Why do small businesses fail? That’s the million-dollar question. Starting a business is not easy, and there are countless statistics out there about the survival rate of startup companies.

Here are a few popular ones:

- Only about 20% of new businesses survive their first year of operation

- The U.S Census data shows that new business creation is nearly at a 40-year low

- Half of small businesses fail within their first five years

Whether you’re a seasoned small business owner or an entrepreneur just starting out, these statistics can be a little scary. What you probably don’t realize is the sample of small companies cited in these studies.

The point is that while there may be some truth to these numbers, you shouldn’t let it kill your entrepreneurial spirit. Instead, try to understand the major reasons why small businesses fail. If you understand the mistakes of others, you can avoid following in their footsteps.

Here are 19 reasons why small businesses fail.

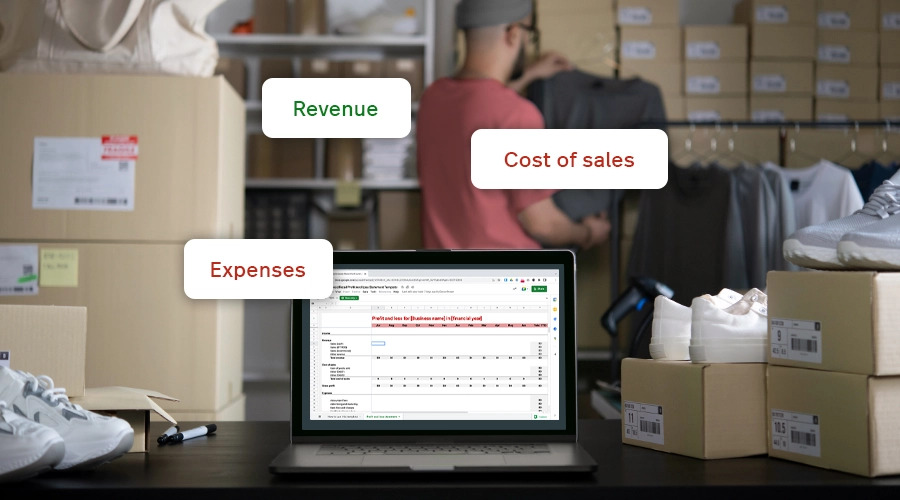

Profit and Loss Template

Examine the financial health of your business by highlighting exactly how much revenue is being generated versus what’s being spent.

19. No business plan or poor planning

This reason is especially true for brand new small business owners. What you think sounds like a good business idea on paper may not fare so well in reality. (For some hard truths, see the fastest-growing occupations as measured by the Bureau of Labor.)

This doesn’t mean you should ignore your passions. Instead, it means you need to do a little research and business planning.

A business plan forces you to define your Unique Value Proposition (UVP) — what differentiates your project from its competitors. In a sea of food trucks gathered in a parking lot, how will yours stand out? Is it the food? The service? Is it the neon hues and festively decorated truck? Is it the daily social media promotion? Likely, it’s all of the above. Maintaining a sustainable business model requires setting yourself apart from competitors.

Other important considerations include: Who comprises your customer base? How will they buy your product or service—in-store, online, or both? What’s your marketing plan? How will customers find out about your business? What are your cash flow projections? Your startup capital? How far will your cash reserves take you? Remember to factor in both business and living expenses, as most businesses are not profitable during their first year.

Answering these kinds of questions while your business idea is still in the planning stage will help you boost the probability of your product or service becoming a success.

18. Neglecting the importance of a unique value proposition (UVP)

A well-crafted UVP serves as a critical communication tool, succinctly conveying the value your business offers to customers. It answers the fundamental question of why a customer should choose your business over others, by emphasizing unique features, benefits, or solutions that address specific needs or problems.

Without a distinct UVP, businesses struggle to differentiate themselves from competitors, making it challenging to capture the attention of potential customers in a crowded market.

Businesses that overlook the development of a strong UVP risk blending in with the competition, losing potential market share and ultimately facing difficulty in sustaining their operations.

How to write a unique value proposition

- Identify your target audience: define who your ideal customers are. Understand their needs, preferences, pain points and what they value in a shopping experience.

- Analyze your competitors: research your competitors to understand their offerings, strengths, and weaknesses. Identifying gaps in their services or products can help you pinpoint opportunities for your business to fill.

- List your unique features and benefits: compile a list of your products’ or services’ features and benefits. Focus on what sets your offerings apart from competitors. Consider quality, price, selection, customer service and any other factors relevant to your target audience.

