Consider this scenario: it’s June, and you’ve just moved into an apartment with a large balcony. You decide to purchase some patio furniture for your new place online. When you go to make your purchase, you notice that the prices for the patio set you want are higher than they were when you first spotted the set a few months ago. That’s dynamic pricing–because demand for patio furniture increases in the summer, the retailer’s pricing algorithm adjusted prices accordingly.

As a consumer, you probably encounter dynamic pricing more than you realize–from airlines to Amazon to ride-share apps and plenty more.

As a retailer, you can use dynamic pricing to optimize your prices and make significant profit gains, online or in-store.

Here’s what we’ll cover in this article:

- What is dynamic pricing?

- Leveraging data for dynamic pricing

- Dynamic pricing strategies for retailers

- Benefits of dynamic pricing

- Challenges with dynamic pricing

Need help pricing your inventory?

Learn all the ways Lightspeed Insights can help you make confident pricing decisions.

What is a dynamic pricing strategy?

Dynamic pricing is when you change the price of a product or service based on real-time, outside elements—like when Uber boosts rates during peak traffic hours. The biggest challenge to getting started is determining which outside element will be the catalyst for your prices changing.

Implementing the right long-term dynamic pricing strategy can lead to a boost in sales of between 2-5% and an increase in profit margins of 5-10%, according to McKinsey.

It won’t happen overnight, though. Accurate and consistent data analysis, consumer behavior research and market research are just a few of the factors involved in using dynamic pricing.

If you choose to use a dynamic pricing strategy, don’t feel the need to constantly adjust your prices, like ecommerce giant Amazon does on a daily basis. What works for one business will not necessarily work for another.

Surge pricing vs. dynamic pricing

It’s important to distinguish between surge pricing and dynamic pricing. Dynamic pricing refers to any model that allows prices to fluctuate, whether that’s up or down. Surge pricing is a category of dynamic pricing referring to prices that are only increased.

Dynamic pricing vs. traditional pricing models

Here’s a handy chart where you can compare what dynamic pricing looks like compared with more traditional pricing models: cost-plus, competitive and value-based pricing.

| Aspect | Dynamic pricing | Cost-plus pricing | Competitive pricing | Value-based pricing |

| Pricing flexibility | Highly flexible, adjusts in real-time based on demand, competition, and inventory | Fixed based on a markup over cost; flexibility depends on periodic review | Fixed based on competitor pricing, reviewed periodically | Flexible, based on perceived value by customers, adjusted less frequently |

| Response to market demand | Immediate adjustment to demand, competition, and stock levels | Not responsive to market changes; based solely on cost and desired profit margin | Moderately responsive, prices change when competitors adjust theirs | Responsive to customer demand and perceived value, but changes slowly |

| Technological requirements | Requires advanced AI, data analytics, and machine learning tools | Minimal technology required, often calculated manually or using spreadsheets | Requires competitor price monitoring, but less tech-heavy than dynamic pricing | Requires customer insights and data analytics for understanding perceived value |

| Customer perception | Can cause confusion or mistrust if not transparent or executed in the right circumstance | Transparent and simple for customers, but may not reflect market dynamics | Clear and competitive, but may lead to price wars | Trusted if aligned with value perception, but may alienate some customers |

| Revenue potential | Potential for higher revenue due to ongoing price optimization | Predictable revenue based on fixed profit margins | Revenue depends on maintaining competitiveness, with limited flexibility | Higher revenue potential if value perception aligns with pricing |

Related: Read more about pricing strategies for retailers in our in-depth article.

Leverage data with dynamic pricing

Data is the foundation of a strong dynamic pricing strategy. Let’s get into just a few of the metrics you should track.

- Customer purchase history: track your customers’ buying behavior.

- Customer demographics/segments: segmenting customers allows you to create a more targeted strategy.

- Inventory tracking: track your inventory to view best selling items, deadstock and more.

- Forecasting demand: predict future demand based on historical sales data, inventory data and other factors.

- Competitor pricing: research competitor pricing (ongoing) to ensure you stay competitive, especially for retailers with similar products.

