Small businesses power the global economy. As competition rises, businesses everywhere have to adopt new platforms and ways of working–plus respond fast to changing consumer demands. If you own a small business, you know very well that cash flow is the key to your business surviving and thriving. And this is why payment processing is worth understanding: it’s all about helping you get paid quickly, safely and affordably.

The US alone has more than 32 million small businesses. They employ around 48% of the private sector workforce. Facts like these put in perspective the significant role these businesses play in driving economic growth.

As consumers’ standards increase when it comes to the overall buying experience, businesses of all sizes have to adapt or risk falling behind.

That’s why, whether it’s in-store POS transactions or ecommerce sales, good payment processing can help you stay on top of your cash flow and keep customers happy.

In this article, we’re going to walk you through these 10 useful things to know about SMB payment processing:

- There are more payment methods than ever before

- Small businesses can choose their own payment provider

- Small businesses should frequently reassess their provider

- Processing fees are unavoidable

- Processing fees can be negotiated

- There’s a difference between payment providers and gateways

- Embedded payment processing makes bookkeeping easier

- Some payment processors are more secure than others

- Payments are processed at different speeds

- Good customer service is essential

Find the best payment processing solution for your business

Not sure where to start your search? Check out our guide to choosing a payment processor.

1. Customers expect a variety of payment optionss

Customers are always changing the way they want to pay you.

- Many shoppers no longer carry cash. Nowadays, the average modern-day consumer pays for their daily purchases using credit cards, debit cards, or mobile wallets.

- Whatever payment processor you choose, it will benefit you if you can accept many different payment methods to meet these customer expectations.

- Debit cards, credit cards, ACH payments, bank transfers, and digital wallets like Apple Pay, Samsung Pay, and Google Pay are just some of the payment methods your customers and clients are using today.

Other payment methods to consider offering include buy-now, pay-later (BNPL), cash-on-delivery, and invoicing for any wholesale business customers.

Using a payment provider that enables you to offer a variety of methods is key to retaining customers, especially if you sell online and in-store.

Why your business should offer multiple payment methods: a case study

Women’s apparel boutique The White Orchid has been open since 2010, and is no stranger to evolving consumer expectations.

In the past several years, the retailer found that maintaining profitability was a challenge when faced with increasing supplier prices. Founder Diane Muno lacked the adequate systems required to keep up.

She also noticed changes in how customers expected their payment experience to go. Preferences shifted toward modern payment systems and sustainable practices.

“They want to be able to pay with their phone, with their watch and every way that suits them. They’re surprised if they have to pay through an old fashioned method,” Diane said.

After switching to Lightspeed’s unified POS and payments platform, Diane unlocked inventory visibility and flexible payments.

Now she has no trouble meeting checkout expectations: customers not only get a modern and streamlined system to pay through, but also the ability to pay through card or phone, tap or swipe, and cash.

2. You can choose who processes your business payments

Just as you can offer many payment methods to your customers, you also have many options when it comes to choosing a payment processing provider. Make sure the provider you choose offers services that are tailored to small businesses. Whether you run a gift shop, a restaurant, cafe, or online store, make sure the provider you choose also offers solutions that are built on an understanding of your unique industry.

Consider how the provider you choose can help you grow. If you open a new store location, can you easily process sales and view multilocation payment data? If you expand online, does your payment provider offer gateway services? Go for a provider that will enable you to scale. Using a patchwork payment solution could cause you trouble further down the road.

