Operating expenses (OPEX) are a crucial part of running a retail business. From rent and utilities to payroll and marketing, these costs directly impact your bottom line. And when margins are tight and competition is fierce, effectively managing OPEX can mean the difference between success and getting left behind.

In this guide, we’ll break down what operating expenses are, why they matter and how you can manage them efficiently in today’s evolving retail landscape.

- What are operating expenses?

- Why are operating expenses important for businesses?

- Capital expenses vs operating expenses: what’s the difference?

- Common challenges in managing operating expenses

- How do you calculate OPEX and CAPEX?

- How to track CAPEX and OPEX?

- What are some examples of retail operating expenses?

- What’s excluded from operating expenses?

- How to manage OPEX

- What’s going to happen with retail operating costs in 2025?

- Preparing for rising retail operating expenses

Searching for the right POS system?

Our free guide will help you understand the kind of point-of-sale system you need to run your business efficiently.

What are operating expenses?

Operating expenses include all the ongoing costs a business incurs to maintain its daily operations. Unlike capital expenses (CAPEX), which involve long-term investments like equipment or real estate, OPEX covers essential recurring costs such as rent, utilities, salaries and marketing expenses.

Is inventory an operating expense?

Is inventory an operating expense? It’s a bit tricky. When you sell an item, its cost moves to Cost of Goods Sold (COGS). But before the sale, inventory is an asset on your balance sheet. Inventory isn’t just finished goods, though; it also includes raw materials, transportation, manufacturing, storage and other overhead costs.

Why are operating expenses important for businesses?

Managing OPEX effectively is a key part of maintaining a healthy bottom line, improving operational efficiency and staying competitive in evolving markets. Uncontrolled expenses can quickly eat into your profit margins, especially in industries like retail, where costs can fluctuate due to external factors like inflation, supply chain disruptions and shifting consumer demand.

But a well-optimized OPEX strategy can allow retailers to allocate resources strategically—investing in areas that drive growth, including the customer experience, digital transformation and employee development. By keeping operating expenses in check, businesses can remain agile and boost cash flow, ensuring they have the flexibility to seize new opportunities, whether expanding into new markets or investing in more innovative technologies.

Capital expenses vs operating expenses: what’s the difference?

Understanding business expenses can be a challenge for many retailers, whether they’re in the planning stages of launching a new venture or actively managing the finances of an existing business.

They fall into two basic categories: OPEX and CAPEX. Here’s how they differ.

Understanding CAPEX

Capital expenses (CAPEX) are significant investments in assets designed to provide long-term benefits to your business. Unlike daily operating expenses, CAPEX involves acquiring or upgrading major assets like new equipment, building renovations or significant tech upgrades. These investments are planned with long-term budgets in mind, as they often require more funding and are seen as investments for future growth.

Understanding OPEX

As we previously mentioned, operating expenses are the costs associated with the day-to-day running of a business. Examples of operating expenses include employee salaries, rent, utilities and marketing initiatives.

COGS vs OPEX

Think of COGS as the price tag on creating your product—it covers direct costs like raw materials and production labor. Operating expenses, on the other hand, keep the business running smoothly, covering essentials like rent and utilities. While COGS is tied to making your product, OPEX is not directly tied to production.

| Category | CAPEX | OPEX |

| Definition | Long-term investments in business assets | Day-to-day costs of running the business |

| Purpose | Supports future growth and expansion | Keeps the business operational |

| Examples | New equipment, building renovations, major tech upgrades | Salaries, rent, utilities, marketing |

| Budgeting | Requires long-term planning and higher funding | Covered by regular operational budgets |

| Accounting treatment | Depreciated over time | Fully expensed in the year incurred |

| COGS vs OPEX | Not directly tied to production costs | Covers ongoing business expenses, separate from the cost of goods sold (COGS) |

Common challenges in managing operating expenses

Managing operating expenses isn’t always as simple as it seems. Businesses often encounter several complex challenges that can impact their bottom line:

- Budgeting and forecasting challenges: Predicting future expenses accurately is difficult, especially in a fluctuating economy. Unexpected costs, such as supplier price increases or higher energy bills, can throw off even the most well-planned budgets.

- Balancing cost control with quality and customer service: Cutting costs too aggressively can impact product quality and the customer experience, leading to lost sales and damage to your brand. Retailers must find a balance between cost efficiency and maintaining high standards.

- Dealing with fluctuating costs: Operating costs such as rent, utilities and wages are often influenced by external factors like inflation and economic shifts. Businesses need to adopt flexible budgeting strategies to adapt to these changes while trying to minimize financial strain.