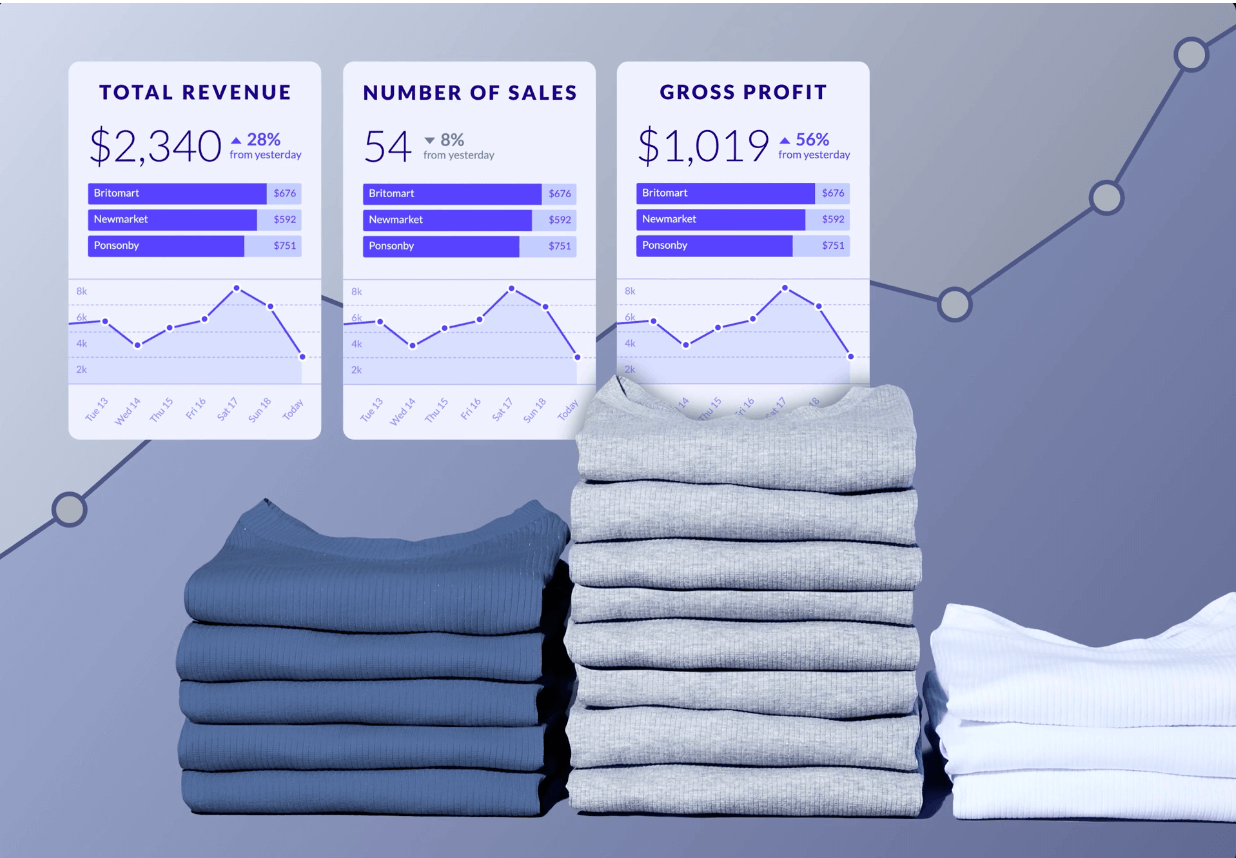

Using a solution that provides all or most of these data points for you is incredibly useful. Lightspeed Insights for retailers allows you to forecast demand, see in-depth inventory and sales reports, track customer history and more.

Data as a superpower: a case study

How can data help your business? In many more ways than one–far beyond pricing. Let’s take a look at Lightspeed customer Squash Blossom. The apparel boutique has been a staple in Atlanta, Georgia, for 25 years and switched to Lightspeed in 2018.

Lightspeed has helped owner Lisa Bobb simplify and automate crucial aspects of her business. More specifically, automated reports with in-depth sales data keeps Bobb’s vendors informed of sales data so they can create purchase orders of best selling items for her.

“All my vendors love that Lightspeed can generate automated reports that they get monthly. They take that and create a reorder for me. They end up getting more business out of me and it’s great because it’s my bestseller. I don’t have to guess,” Bobb says.

That illustrates one of the ways data can be a superpower–and how important it is to harness it.

Now we’ll get into how you can price products with analytics as your base.

Dynamic pricing strategies for retailers

So, how does dynamic pricing work? The following strategies are designed to get you started with dynamic pricing. They help you determine price ranges for your products, as well as the desires and flexibility of your customers.