- Articulate what solves customer problems: identify which features or benefits directly address your customers’ needs or pain points. This will form the core of your UVP, as solving these problems is likely what will attract customers to your business.

- Simplify your message: condense your findings into a clear, concise statement that communicates the value customers gain from choosing your business.

17. Ineffective branding and positioning

Branding is more than just a logo or color scheme—it’s the heart of a company’s identity, embodying its values, mission, and what it stands for. When a business fails to establish a strong brand identity, it struggles to connect with its target audience on a meaningful level.

Building a strong brand identity

The cornerstone of successful branding and positioning is consistent brand messaging. Consistency ensures that every interaction customers have with the business—whether through advertising, social media or customer service—reinforces the same core message and values. This consistency builds trust and recognition, crucial components in a customer’s decision to choose one business over another.

Not sure if your branding is consistent enough? Run through a brand building exercise to see if you could make it stronger:

- Define your brand’s core values and personality: review what your business stands for, its mission and the values it embodies. These core elements should resonate with your target audience and reflect in every aspect of your business, from customer service to product selection.

- Develop a consistent visual identity: your visual identity, including your logo, color scheme, typography and imagery, should consistently communicate your brand’s personality and values across all touchpoints. Ensure that your storefront, website, social media and all marketing materials present a cohesive look and feel that accurately represents your brand.

- Engage and connect with your audience: utilize social media, content marketing and in-store experiences to tell your brand’s story, share your values, and connect with your customers on an emotional level. Listening to customer feedback and adapting your approach can further strengthen your brand identity by showing that you value and respond to your audience’s needs and preferences.

Effective marketing and positioning strategies

Once you’ve reviewed and updated your brand identity, make sure you’re communicating it effectively.

- Leverage omnichannel marketing: create a seamless experience for your customers across all channels, including in-store, online and through mobile apps. Omnichannel marketing ensures that your messaging is consistent and accessible, whether customers are shopping from their computer, smartphone, or physically in your store.

- Utilize targeted social media campaigns: identify the social media platforms where your target audience is most active and engage them with content that resonates with their interests and needs. Use targeted ads, influencer collaborations and interactive content to increase brand awareness, drive traffic to your website or store and boost sales.

- Create value through educational content: position your retail business as an authority in your niche by providing valuable and informative content to your customers. This can be through blogs, videos, tutorials or in-store workshops that educate your audience on topics related to your products or services.

16. Overlooking legal and compliance issues

Legal and regulatory landscapes can be complex, with requirements varying significantly across different industries and regions. Understanding and adhering to these requirements is not optional. It’s essential for the survival and growth of any business.

Ignorance of the law is not a defense, and failure to comply can result in severe consequences, including fines, lawsuits or even business closure.

For instance, not respecting intellectual property laws could lead to costly litigation, while neglecting employment laws might result in damaging disputes or sanctions. Demonstrating a commitment to legal and ethical practices enhances a business’s reputation and competitive edge, encouraging customer loyalty and attracting investment.

Navigating the maze of legal requirements can seem daunting. However, investing in legal advice is not just a cost, it’s a strategic investment in the business’s future. Legal professionals can provide invaluable guidance on the necessary licenses and permits, advise on the correct legal structure for the business, help draft solid contracts, and ensure that the business stays updated on relevant laws and regulations.

15. Failure to adapt to technology and innovation

Not adapting to new technology and innovation is a common pitfall that can lead to the downfall of small businesses, especially in retail. As consumer preferences shift towards convenience, personalization and seamless shopping experiences, staying current with technological advancements is crucial. Retailers who ignore these trends risk becoming obsolete.

For example, retail businesses that fail to establish an online presence beyond just their own website miss out on a vast digital market. Retailers should be selling on their site, major marketplaces and social media all at once, and using tools like Lightspeed eCom to keep the management of all those different sales channels simple.

Similarly, the implementation of data analytics can offer invaluable insights into customer behavior, enabling personalized marketing strategies and inventory management. Retailers not leveraging these tools may fail to meet customer expectations and lose to competitors who do.

Additionally, contactless payments and mobile wallets have become the norm, enhancing customer convenience and safety. Neglecting these payment options can lead to a decline in customer satisfaction and sales.

