markets and fully expects to see a positive return on these efforts in Fiscal 2026. Partially offsetting these negative influences are recent software price increases and a series of popular software modules that have recently been released. Finally, the Company’s fiscal fourth quarter is seasonally the weakest for GTV performance.

The Company’s outlook has been updated as follows:

Fiscal 2025

- Revenue growth of approximately 20%.

- Adjusted EBITDA1 of over $53 million.

Conference Call and Webcast Information

Lightspeed will host a conference call and webcast to discuss the Company’s financial results at 8:00 am ET on Thursday, February 6, 2025. To access the telephonic version of the conference call, visit https://registrations.events/direct/Q4I743165278. After registering, instructions will be shared on how to join the call including dial-in information as well as a unique passcode and registrant ID. At the time of the call, registered participants will dial in using the numbers from the confirmation email, and upon entering their unique passcode and ID, will be entered directly into the conference. Alternatively, the webcast will be available live in the Events section of the Company’s Investor Relations website, https://investors.lightspeedhq.com/English/events-and-presentations/upcoming-events/.

Among other things, Lightspeed will discuss quarterly results, financial outlook and trends in its customer base on the conference call and webcast, and related materials will be made available on the Company’s website at https://investors.lightspeedhq.com. Investors should carefully review the factors, assumptions and uncertainties included in such related materials.

An audio replay of the call will also be available to investors beginning at approximately 11:00 a.m. Eastern Time on February 6, 2025 until 11:59 p.m. Eastern Time on February 13, 2025, by dialing 800.770.2030 for the U.S. or Canada, or 647.362.9199 for international callers and providing conference ID 74316. In addition, an archived webcast will be available on the Investors section of the Company’s website at https://investors.lightspeedhq.com.

Lightspeed’s unaudited condensed interim consolidated financial statements and management’s discussion and analysis for the three and nine months ended December 31, 2024 are available on Lightspeed’s website at https://investors.lightspeedhq.com and will be filed on SEDAR+ at www.sedarplus.com and on EDGAR at www.sec.gov.

Financial Outlook Assumptions

When calculating the Adjusted EBITDA included in our financial outlook for the full year ending March 31, 2025, we considered IFRS measures including revenues, direct cost of revenues, and operating expenses. Our financial outlook is based on a number of assumptions, including assumptions related to inflation, changes in interest rates, consumer spending, foreign exchange rates and other macroeconomic conditions; that the jurisdictions in which Lightspeed has significant operations do not impose strict measures like those put in place in response to pandemics like the COVID-19 pandemic; requests for subscription pauses and churn rates owing to business failures remain in line with planned levels; our Customer Location count remaining in line with our planned levels (particularly in higher GTV cohorts); quarterly subscription revenue growth gradually ramping up throughout the year towards ~10% growth; revenue streams resulting from certain partner referrals remaining in line with our expectations (particularly in light of our decision to unify our POS and payments solutions, which payments solutions have in the past and may in the future, in some instances, be perceived by certain referral partners to be competing with their own solutions); customers adopting our payments solutions having an average GTV at our planned levels; continued uptake of our payments solutions in line with our expectations in connection with our ongoing efforts to sell our POS and payments solutions as one unified platform; our ability to price our payments solutions in line with our expectations and to achieve suitable margins and to execute on more optimized pricing structures; our ability to manage default risks of our merchant cash advances in line with our expectations; seasonal trends of our key verticals being in line with our expectations and the resulting impact on our GTV and transaction-based revenues; continued success in module adoption expansion throughout our customer base; our ability to selectively pursue strategic opportunities and derive the benefits we expect from the acquisitions we have completed including expected synergies resulting from the prioritization of our flagship Lightspeed Retail and Lightspeed Restaurant offerings; market acceptance and adoption of our flagship offerings; our ability to attract and retain key personnel required to achieve our plans, including outbound and field sales personnel in our key markets; our ability to execute our succession planning; our expectations regarding the costs, timing and impact of our reorganizations and other cost reduction initiatives; our expectations regarding our growth strategy for retail in North America and hospitality in Europe and our strategies for other geographies and verticals; our ability to manage customer churn; and our ability to manage customer discount requests. Our financial outlook does not give effect to the potential impact of acquisitions, divestitures or other strategic transactions that may be announced or closed after the date hereof. Our financial outlook, including the various underlying assumptions, constitutes forward-looking information and should be read in conjunction with the cautionary statement on forward-looking information below. Many factors may cause our actual results, level of activity, performance or achievements to differ materially from those expressed or implied by such forward-looking information, including the risks and uncertainties related to: macroeconomic factors affecting small and medium-sized businesses, including inflation, changes in interest rates and consumer spending trends; instability in the banking sector; exchange rate fluctuations and the use of hedging; any pandemic or global health crisis; the Russian invasion of Ukraine and reactions thereto; the Israel-Hamas war and reactions thereto; uncertainty and changes as a result of elections and changes in administrations in the U.S., Canada and Europe (including the potential impacts of tariffs, other trade conditions or protective government actions); certain natural disasters (including wildfires in California); our inability to attract and retain customers, including among high GTV customers; our inability to increase customer sales; our inability to implement our growth strategy; our inability to continue to increase adoption of our payments solutions, including our initiative to sell our POS and payments solutions as one unified platform; our ability to successfully execute our pricing and packaging initiatives; risks relating to our merchant cash advance program; our ability to continue offering merchant cash advances and scaling our merchant cash advance program in line with our expectations; our reliance on a small number of cloud service suppliers and suppliers for parts of the technology in our payments solutions; our ability to manage and maintain integrations between our platform and certain third-party platforms; our ability to maintain sufficient levels of hardware inventory; our inability to improve and enhance the functionality, performance, reliability, design, security and scalability of our platform; our ability to prevent and manage information security breaches or other cyber-security threats; our ability to compete against competitors; strategic relations with third parties; our reliance on integration of third-party payment processing solutions; compatibility of our solutions with third-party applications and systems; changes to technologies on which our platform is reliant; our ability to effectively incorporate artificial intelligence solutions into our business and operations; our ability to obtain, maintain and protect our intellectual property; risks relating to international operations, sales and use of our platform in various countries; our liquidity and capital resources; pending and threatened litigation and regulatory compliance; any external stakeholder activism; changes in tax laws and their application; our ability to expand our sales, marketing and support capability and capacity; our ability to execute on our reorganizations and cost reduction initiatives; our ability to execute on our growth strategy focused on retail in North America and hospitality Europe and our strategies for other geographies and verticals; our ability to successfully make future investments in our business through capital expenditures; our ability to successfully execute our capital allocation strategies; our ability to execute on our business and operational strategy; and maintaining our customer service levels and reputation. The purpose of the forward-looking information is to provide the reader with a description of management’s expectations regarding our financial performance and may not be appropriate for other purposes.