Lightspeed Announces Fourth Quarter and Full Year 2024 Financial Results and Provides Outlook for Fiscal 2025

Total revenue of $230.2 million grew 25% year-over-year and annual revenue exceeded previously-established outlook

Net loss and Adjusted EBITDA1 improved to ($32.5) million and $4.4 million, respectively

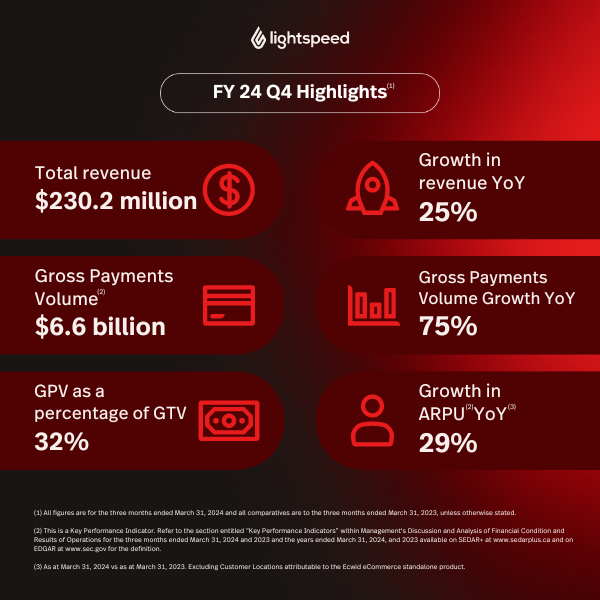

GPV as a percentage of GTV was 32% in the quarter, up from 19% in the prior year

ARPU2 of ~$431 grew 29% year-over-year with Net Retention Rate of ~110%

Lightspeed reports in US dollars and in accordance with IFRS.

Lightspeed Commerce Inc., today announced financial results for the three months and fiscal year ended March 31, 2024. Additionally, the Lightspeed Board of Directors is pleased to announce that Dax Dasilva has been reappointed as Lightspeed’s permanent CEO, removing the interim tag from his title. Lightspeed is the unified POS and payments platform for ambitious entrepreneurs to accelerate growth, provide the best customer experiences and become a go-to destination in their space.

“On the back of a strong fourth quarter, Lightspeed is coming into the new fiscal year with a revitalized sense of energy and purpose,” said Dax Dasilva, Founder and CEO. “I am excited to be guiding the Company through the next phase of its evolution. With the strongest product offerings we have ever had and a renewed commitment towards product innovation, Lightspeed is continuing to accelerate its sustainable and profitable growth.”

“Fiscal 2024 was a milestone year for Lightspeed with the company exceeding our previously-established revenue outlook and achieving a full year of positive Adjusted EBITDA for the first time,” said Asha Bakshani, CFO. “With the Company focused on its two flagship offerings and payments penetration on a strong upward trajectory, Lightspeed is expected to exceed the $1 billion revenue mark3 in Fiscal 2025 by growing subscription revenue and increasing our high GTV customer base, resulting in expanding margins throughout Fiscal 2025.”

Fourth Quarter Financial Highlights

(All comparisons are relative to the three-month period ended March 31, 2023 unless otherwise stated):

- Total revenue of $230.2 million, an increase of 25% year-over-year.

- Transaction-based revenue of $139.0 million, an increase of 40% year-over-year.

- Subscription revenue of $81.3 million, an increase of 7% year-over-year.

- Net loss of ($32.5) million, or ($0.21) per share, as compared to a net loss of ($74.5) million, or ($0.49) per share. After adjusting the net loss by $41.1 million for certain items including share-based compensation, amortization of intangible assets, and restructuring, the Company delivered Adjusted Income1 of $8.5 million, or $0.06 per share1 as compared to an Adjusted Loss1 of ($0.4) million, or ($0.00) per share1.

- Adjusted EBITDA1 of $4.4 million versus Adjusted EBITDA1 of ($4.3) million.

- As at March 31, 2024, Lightspeed had $722.1 million in cash and cash equivalents.