Innovations in small business management

In the rapidly evolving landscape of small business management, several innovations have emerged to streamline operations, enhance customer engagement and improve overall efficiency. Here are three recent innovations:

- AI and machine learning: Artificial Intelligence (AI) and Machine Learning (ML) technologies are being increasingly adopted by small businesses for a variety of applications, including predictive analytics, customer service (through chatbots) and personalized marketing. These technologies help in making informed decisions, automating repetitive tasks, and enhancing the customer experience.

- Digital payment platforms: the rise of digital wallets and mobile payment solutions has transformed financial transactions, making them faster, more secure, and convenient. Small businesses are integrating these platforms into their payment systems to accommodate the growing preference for contactless payments, thereby improving customer satisfaction and operational efficiency.

- Social commerce: the shift towards online shopping has been accelerated by innovations in ecommerce platforms and social commerce, enabling small businesses to sell their products and services directly through social media platforms and websites. This not only expands their market reach but also provides valuable insights into consumer behavior.

14. Failure to understand customer behavior today

In our connected age, ‘the customer is always right’ rings more true than ever. For example, today’s consumers expect small brick-and-mortar companies to accept credit cards and “currencies” like Apple Pay, even if the shop is a tiny mom-and-pop operation. And they demand quality customer service. If you don’t deliver it, expect your customers to complain loudly on social media and with other communication tools.

For better or worse, review sites and platforms amplify word-of-mouth marking.

In our digitally obsessed society, it’s easier than ever for customers to share their thoughts and opinions about the businesses they interact with—which means it’s easier than ever for business owners to monitor and solicit customer feedback.

Not sure where to start? Here is a list of channels to help you monitor feedback and engage in conversations with customers.

Social media

All social media platforms (Facebook, Twitter, Instagram, Pinterest, TikTok, etc…) are great social listening tools that make it easier than ever to listen to your customers. In fact, in today’s world, using a social media platform to contact a business is often preferred by customers as a faster alternative than traditional phone calls. Thanks to push notifications that alert you when your business has been mentioned, re-tweeted, liked, pinged or poked, knowing when to engage with customers is easier than ever.

Yelp reviews

Yelp is one of the go-to destinations for people who want to find local businesses. With over 148 million cumulative reviews, it’s also a great place to find out what customers are saying about their experience with your business. If a company receives a poor review, Yelp encourages the business owner to jump into the conversation, so you have an opportunity to apologize or explain.

Google reviews

Just like Yelp, this a more passive channel than social media, but nonetheless, very important. Google is dominating the review market with 6 in 10 consumers now looking to Google for reviews. Since literally everything is Googled these days, your business’ Google reviews are likely one of the first things a user will notice about your business.

Dedicated customer advocacy website

One of the most trusted websites for consumer reviews is Trustpilot. With over 45,000 new reviewers each day, they’ve built an entire online review community dedicated to helping customers share their genuine experiences.

Customer surveys

Surveys are still one of the best ways to ask customers specific and direct questions. If you collect customer email information at the point of sale, you can quickly identify your top customers and previous customers who are less engaged. Using this data, you can create a survey for free using SurveyMonkey to find out how you can improve your business. It doesn’t hurt to offer an incentive for completion, like a discount on their next purchase.

With 85% of consumers saying they trust online reviews as much as personal recommendations, it’s imperative that your online reputation is intact so that potential customers aren’t turned off by poor reviews. At the very least you should try to make sure your positive reviews outnumber the negative ones. While poor reviews may not bring down a startup on their own, they play a large role in the success of brick and mortar businesses.

At the very least, you need to keep your business information current across as many channels as possible.

13. Not prioritizing customer experience and satisfaction

In retail, personal interaction and customer service are paramount. Customers have endless options at their fingertips, making it easier than ever to switch to a competitor after just one poor experience. Retail businesses that fail to recognize the importance of customer satisfaction often see a decline in loyalty, negative word-of-mouth, and a drop in repeat business, all of which can lead to failure.

For example, a retail store with unhelpful staff, limited product information and a complicated checkout process will likely frustrate customers, driving them towards more user-friendly competitors. Similarly, an online retailer that neglects post-purchase support, such as handling returns and addressing customer complaints, risks damaging its reputation and losing customer trust.