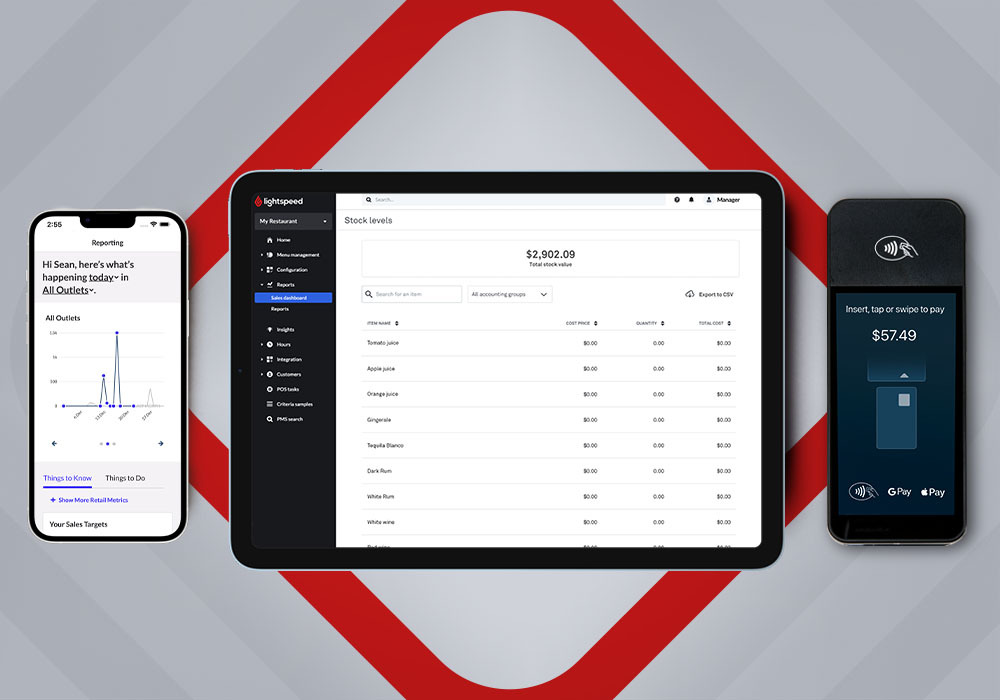

Did you know? Lightspeed Payments is an embedded payment platform that works seamlessly within our POS to allow you to process sales, get paid and streamline your workflows in one platform. Lightspeed offers payment processing for retailers and restaurants of all types.

3. You should reassess your payment provider every year

In a similar vein, avoid getting stuck with a payment processor you have outgrown. If your goal is to increase your sales with a better payment processing setup, then measure your sales numbers before and after using the processor.

For instance, if you started using a processor in August, then review your sales from August to October. Then compare the numbers with the three months prior to August. This might give you a good idea of how successful the implementation has been.

4. Payment processing fees are unavoidable …

But don’t sign anything before you get the full picture about fees. Payment processing costs typically vary from 1.7% to 3.5% for every transaction, depending on the processor you choose.

According to Clearly Payments, the global overall average processing rate for credit card transactions is 2.4%. This of course depends on your region, provider and other factors.

Some processors charge a monthly fixed cost but charge less for each transaction, while others charge significantchargeback fees.

“When we opened our business, there was an initial belief that payment processing fees were static,” said Yuvi Alpert, CEO of Noémie, a direct-to-consumer fine jewelry brand. “We soon found that small mistakes like properly setting up your account and terminal can make a big difference.”

5. … but you can (and should) negotiate

But that doesn’t mean you have zero bargaining power.

If you have a startup or a small firm with a low monthly sales volume, consider a flat-rate supplier. Consider asking potential payment processors for an all-inclusive monthly fee with a reduced transaction rate, especially if you have high sales volume or need special services.

- Make sure you don’t just go with the cheapest payment processor you can find.

- A thorough vetting procedure is required to find the best processor for your business.

- When you’re shopping for a payment processor, you’re looking for a business partner that will safeguard your most significant asset: revenue.

“To have bargaining power, you need to have sales volume in your business which will make your vendor want your business, and that’s when you can negotiate processing fees,” said Christopher Sioco, COO of Parachor Consulting, a tax services firm.

Negotiating may be more difficult if you don’t have significant transaction volume, as fitness and health agency CEO Chad Price explains. “I’ve actually not been able to negotiate my payment processing fees because I chose a pricing plan that works by percentage. That way, I don’t get a strict flat fee but it changes depending on the volume of transactions.”

Related: Learn all about payment processing fees and pricing models in our in-depth guide.

6. Payment providers differ from payment gateways

Here’s another thing to know before you start talking with potential payment processing partners. A payment gateway and a payment provider are two different things.

- A payment gateway is software that allows you to accept payments online. Gateways collect sensitive information from your customers and send it securely to your payment provider, who then processes the payment and sends you the money.