Full Fiscal Year Financial Highlights

(All comparisons are relative to the full fiscal year ended March 31, 2023 unless otherwise stated):

- Total revenue of $909.3 million, an increase of 24% year-over-year and ahead of previously established outlook.

- Transaction-based revenue of $545.5 million, an increase of 37% year-over-year.

- Subscription revenue of $322.0 million, an increase of 8% year-over-year.

- Net Loss of ($164.0) million, or ($1.07) per share, as compared to a net loss of ($1,070.0) million, or ($7.11) per share. After adjusting the net loss by $188.5 million for certain items including share-based compensation, amortization of intangible assets, and restructuring, the Company delivered Adjusted Income1 $24.5 million, or $0.16 per share1 as compared to an Adjusted Loss1 of ($25.1) million, or ($0.17) per share1. Net loss for the fiscal year ended March 31, 2023 includes a non-cash goodwill impairment charge of ($748.7) million.

- Adjusted EBITDA1 of $1.3 million versus Adjusted EBITDA1 of ($33.9) million in 2023.

Fourth Quarter Operational Highlights

- Lightspeed delivered several new product releases in the quarter including:

- AI-powered configuration recommendations for Lightspeed Restaurant merchants to help maximize the power of the platform.

- Margin-based pricing in Lightspeed Retail which automatically calculates the right mark-up and price based on the retailer’s desired margin.

- Enhanced Order Tracking with Apple Wallet which enables Lightspeed e-commerce customers to track orders directly through Apple Wallet, eliminating the need to sift through emails or visit third-party sites.

- Payment Links now allows customers to pay anywhere, anytime, with a link from the merchant.

- Enhancements to Lightspeed Restaurant’s Order Anywhere platform including order history and account management, quick reordering, and new reporting features, all of which help improve repeat guest business.

- ARPU2,4 increased 29% to approximately $431 from approximately $335 in the same quarter last year driven by our focus on our unified POS and payments offering and high GTV customer adoption.

- Overall gross margin came in at 43%, slightly up from the prior quarter. Subscription gross margins grew to 77% in the quarter from 75% in the same quarter last year driven by a dedicated effort to consolidate cloud vendor arrangements and improved overall efficiencies. Transaction-based gross margins were 29% versus 33% last year given the increase in customers moving over to Lightspeed Payments which generally results in higher gross profit dollar contributions but at lower gross margins than referral fees. This was partially offset by increased Lightspeed Capital revenue, which carries high gross margins, as well as an increasing portion of GPV coming from international markets where Lightspeed Payments carries a higher gross margin.

- In the quarter, GTV generated by Lightspeed’s flagship platforms increased by 29% compared to the same period last year, demonstrating that for its ideal customer profile and with its flagship products, Lightspeed continues to gain traction. Total GTV4 of $20.7 billion, was up 2% year-over-year.

- An increasing portion of GTV is being processed through the Company’s payments solutions. GPV4 increased 75% to $6.6 billion in the quarter from $3.8 billion in the same period last year, largely due to the Company’s unified POS and payments initiatives during Fiscal 2024.

- Customer Locations with GTV exceeding $500,000/year5 increased 5% year-over-year, and the number of Customer Locations with GTV exceeding $1 million/year5 increased 6% year-over-year.

- Lightspeed Capital showed strong growth with revenue increasing 135% year-over-year.

- Notable customer wins include:

- Five-star hotel, Hôtel les Roches Blanches in Cassis on the Southern Coast of France, adopted Lightspeed Restaurant to operate their four beautiful restaurants and luxury villa;

- Johnston Canyon Lodge & Bungalows in Banff National Park has chosen Lightspeed to power their restaurant and cafe;

- NASA’s Langley Research Center selected Lightspeed Retail to operate their retail outlet and bar;

- Honsberger Estate Winery, with a bottle shop and restaurant nestled in Ontario’s Niagara region, chose Lightspeed Restaurant to unify their tech stack;

- 5 Star Nutrition, multi-location supplement, protein, and smoothies retailer selected Lightspeed Retail to power their complex national business;

- Ester Restaurant and Bar in Sydney implemented Lightspeed Restaurant to run their highly-regarded restaurant;

- Ontario’s Stratford Festival will be using Lightspeed Retail to power retail sales across their multiple theaters;

- Dozens of new brands were added to our Supplier Network including ALDO Group, Saint Owen, and Seven ’til Midnight.