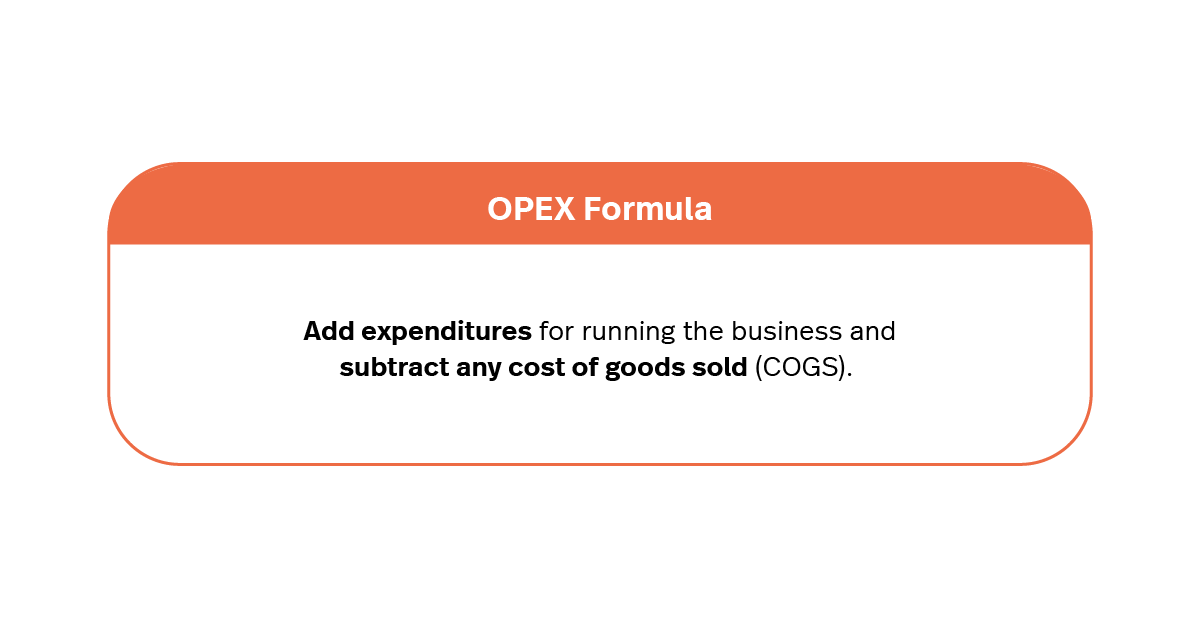

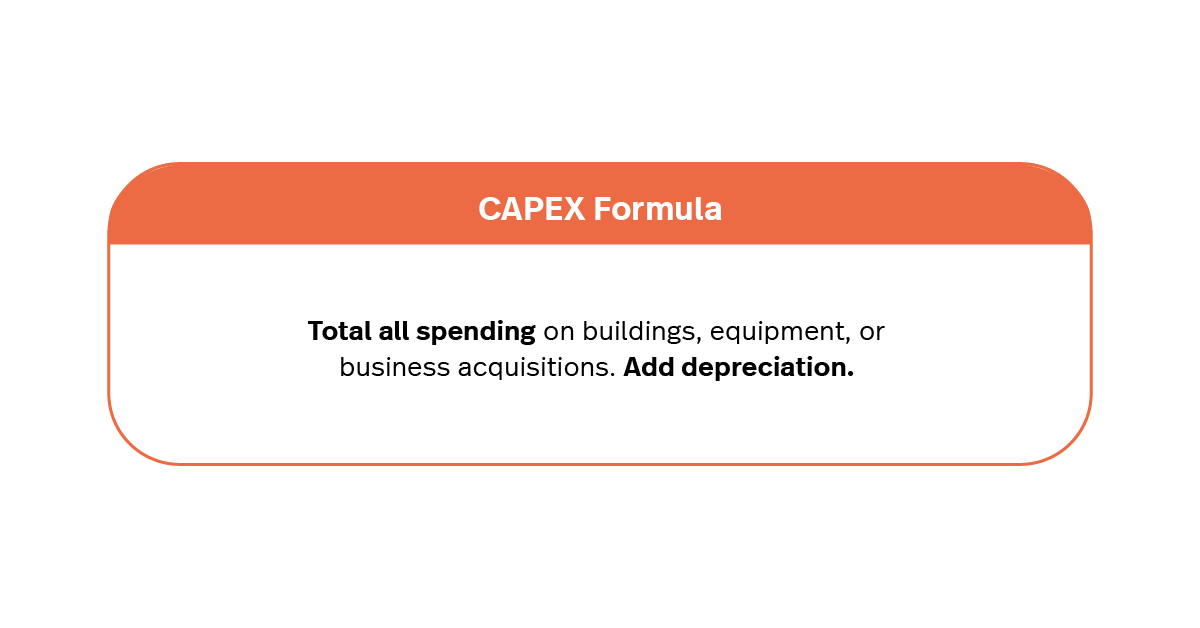

How do you calculate OPEX and CAPEX?