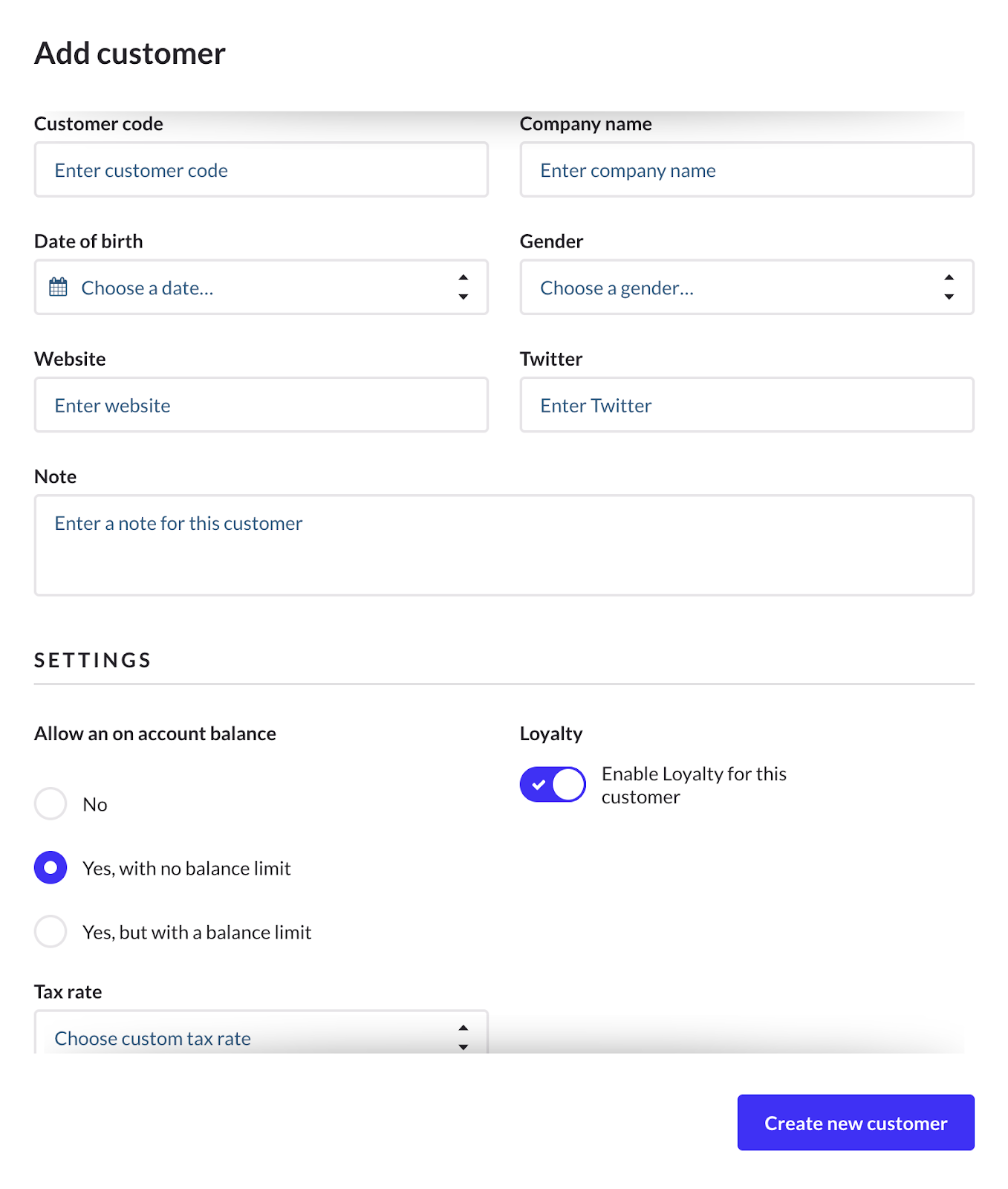

Building customer loyalty programs

To prevent these outcomes, businesses should focus on building robust customer loyalty programs and personalizing the customer experience. Loyalty programs that offer rewards, exclusive deals and personalized discounts encourage repeat business and can turn a satisfied customer into a loyal advocate.

Personalize the customer experience

Use Lightspeed’s built-in customer profiles to tailor experiences, recommendations and communications to individual preferences and behaviors. This can range from greeting customers by name to suggesting products based on past purchases or browsing history.

12. Ineffective online presence and digital marketing

An ineffective online presence and lack of digital marketing are significant obstacles for small businesses. With potential customers turning to the internet for shopping and product research, a strong online presence is not just beneficial—it’s essential.

Retailers without a user-friendly website or active digital marketing strategies miss out on countless opportunities to attract and retain customers. Here’s how you can make sure you don’t get caught in this trap.

Have a strong website

Your website serves as your digital storefront, offering a first impression that can either attract or repel potential customers. It should be visually appealing, easy to navigate and optimized for mobile devices, as mobile shopping makes up around 60% of ecommerce globally.