1. Price based on customer purchase history

One retail dynamic pricing option is basing prices on a customer’s purchasing history. In other words, your prices adapt based on how much a customer has purchased from you in the past. This dynamic pricing option requires that you sell both discounted and regular price products.

After a customer buys a product, you should be able to save the sales data associated with that customer and determine if they’re typically a bargain hunter or regular price shopper.

Send the customers who regularly pay full price for products a set of marketing materials that emphasizes new products they might like—not discounts or promotions. Send promo codes and special deals to the ones who historically buy discounted products.

Tip This dynamic pricing option also gives you plenty of room for other testing. For example, try marketing pricier products to the customers who typically buy full-price, and try marketing items you want to liquidate to the ones who buy things on sale.

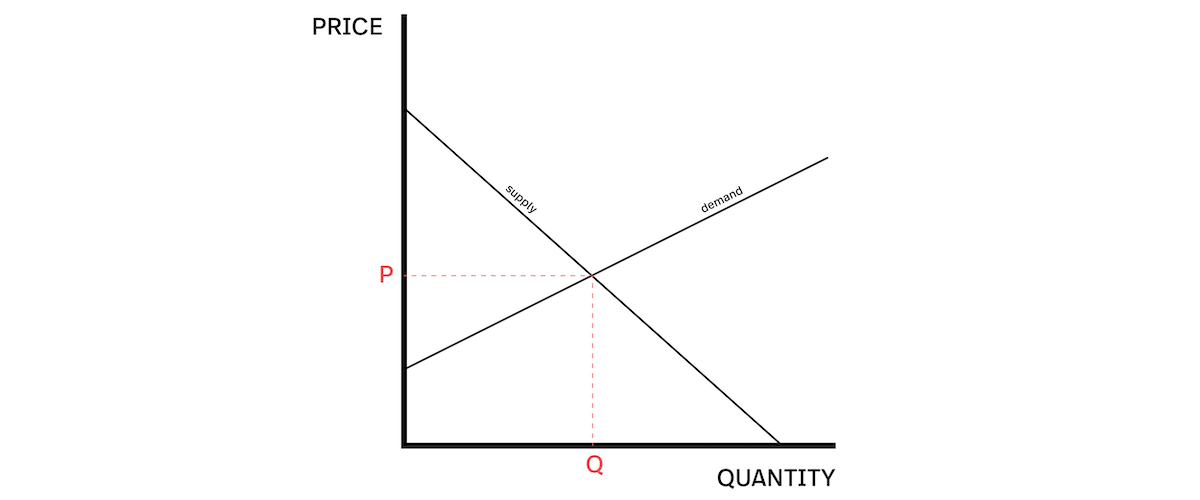

2. Price based on demand

Another common strategy is to adjust the purchase price based on demand, which is also known as demand-based pricing. As a product reaches its peak demand, its price reaches a ceiling. This is especially useful for products that are taking a long time to reach their pique interest, like sandals or other seasonal products.

If your items become more popular over time, you can increase prices slowly as well. It also protects against some supply chain concerns. When demand is at its highest, not only are customers typically willing to pay more, but a discount or deal could quickly lead to out-of-stock issues that can cause long-term harm to your business.

Here’s a simplified tool version of demand pricing, but it can help you figure out where on the price axis you might be.

Tip Demand-based pricing should include a look at your margins. If you’re making a 50% margin on a product and you increase the price by 10%, you can see up to a 16% decline in sales volume while still increasing your revenue from it.

3. Price based on release date

The crux of this dynamic pricing strategy is that the newer something is, the more it’ll cost. It’s perfect for in-store and online retailers who have a consistent flow of new products, like apparel shops.

If your marketing persona for the product is the person that “just has to have the latest new thing”, then you know they’re willing to pay more if they can be one of the first people to get it.

The more excited your customers are about a product, the more you can play with its price. In some cases, a product can even appreciate in value after the original release.

One product category where this is especially true is with sneakers, which has a global market value of around $80 billion. Highly anticipated sneakers typically have pre-orders and waitlists, and sell out remarkably fast. As the shoe becomes scarcer and fewer remain, but demand remains high, they become increasingly expensive.

4. Price based on time or season

Buying a winter jacket costs more in winter than at the end of spring. We all know about these items and typically think of it as a “sale,” but it’s actually a form of dynamic pricing.

However, you can also do this with goods throughout the day or week. Any restaurant or bar offering a “happy hour special” follows this pricing scheme to drive foot traffic when there is the most competition and the greatest demand.