- After the quarter, Lightspeed authorized a share repurchase program to purchase for cancellation up to 9,722,677 shares over a twelve-month period representing approximately 10% of the Company’s public float. This is the maximum allowed per year under TSX rules. The Company plans to execute the program with the primary objective of delivering maximum value for shareholders.

- On April 3, 2024, the Company announced a reorganization of operations with a reduction in headcount-related expenses of approximately 10% and the elimination of approximately 280 roles. In addition, the Company expects to explore several other cost reduction initiatives during the course of the year.

Financial Outlook

The following outlook supersedes all prior statements made by the Company and is based on current expectations.

Lightspeed expects to meaningfully expand Adjusted EBITDA profitability in the coming year while growing our high GTV customer base and subscription revenues. The Company also expects to continue to increase the proportion of GTV that is processed through its payments platform. Lightspeed will continue to balance growth in both revenue and Adjusted EBITDA as it scales its business to beyond $1 billion in revenue.

The Company expects subscription revenue growth to be better in the second half of the year than the first half. In addition, owing to the steep climb in GPV as a percentage of GTV that occurred in Fiscal 2024, transaction-based revenue growth is expected to be stronger in the first half of the fiscal year than the second half. As a result, the Company’s outlook is as follows:

First Quarter 2025

- Revenue of approximately $255 million to $260 million, with subscription revenue growth for the quarter consistent with Q4 2024.

- Adjusted EBITDA1 of approximately $7 million.

Fiscal 2025

- Revenue growth of at least 20%.

- Adjusted EBITDA1 of a minimum of $40 million.

Conference Call and Webcast Information

Lightspeed will host a conference call and webcast to discuss the Company’s financial results at 8:00 am ET on Thursday, May 16, 2024. To access the telephonic version of the conference call, visit https://registrations.events/direct/Q4I7431649. After registering, instructions will be shared on how to join the call including dial-in information as well as a unique passcode and registrant ID. At the time of the call, registered participants will dial in using the numbers from the confirmation email, and upon entering their unique passcode and ID, will be entered directly into the conference. Alternatively, the webcast will be available live on the Investors section of the Company’s website at https://investors.lightspeedhq.com.

Among other things, Lightspeed will discuss quarterly results, financial outlook and trends in its customer base on the conference call and webcast, and related materials will be made available on the Company’s website at https://investors.lightspeedhq.com. Investors should carefully review the factors, assumptions and uncertainties included in such related materials.

An audio replay of the call will also be available to investors beginning at approximately 11:00 a.m. Eastern Time on May 16, 2024 until 11:59 p.m. Eastern Time on May 23, 2024, by dialing 800.770.2030 for the U.S. or Canada, or 647.362.9199 for international callers and providing conference ID 74316. In addition, an archived webcast will be available on the Investors section of the Company’s website at https://investors.lightspeedhq.com.

Lightspeed’s audited annual consolidated financial statements, management’s discussion and analysis and annual information form for the fiscal year ended March 31, 2024 are available on Lightspeed’s website at https://investors.lightspeedhq.com and will be filed on SEDAR+ at www.sedarplus.com and on EDGAR at www.sec.gov. Shareholders may, upon request, receive a hard copy of the complete audited financial statements free of charge.