Make sure you’re providing a seamless shopping experience with detailed product information, high-quality product photos, customer reviews and a secure checkout process.

Leverage social media

Platforms like Instagram, Facebook and Pinterest can be powerful tools for engaging with customers, showcasing products and driving traffic to your website. Creating consistent, high-quality content that resonates with your target audience can boost brand awareness and foster a community around your business.

Make sure you’re using social media for:

- Product launches and promotions: announce new product arrivals, special promotions or exclusive deals. Engaging visuals, limited-time offers and shareable content can drive excitement and traffic, encouraging both online and in-store visits.

- Customer engagement and feedback: create interactive posts, polls and live sessions to engage with customers. This direct interaction fosters community and provides valuable insights into customer preferences and feedback.

- Influencer collaborations: partner with influencers whose followers match your target audience. Influencers can showcase your products in a relatable and authentic way, expanding your reach and credibility among potential customers.

Utilize SEO (search engine optimization) strategies

Strong SEO is vital for ensuring that your website and content are discoverable by potential customers searching online.

Three areas of SEO you should be focusing on:

- Keyword optimization: research and use relevant keywords throughout your website’s content, including product descriptions, blog posts and meta tags. Targeting the right keywords helps improve your site’s visibility in search engine results for those terms, attracting more potential customers.

- Mobile optimization: ensure your website is mobile-friendly, with responsive design and fast loading times.

- Quality content creation: produce high-quality, relevant content that addresses your target audience’s needs and interests. Regularly updating your site with valuable content, such as product guides, how-to articles, product reviews and industry news, can improve search rankings and engage customers.

Implement a variety of email marketing techniques

Email marketing remains one of the most effective techniques for directly reaching customers. Retailers can use email campaigns to announce new products and offer exclusive discounts to grow sales.

- Personalized recommendations: utilize customer purchase history and browsing behavior to send personalized product recommendations. This tailored approach makes emails more relevant to the recipient, increasing the likelihood of engagement and sales. Lightspeed Retailer Thread + Seed uses Advanced Marketing for personalized targeting: “Being able to see who our high spenders are and knowing how to target them means we can track their spending and figure out, who are our top spenders? Who do we want to be approaching for something like our one on one styling sessions, and so forth?

- Segmentation: divide your email list into segments based on criteria like purchase history, location and interests. Tailoring your messages to different segments allows for more targeted and effective communication, improving open rates and conversions.

- Exclusive offers and loyalty rewards: send exclusive discounts, early access to sales and loyalty rewards to email subscribers. This not only incentivizes purchases but also fosters customer loyalty and encourages subscribers to stay engaged with your brand.

11. Inventory mismanagement

Your business startup cannot be successful if your inventory is poorly managed. According to the Small Business Administration (SBA), problems with inventory ranks among the major reasons new businesses fail. Poor management can often lead to inventory shortages and overages—silent cash flow killers.

It’s a rookie mistake that easily happens to new businesses that don’t understand their sales patterns. The best way to combat this is to use inventory management software or a point of sale (POS) system that can track inventory and provide reports detailing your best and worst selling products to help you identify sales patterns.

If you’re not keeping track of your top-selling items or when they’re in high demand, you’re going to experience inventory shortages that will shrink your profits.

As a merchant, you take on risk when you buy large amounts of inventory with the goal of selling it for a profit. If you don’t sell those products as quickly as you forecasted, they can lose value or become obsolete. This forces you to sell them at a deep discount, or not at all. Until you can recoup your money by selling the inventory you have on hand, your capital will be tied up in a lot of unsold inventory.

Picture this. Instead of thinking of stock items as inventory lining your shelves, think of it as piles of cold hard cash. Each product in storage or your local warehouse is cold hard cash you’ll never see since it’s not contributing a return on investment (ROI).

The harsh reality is that U.S. retailers are sitting on $1.43 of inventory for every $1.00 in sales they make. Proper inventory management using modern tools will ensure you’re not one of them.

10. Financial mismanagement and lack of budgeting

Financial mismanagement and lack of budgeting are pivotal reasons small businesses, particularly in retail, face failure.

Effective cash flow management is crucial. Without it, businesses may struggle to cover essential expenses like rent, inventory and salaries. Retailers must carefully balance stocking diverse and sufficient inventory against the risk of over-purchasing, which can tie up precious capital and lead to cash flow problems.