Retailers can calculate OPEX and CAPEX using the following formulas.

Understanding the difference between OPEX and CAPEX helps retailers make smarter financial decisions. When calculating OPEX, you’re looking at the recurring costs that keep your business running, while CAPEX calculations focus on long-term investments that add value over time. By analyzing these expenses separately, retailers can better manage cash flow and plan for growth.

How to track CAPEX and OPEX

If you’re not already using accounting software to track expenses, now’s a great time to start! Tools like QuickBooks can help categorize every transaction, making it easier to distinguish between operating expenses and capital expenditures. Regularly tracking and reviewing expenses ensures you know where cash is flowing and helps with budgeting and forecasting.

Separating OPEX and CAPEX in your budget allows for better organization and prioritization. OPEX gives a real-time snapshot of financial health, while CAPEX planning ensures sustainable growth.

Retailers should also consider industry-specific expenses. Ecommerce businesses might save on rent but spend more on IT and shipping, while brick-and-mortar stores have physical location costs but may not need as much digital infrastructure.

By tracking expenses effectively, retailers can optimize operations, reduce unnecessary costs and make informed financial decisions that drive long-term success.

How to track capital expenses

Capital expenditures require a different approach than operating expenses. CAPEX consists of long-term expenses such as maintenance and anything that involves investments for future growth. As a result, capital expenses require long-term budgetary planning. Think of this as tracking future projects for growth.

Tracking CAPEX involves creating deadlines, identifying the scope of the project and accounting for budgetary needs. Include important details such as materials, funding requirements, labor costs and other necessary information.

Accounting software, rather than manual bookkeeping, will give you more freedom when mapping out your capital expenses.

How to track operating expenses

Spreadsheets can be a good starting point for tracking business expenses when you first open your new venture. But as you scale and your expenses become more complicated, you’ll need a more sophisticated way of tracking your expenses.

That’s where accounting software comes in once again: not only will you save time on bookkeeping, but you’ll get a better overview of your expenses compared to your overall revenue. This can help you understand where you need to cut costs, and how to streamline your expenses to maximize revenue.

If you’re transitioning from Excel spreadsheets to a software that comprehensively tracks expenses, don’t stress about losing data. These sheets can easily be imported to most accounting software.

By eliminating manual entry of your daily and monthly expenses, you’ll reduce the risk of errors and make your life (and your accountant’s life!) much simpler when it comes to tax time.

What are some examples of retail operating expenses?

Not all operating expenses are created equal; some drive revenue, while others keep the business running smoothly. Direct expenses, like sales commissions, are tied directly to making money. Indirect expenses, such as office supplies, support daily operations but don’t generate revenue on their own. The good news? As long as they meet tax guidelines, both can be tax-deductible, helping to lower your taxable income.

Typically, the top retail operating expenses include:

- Salaries: Payroll costs typically make up a significant portion of your budget. Your business also has to factor in taxes and benefits for employees here.

- Store rent: You might pay more in rent for a prime location with high foot traffic, while an online retailer might not have to think about this expense at all. Renting usually comes with added expenses for maintenance, cleaning, utilities and tax.

- Marketing and ad spend: This covers all your spending on traditional channels like television adverts, print coupons, email marketing and social media promotion.

- Product deliveries: Delivery costs for retailers can vary significantly depending on the size and weight of the product being shipped, as well as the distance it needs to travel.

Like other businesses, retailers are also likely to spend recurring monthly amounts on:

- Software subscriptions

- Ecommerce platforms

- Website maintenance

- Merchant and bank fees

- Telephone and internet bills

- Consulting

What’s excluded from operating expenses?

Operating expenses do not typically include one-time costs such as capital investments or long-term debt payments. These business costs, and a range of others, are what are known as non-operating expenses.

Understanding non-operating expenses

Non-operating expenses are not related to a company’s core business operations. These can include:

- Fees for legal services

- Charges for interest on loans

- Gains or losses from asset sales

Non-operating expenses still need to be monitored closely, so you can make financial decisions and accurately calculate your business’ earnings.

How to manage OPEX

When it comes to overseeing your operating expenses, one of the most important things to do is manage your budget efficiently.