Tip: This kind of dynamic pricing is often used to attract new customers by providing significant discounts for a limited time.

Benefits of dynamic pricing

While dynamic pricing can seem tricky to carry out, it can actually lead to a lot of gains for your business. Here are just a few.

1. Increased revenue and profit margins

We touched on this earlier, but this is probably the most significant benefit of dynamic pricing for retailers looking to grow. This form of price optimization allows you to maximize your sales without sacrificing profitability. This isn’t to say that your focus should be on charging customers the highest price you can get away with–it all comes down to supply and demand. The price adjustments should match customer demands.

What does this look like in action? Let’s take the example of a gift shop retailer. Their busiest season is around the holidays at the end of the year, so they prepare their inventory accordingly. Because demand for their products is highest around this time, prices can be raised accordingly. Post-peak season, because demand is lower, this gift shop retailer will offer discounts, bundle deals and slashed prices. Ultimately, the gift shop retailer can maximize their profits during a period in which they know demand will be high.

2. Improve inventory management

Dynamic pricing is a great way to avoid both stockouts and dead inventory. For instance, if a product is selling out quickly, you can raise prices slightly to slow down the pace of sales and ensure that the product stays in stock longer. Of course, this is within reason, and only if it makes sense given the context and item. On the other hand, if an item isn’t selling well, you can reduce prices to speed up sales and clear out stock. This is a great way to manage your seasonal or perishable inventory, thereby saving costs.

Related: Check out our ultimate guide to retail inventory management.

3. Flexibility in the face of market changes

Among significant shifts in consumer behavior, increased competition, and an overall challenging economic landscape, retailers have been forced to evolve. Dynamic pricing is a strategy that helps in the face of such uncertainty. Staying ahead of competitors is made simpler. It’s also easier to capitalize on retail trends with dynamic pricing–if you sell a product that’s gaining traction on social media, for instance, you can quickly maximize on that trending product using dynamic pricing.

4. Gain better customer insights

This one is a sort of chicken-and-egg situation: you delve into customer data to help hone your dynamic pricing strategy, and from there the insights you glean help you refine your strategy–and overall business.

But this can go even further–dynamic pricing tools are often powered by AI and analytic software to track customer behavior, preferences and purchasing patterns. With these insights, you can better understand how customer segments respond to pricing changes and adjust your strategy accordingly. This data can help you encourage repeat business, increase customer retention and create personalized shopping experiences.

Dynamic pricing challenges

As with anything in business, dynamic pricing has its challenges. Let’s take a look.

1. Angry customers

We’ve all been there. You see a product at a certain price, but leave and return a few days later to find the price has increased. For some shoppers, this isn’t a big deal. But for others, it’s a major issue that damages your brand reputation. That’s why it’s so important to use accurate data to inform your pricing decisions.

If prices change too frequently or without any perceived justification, your customers may feel they are being treated unfairly. A lack of transparency increases the risk of hurting your reputation and alienating your customer base.

Remember how we had to clear up dynamic pricing vs. surge pricing? Recently, Wendy’s announced it would start testing dynamic pricing for its menu. Many consumers perceived this as price gouging and surge pricing, even though they planned to implement a dynamic pricing strategy. Others saw the move as exploitative, potentially taking advantage of customers to raise prices during busier periods. No matter what Wendy’s said to backtrack, it was too late: their reputation was severely damaged in the aftermath.

The lesson? Your customers should come first–pricing intentionally and within reason is essential.

2. Pricing battles

If you’re in a competitive market, there’s a good chance you and your competitors are monitoring each other’s pricing. Regularly changing your pricing could result in a race to the bottom that hurts your profitability. As always, do what’s best for your business considering all the factors that we discussed earlier–not competitive pricing alone.

3. Increased complexity

Another challenge to consider are the heightened technological and time requirements involved in dynamic pricing compared with other models. It requires sophisticated technology and software that measures factors like consumer behavior, sales data and inventory in real-time. That’s where a solution like Lightspeed can help: you get advanced data solutions right in your POS.

Lightspeed can help your business

Whether your store is online, brick-and-mortar, or both, one thing is certain. Customers will shop around to get the best prices. That’s why dynamic pricing is so valuable. Adjusting your prices based on their relation to other variables gives you flexibility, and helps you set the best price possible.

Interested in running your business more efficiently using Lightspeed? Talk to one of our experts today.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.