Another common pitfall is not allocating funds for marketing or underestimating the costs associated with acquiring new customers, which can stifle growth.

Effective budgeting strategies

Engaging a financial advisor can make a significant difference. They provide expert guidance on budgeting, financial planning, and investment strategies tailored to the business’s specific needs, helping to navigate financial challenges and avoid common pitfalls.

Here are some budgeting strategies you can use with your financial advisor:

- Zero-based budgeting: start each new budget period with a base of zero and justify every expense, rather than using previous spending patterns as a baseline. This approach forces retailers to evaluate the necessity and ROI of every cost, ensuring that all spending contributes directly to business goals and helps in eliminating unnecessary expenses.

- Inventory management Optimization: use inventory management techniques such as just-in-time (JIT) to minimize holding costs or the ABC analysis to prioritize inventory based on profitability and turnover rates. Efficient inventory management can free up cash flow and reduce waste, allowing retailers to allocate resources more effectively to areas with higher returns.

- Flexible budgeting: implement a flexible budget that can adjust to changes in sales volume or operational costs. This strategy allows retailers to adapt their spending in response to actual performance and unforeseen expenses, ensuring that the budget remains relevant and effective throughout the financial period.

9. Poor employee management and training

Poor employee management and inadequate training are critical factors that can lead to the failure of retailers, fast.

In retail, the direct interaction between employees and customers means that every employee’s knowledge, skills and attitude can significantly impact customer satisfaction and loyalty. Without proper training, employees may lack the necessary product knowledge, sales techniques, and customer service skills to effectively engage with customers and close sales.

Poor management practices, like a lack of clear communication, failure to motivate and recognize employee contributions and inadequate feedback, can lead to low morale and high turnover rates. High turnover not only increases recruitment and training costs but also affects team cohesion and service continuity, which can further erode customer satisfaction.

Strategies for effective team leadership

Make sure your managers know the importance of:

- Empowering and engaging the team: effective retail team leadership involves empowering employees by involving them in decision-making processes, acknowledging their ideas and fostering an environment where they feel valued and motivated.

- Continuous training and development: implement ongoing training programs to enhance product knowledge, customer service skills and operational efficiency. Regular training ensures that team members are up-to-date with the latest retail trends, technologies, and best practices. This commitment to development helps in building a knowledgeable and adaptable workforce capable of delivering exceptional customer experiences and driving sales.

Creating a positive workplace culture

If your business has a positive culture, employees will be less likely to leave.

- Recognize and reward: regularly acknowledge and reward employees for their hard work, achievements, and exceptional customer service. Recognition can be as simple as verbal praise, employee of the month awards or incentives for reaching sales targets.

- Foster open communication: encourage open, honest communication by creating an environment where team members feel comfortable sharing their ideas, feedback, and concerns. Regular team meetings and one-on-one check-ins can facilitate this, helping to build trust and collaboration among staff.

- Promote work-life balance: recognize the importance of work-life balance by offering flexible scheduling, considering employees’ needs outside of work and promoting a supportive atmosphere.

8. Unsustainable growth

In business, slow and steady wins the race most of the time. Expanding too quickly, which usually entails financing on credit like a small business loan, can backfire if the market changes or you hit a rough patch.

Trying to take on more business than you can handle drains your working capital and usually results in a quality decline. You are overwhelmed and your product or service suffers.

Instead, be smart about which customers you court, and how you will pay back each business loan. Saying no is part of running a business.

7. Lack of sales

On the other end of the spectrum, nothing hurts a new business faster than not reaching its sales goals.

This can happen when you rely too much on one large customer. If your cafe depends on student traffic during the school year, you will need to diversify come summer to stay afloat.

The only way to make sure you’ll hit your sales targets is to gain analytic insights from existing data and use those insights to inform your sales strategy. A quality point of sale system is a good place to start.

6. Inadequate network and community engagement

Inadequate engagement can significantly hinder a retail business’s growth and lead to its failure.

Networking is not just about making connections. It’s about building relationships that can offer support, insight and opportunities. Small businesses thrive on the strength of their local networks—customers, suppliers and fellow business owners. Without active engagement in these networks, retailers may miss out on valuable partnerships, shared resources and local customer loyalty.

Engaging with the local community involves participating in local events, supporting local causes and creating a space that serves as more than just a store. Such engagement fosters a sense of belonging and community support, which can be crucial during tough economic times.

Establishing partnerships and collaborations with other businesses can lead to cross-promotion opportunities and broadened customer bases. For instance, a clothing retailer could collaborate with a local jewelry artisan for a pop-up event, benefiting both parties through shared marketing efforts and customer cross-pollination.