- A payment provider is an organization that processes card transactions for merchants. Examples include Stripe and PayPal, but there are many others.

Some gateways and providers can also link up with your accounting software, to make it easier for you to close your books at the end of each month.

7. Embedded payment processing makes bookkeeping easier

We talked about embedded payments a little earlier, but there are many benefits to choosing this option. It takes the concept of integrated payments a step further.

With embedded payments, payment processing software is natively built-in to a company’s existing suite of products to create a streamlined checkout workflow. The provider owns every aspect of the customer journey, providing an improved end-to-end experience for the customer.

Ultimately as a business owner, you get one provider for all your business operations with every application connected in one place.

If you do your own bookkeeping, this means you will no longer have to manually check and mark the POS transactions that have been paid. Each transaction is automatically recorded in your POS system and consolidated in reports. This makes reconciliation highly efficient, saving you time and money.

Consider embedded payments if you want to simplify your accounting and bookkeeping processes, or if you think your business will soon start selling across more sales channels.

Simplifying bookkeeping with an embedded payment solution: a case study

Jewelry retailer Melissa Joy Manning has seen steady success since she started her business 25 years ago. Her thriving business now runs online, in-store and wholesale.

But she found her operations being held back by an inflexible POS system, and an equally difficult payment processor.

“There was very little transparency in fees, and it was difficult to figure anything out,” she said. So she switched to Lightspeed.

Their workflows immediately became clearer, helping their stores run smoothly. Crucially, with access to payment data and reports, they have a complete picture of their performance and financials. This simplified bookkeeping for the business.

“With Lightspeed, we’re saving a lot of time in the reconciliation process. We’re also saving a lot of money in fees, and it’s made the business much faster, much easier and so much cheaper to operate on that end.”

8. Some forms of payment processing types are safer than others

As you consider simplicity, remember to think about payment security too, especially if you’re starting to sell more and more of your products online.

- Make sure to use a payment processor that keeps your data and your customers’ data safe and secure from hackers.

- When customers fill out payment forms with their credit card information, you need safe technology to verify their identities and protect their private data from cyber fraudsters.

- Look for PCI-compliant payment partners to ensure you have good enough protection.

“When choosing a payment provider, my biggest consideration is proactive fraud detection and prevention,” said Sam Speller, founder of Kenko Matcha, which sells specialty matcha green tea.

“It’s essential to choose a company that uses both hardware-based encryptions as well as software-based encryption for all of their systems and data storage methods. Another feature I look out for is compliance with PCI regulations [the industry standard for payments security]. With this compliance, I am guaranteed that my customers’ financial information is protected at all times,” said Speller.

9. Payments take (a little) time to hit your bank account

After simplicity and security, comes speed. If you’re using a traditional POS system, payments will likely be processed slower than if you’re using an ecommerce platform. This is because ecommerce platforms are designed to handle large volumes of payments quickly and efficiently.

- For example, it typically takes two business days for credit card payments processed with Lightspeed Payments to be deposited into your bank account.

- Other payment processors typically take up to three days to process funds, and with every payment processor, very large settlements may take longer to process. However, Lightspeed also offers instant payouts for merchants to access their funds immediately.

- If you’re using a traditional POS system, you can invest in a fast card reader or mobile POS terminal that allows customers to pay with their smartphones.

By taking steps to optimize your payment processing, you can ensure that your customers have a positive experience and that cash is landing in your bank account as soon as possible.

10. Good customer service can help you get paid faster

Finally, be sure to look specifically for a processor that ranks high for customer service around your priority features.

“Having 24/7 availability is a major concern for me. I only work with providers that have staff on call at all times—even on holidays and weekends. This ensures that I can always reach someone when I need them, whether it’s an issue with my account or some other problem I need help with,” said Speller.

Did you know? Lightspeed Payments offers free, 24/7 customer service. That includes onboarding, access to resources like webinars and demos, and unlimited support.

Find the right payment processor for your growing business

As you search for a payment provider, consider your business’ unique needs. There are plenty of payment provider options out there, so take the time to do your research.

Interested in using an embedded payment provider that grows with your business? Talk to a Lightspeed Payments expert today.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.