Financial Outlook Assumptions

When calculating the Adjusted EBITDA included in our financial outlook for the quarter ending June 30, 2024 and full year ending March 31, 2025, we considered IFRS measures including revenues, direct cost of revenues, and operating expenses. Our financial outlook is based on a number of assumptions, including assumptions related to inflation, changes in interest rates, consumer spending, foreign exchange rates and other macroeconomic conditions; that the jurisdictions in which Lightspeed has significant operations do not impose strict measures like those put in place in response to pandemics like the COVID-19 pandemic; requests for subscription pauses and churn rates owing to business failures remain in line with planned levels; our Customer Location count remaining in line with our planned levels (particularly in higher GTV cohorts); quarterly subscription revenue growth gradually ramping up throughout the year to 10-15% growth; revenue streams resulting from certain partner referrals remaining in line with our expectations (particularly in light of our decision to unify our POS and payments solutions, which payments solutions have in the past and may in the future, in some instances, be perceived by certain referral partners to be competing with their own solutions); customers adopting our payments solutions having an average GTV at our planned levels; continued uptake of our payments solutions in line with our expectations in connection with our ongoing efforts to sell our POS and payments solutions as one unified platform; gross margins reflecting a trend towards more transaction-based revenue in our revenue mix; our ability to price our payments solutions in line with our expectations and to achieve suitable margins and to execute on more optimized pricing structures; our ability to achieve success in the continued expansion of our payments solutions, including as part of our initiative to sell our POS and payments solutions as one unified platform; our ability to manage default risks of our merchant cash advances in line with our expectations; seasonal trends of our key verticals being in line with our expectations and the resulting impact on our GTV and transaction-based revenues; continued success in module adoption expansion throughout our customer base; our ability to selectively pursue strategic opportunities and derive the benefits we expect from the acquisitions we have completed including expected synergies resulting from the prioritization of our flagship Lightspeed Retail and Lightspeed Restaurant offerings; market acceptance and adoption of our flagship offerings, including migration of existing customers to our flagship offerings; our ability to attract and retain key personnel required to achieve our plans; our ability to execute our succession planning; our expectations regarding the costs, timing and impact of our reorganization and other cost reduction initiatives; our ability to manage customer churn; and our ability to manage customer discount requests. Our financial outlook does not give effect to the potential impact of acquisitions that may be announced or closed after the date hereof. Our financial outlook, including the various underlying assumptions, constitutes forward-looking information and should be read in conjunction with the cautionary statement on forward-looking information below. Many factors may cause our actual results, level of activity, performance or achievements to differ materially from those expressed or implied by such forward-looking information, including the risks and uncertainties related to: macroeconomic factors affecting small and medium-sized businesses, including inflation, changes in interest rates and consumer spending trends; instability in the banking sector; exchange rate fluctuations; any pandemic or global health crisis; the Russian invasion of Ukraine and reactions thereto; the Israel-Hamas war and reactions thereto; our inability to attract and retain customers; our inability to increase customer sales; our inability to implement our growth strategy; our inability to continue to increase adoption of our payments solutions, including our initiative to sell our POS and payments solutions as one unified platform; risks relating to our merchant cash advance program; our ability to continue offering merchant cash advances and scaling our merchant cash advance program in line with our expectations; our reliance on a small number of cloud service suppliers and suppliers for parts of the technology in our payments solutions; our ability to maintain sufficient levels of hardware inventory; our inability to improve and enhance the functionality, performance, reliability, design, security and scalability of our platform; our ability to prevent and manage information security breaches or other cyber-security threats; our ability to compete against competitors; strategic relations with third parties; our reliance on integration of third-party payment processing solutions; compatibility of our solutions with third-party applications and systems; changes to technologies on which our platform is reliant; our ability to effectively incorporate artificial intelligence solutions into our business and operations; our ability to obtain, maintain and protect our intellectual property; risks relating to international operations, sales and use of our platform in various countries; our liquidity and capital resources; pending and threatened litigation and regulatory compliance; changes in tax laws and their application; our ability to expand our sales, marketing and support capability and capacity; our ability to execute on our reorganization and cost reduction initiatives; our ability to successfully make future investments in our business through capital expenditures; our ability to successfully execute our capital allocation strategies; and maintaining our customer service levels and reputation. The purpose of the forward-looking information is to provide the reader with a description of management’s expectations regarding our financial performance and may not be appropriate for other purposes.

For more information, please read the press release here.