5. Trying to do it all

Small business owners are a scrappy bunch, and tend to view themselves as Jacks (or Jills) of all trades. But entrepreneurs, like all people, have strengths and weaknesses, not to mention a finite number of hours in each day.

Delegation is your friend. Whether that means hiring your first employees or investing in software that cuts down on busywork, your business will only start making money once you offload some of your responsibilities onto other qualified shoulders.

4. Underestimating administrative tasks

When you were planning your company, maybe you imagined happy customers, smart marketing and of course, plenty of cash. You probably didn’t imagine spreadsheet after spreadsheet. But large chunks of running a business revolve around administrative tasks.

From inventory management to managing employees to all the bookkeeping and accounting involved in the endless quest to meet your financing goals and turn a profit, administrative responsibilities can easily eat up your entire day.

According to a poll conducted by SCORE, 47% of small business owners dislike the financial costs associated with bookkeeping, and 13% dislike the administrative headaches and the amount of time it sucks out of their workday.

So be prepared. Hire accordingly or outsource many of your rote tasks to technology. As an example, Lightspeed Accounting seamlessly integrates with QuickBooks, so you never have to manually input your accounting data. Shortcuts like this save you time, and time is money.

3. Refusal to pivot

That’s right, old-fashioned stubbornness comes in at #3 of the top reasons small businesses fail. It’s easy for entrepreneurs to become obsessed with their business idea or product, even when all evidence points to it not being a success.

Maybe by the time your brick-and-mortar store is celebrating its second anniversary, all the excitement and shininess of your new store has worn off, and fewer locals are walking through your doors. Now what? Do you become a statistic and resign to failure, or do you take the time to figure out where you need to adapt? Maybe you pivot to appeal to tourists, or stock a different type of merchandise that appeals to your customer base, or use your space to host weddings and parties on the weekends.

Sometimes an effort to pivot to ecommerce can backfire, if not done properly. Typically, physical stores and digital stores will share inventory. And while you may keep them in separate storage areas, if you sell out of an item online faster than in-store, you’ll have to fulfill some of your online orders from your store inventory. Unless of course, you’d rather ship to your warehouse first and then ship to the customer—causing unnecessary delays and a poor customer experience. To avoid this, invest in a POS system that offers a truly omnichannel ecommerce experience that automates the exchange between online and physical inventory.

2. Lack of data

Your small business is competing with cash-rich behemoths like Wal-Mart and Starbucks. What do those giants have at their disposal? Data. Tons of data.

Though your market is much smaller, you should still gather as much information as you can. If you don’t have insight into the performance of your business in real-time, it will drastically limit your ability to make smart, data-driven decisions.

For example, you need complete visibility into the revenue you collect and the expenses you pay. Without this knowledge, you are literally flying blind.

On the expense side of the equation, if you want to buy a new line of inventory or make some updates to your storefront, you need to know how it’s going to impact your bottom line. And it’s not just these expenses you need to keep an eye on, but all of your costs.

As a business owner, you need to know what percentage of revenue you can allocate to employee wages, utility bills or rent so you can set proper targets for cost savings. On the revenue side, you want your business to grow month over month or year over year.

If you don’t achieve your goals, you may want to examine areas of your business where you’re overspending—i.e., the expense side. To ensure your expenses don’t exceed your revenue and turn your business into a failure rate statistic, it’s helpful to know your net income.

Calculating your net income

First, you need to define your Gross Profit (GP) by taking the Cost of Goods Sold (COGS) and subtract the number from the total net sales. If you’re using a POS system like Lightspeed, you can find reports like these, and more.

The second factor you’ll need in this calculation is your Operating Profit (OP). To find the OP, you need to subtract your operating expenses (i.e., payroll, rent, utilities) from your gross profit. If you’re using accounting software, you’ll easily be able to retrieve this information.

Lastly, you have non-operating expenses. These are expenses that are not related to core business operations like your operating profits, but rather taxes or interest you may have on loans or cash advances. Non-operating expenses are subtracted from your operating profit to yield your net income.

The secret to running a lean business is a long-term, ongoing strategy that strives to eliminate waste to improve efficiency, agility and quality of business operations—all while maximizing value to customers.

While this seems like a contradiction, doing more with fewer resources, it’s much easier than you think once you break it down into small steps. The ideology of a lean business is built on the methodology of build-measure-learn.