Here are a few ways to effectively manage your operating expenses:

- Take advantage of low-cost marketing methods, such as email outreach and social media posts.

- Remove third-party providers and embrace technology to cut costs by using an integrated POS system and payments platform, like Lightspeed.

- Assess areas where you can reduce waste.

- Review all subscriptions and cancel anything redundant or unused.

- Be efficient–regularly review supplier contracts and streamline operations to reduce costs without sacrificing quality.

What’s going to happen with retail operating costs in 2025?

Retailers in 2025 are facing a rapidly changing landscape influenced by economic uncertainty, shifting consumer behavior and technological advancements. As costs continue to rise in key areas, businesses must stay ahead of trends to manage expenses effectively while maintaining profitability and customer satisfaction.

- AI and automation will reshape cost structures

According to McKinsey, artificial intelligence and automation are expected to play an even greater role in retail operations, from inventory management and demand forecasting to customer service and marketing. AI-powered tools can help retailers optimize staffing levels, reduce waste, and streamline supply chain processes—all of which can contribute to lower operating costs.

- Sustainability will become a financial necessity

Sustainable business practices are no longer just about corporate responsibility—they are becoming essential cost-saving strategies. Retailers are investing in energy-efficient solutions, waste reduction programs and sustainable sourcing to meet consumer demand while cutting long-term operational costs.

- The rise of hybrid shopping experiences

The integration of ecommerce and brick-and-mortar retail is continuing to evolve, requiring retailers to invest in omnichannel strategies. However, maintaining multiple sales channels comes with additional operational expenses, including digital platform fees, logistics and fulfillment costs.

- Labor shortages and rising wages

Labor costs are expected to increase due to ongoing workforce shortages and new regulations around fair wages. Deloitte predicts that retailers will need to find innovative ways to attract and retain employees while managing payroll expenses.

- Supply chain volatility will drive up costs

Retailers continue to navigate unpredictable supply chain challenges, including shipping delays, raw material price fluctuations and geopolitical disruptions. This volatility requires businesses to reassess sourcing strategies, build stronger supplier relationships, and invest in inventory optimization technologies.

Preparing for rising retail operating expenses

A well-defined budget ensures all operating expenses are covered while keeping the business profitable. It’s essential to account for seasonal fluctuations, market changes, and unexpected costs to maintain financial stability.

As costs rise, retailers often face tough decisions—increase prices or accept lower profit margins. To make informed choices, business owners should analyze industry performance metrics and key indicators. Understanding market trends helps retailers stay competitive while balancing pricing strategies and profitability. Proactively tracking these factors ensures smarter financial planning and long-term success.

If you’d like to explore how Lightspeed can help you manage your operating expenses and grow your retail business, talk to one of our experts.

FAQs

Is income tax expense an operating expense?

No, income tax expense is not considered an operating expense. It’s classified as a non-operating expense because it’s not directly related to a company’s core business operations. Operating expenses typically include day-to-day costs like rent, salaries and utilities—not taxes owed on profits.

Is operating expense a liability or asset?

Operating expenses are neither liabilities nor assets. Instead, they are recorded as expenses on the income statement. They represent the costs a business incurs to keep operations running smoothly and are fully expensed in the period in which they occur.

How do operating costs affect profit?

Operating costs directly impact your bottom line. The higher your operating expenses, the lower your operating profit will be—unless your revenue increases proportionally. Keeping OPEX under control helps businesses maintain healthy margins and free up cash flow for growth initiatives.

Are operating expenses included in COGS?

No, operating expenses and Cost of Goods Sold (COGS) are separate. COGS includes the direct costs of producing goods (like raw materials and labor tied to manufacturing), while operating expenses cover the broader costs of running the business—such as rent, utilities and marketing.

Are wages operating expenses?

Yes, wages are considered operating expenses. Salaries and employee benefits are typically among the largest operating costs for a retail business. These expenses fall under the category of day-to-day costs necessary to keep the business functioning.

What does an increase in operating expenses mean?

An increase in operating expenses can signal higher costs of doing business—due to inflation, rising wages, supply chain issues, or expansion. While some increases may support growth (like marketing investments), unchecked OPEX can reduce profitability if not managed strategically.

Editor’s note: Nothing in this blog post should be construed as advice of any kind. Any legal, financial or tax-related content is provided for informational purposes only and is not a substitute for obtaining advice from a qualified legal or accounting professional. Where available, we’ve included primary sources. While we work hard to publish accurate content, we cannot be held responsible for any actions or omissions based on that content. Lightspeed does not undertake to complete further verifications or keep this blog post updated over time.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.