Build

The main idea behind build is that Rome wasn’t built in one day. Nor was Google’s Gmail, Apple’s iPhone or mega-retailer, Amazon. Businesses don’t start out doing all the cool and fancy things they’re known for today. For instance, Amazon started as an online bookstore, and now they deliver groceries to your home and provide streaming music services. The point is these companies started with a basic idea, or in the business world, a Minimum Viable Product (MVP) that they can introduce to the market.

Measure

Next, these companies measured. They measured the results of the MVP during the experimental stage. How did the market respond to your product or business? Did they react the way you expected them to, or was the reaction the complete opposite of your hypothesis?

Learn

Once you have some reliable data measurements, you can then determine which direction to move based on the results of that data. Have you been right all along and now you have the data to back it up? Or did the measurements provide you with some insight into areas you can improve?

Applying build-measure-learn

To apply this to your small business, you need to go back and look at your business plan. What are you trying to build? What are your goals? Finally, what is the bare minimum you need to get started?

Whatever the outcome, know that it is backed by reliable data that you can trust to help pivot your business in the direction that will help it be most successful.

Real-time data dramatically reduces lag time between data collection to data analysis, thus making your business more agile and responsive to changing trends. And if there’s one thing every small and medium-sized business has over big-box retailers is the innate ability to be agile because they don’t have to cut through the corporate red tape to make changes. They can see the data trends in real-time and respond accordingly.

1. Poor management

We’ve finally reached the #1 reason why a new business might fail. Entrepreneurs have power over their businesses, and with great power comes great responsibility.

Management is partly about attitude and mindset—and it does have an effect on your bottom line.

Sometimes small business owners become set in their ways when it comes to doing certain things. This is especially true for veteran business owners. For new entrepreneurs, make sure you don’t fall into this trap. And to be fair, it’s not just business owners. It’s everybody. It’s human nature, and we are all guilty of it at some point in our lives.

Assumption and complacency typically happen when a business is doing well and fall into a false sense of security that your business is operating in the best possible and most productive way. That’s precisely when fallacy swoops in and wreaks havoc if you’re not careful.

Planning your road to business success

Operating a successful business is not something you can leave up to chance or luck. It takes a clearly defined business plan, strategic operations and sound financial management from startup and throughout the life of your business.

These 19 reasons should give you a solid understanding of how to turn around a failing small business so your company doesn’t become a failure rate statistic. While you might not be able to avoid every single reason listed above, it’s important to be aware and think preemptively about what you can do to tackle each of them, and come out winning. If you want to get started on proper inventory management, analytics, and ecommerce, let’s chat!

FAQs

What is the #1 reason small businesses fail?

The number one reason small businesses fail is inadequate cash flow management. Without sufficient cash flow, businesses struggle to cover daily operations, invest in growth or manage unexpected expenses, leading to financial instability and ultimately, failure.

What is the biggest mistake small businesses make?

The biggest mistake small businesses make is neglecting to plan thoroughly. This includes failing to develop a solid business plan, underestimating the importance of financial planning and not preparing for market changes. Without a clear strategy and adaptability, businesses struggle to navigate challenges and seize opportunities, leading to potential failure.

How do you revive a failing business?

To revive a failing business, start by conducting a thorough analysis to identify the root causes of its struggles.

Restructure your business plan focusing on viable products or services, streamline operations to reduce costs and enhance customer experience to boost loyalty.

Consider diversifying offerings or exploring new markets. Improving financial management and seeking external funding if necessary are also crucial. Engage with customers and stakeholders for feedback and support.

Lastly, don’t hesitate to seek advice from mentors or industry experts who can provide fresh perspectives and strategies.

How long does the average small business last?

The longevity of a small business can vary widely by industry, location and other factors.

According to data from the Bureau of Labor Statistics, about 50% of small businesses survive at least five years, and roughly 33% survive ten years or more.

What year do most small businesses fail?

Most small businesses face the highest risk of failure within their first five years. Specifically, around 10% of small businesses fail in their first year, around 31% in their second year, and by the end of the fifth year, almost 50% have ceased operations. This critical period highlights the importance of solid planning, financial management and adaptability in the early stages of a business.

How many startups survive 5 years?

Approximately 50% of startups survive past their fifth year.

How many businesses make over $1 million?

Less than 10% of U.S. businesses generate over $1 million in annual revenue. Achieving this level of revenue typically requires strategic planning, effective marketing, strong customer relationships and continuous innovation to stand out in competitive markets.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.