Buy now, pay later (shortened to BNPL) provides customers with an alternative way to pay in-store and online. BNPL services quickly became a hit for ecommerce stores, thanks to the flexible and accessible nature of the service—where customers pay for goods through installments, with little to no interest and minimal credit checks.

Having first launched in 2015, BNPL services are no longer a new concept, but they’re still gaining popularity. It’s estimated that there are more than 360 million BNPL users globally, with 79 million of those people based in the US. By 2027, it is expected that there will be 900 million BNPL users—an increase of 157%.

With its popularity and continuing growth, BNPL is a must-have for retailers selling online. In this article, we’ll review what you need to know about adding buy now, pay later to your store.

- What is buy now, pay later?

- The alternatives to buy now, pay later

- How BNPL works for retailers

- Pros and cons of BNPL for retailers

- When you can expect to get paid

- Fees involved with buy now, pay later

- How you can start offering buy now, pay later

Safe and convenient payment options for your online store

Offer your online shoppers fast and secure payment options to grow your conversion rate and revenue.

What is buy now, pay later?

Buy now, pay later, really, is exactly what it sounds like: a way for shoppers to buy their goods now and pay them off later. It’s a short-term financing option where shoppers agree to pay for their purchase in installments after a downpayment (typically 25%).

BNPL generally promises no interest and, depending on the service provider, no late fees with minimal to no credit checks. However, payment plans above the typical pay-in-four installments can charge interest, and some BNPL providers do charge fees for missed payments or renegotiating installments.

BNPL is primarily used for online shopping, and is now available for a wide range of products and price points. Retailers selling $900 leather coats offer it, and retailers selling $20 fitness aids offer it. Online shoppers are coming to expect an option to buy now and pay later everywhere they shop online.

Millennials and Gen Z were early adopters of BNPL, and the payment method quickly grew in popularity among these generations. In 2019, 6% of American Gen Z shoppers used BNPL, which jumped to 36% by 2021. American Millennials were even bigger fans, with 41% using buy now, pay later in 2021.

However, in recent years, BNPL has gained traction across all consumer groups. According to Statista consumer insights, 41% of U.S. adults have used buy now, pay later services in the past 12 months, with another 22% saying they haven’t but could imagine doing so in the future.

How does BNPL work?

There are different buy now, pay later service providers out there, and they all have their own quirks. Overall, though, here’s how the service works:

- An online shopper heads to checkout with a cart full of goods that are eligible for buy now, pay later

- After a quick eligibility check—if the BNPL provider does them, as not all do—the shopper is approved

- They opt to pay for their purchase in four or more installments and pay a downpayment

- The retailer ships the shopper their purchase

- The shoppers makes payments to the BNPL service provider

The alternatives to buy now, pay later

Buy now, pay later isn’t an entirelynew concept. The basic principle behind it—pay in installments, not all at once—has been around for decades. Installment lending was the most popular way of paying off purchases prior to 1977, and BNPL is an updated take on that.

Alternatives exist in the form of payment management methods shoppers have been using for years. The vast majority of retailers offer at least one of them—credit cards are ubiquitous with shopping—but there are good reasons why buy now, pay later has taken off and is now vital for online retail.

Let’s examine the alternatives to demonstrate why.

BNPL vs point of sale financing

Technically, all buy now, pay later is point of sale financing, but not all point of sale financing is BNPL.

Point of sale financing that isn’t BNPL is still offered at the same stage—as shoppers are paying—and involves payment installments. Like BNPL, customers receive their items right away.

It generally involves interest, though there may be interest-free periods, and payments take place over a year or more. Typically, big ticket items such as appliances and furniture are eligible, and clothing and smaller personal goods retailers are less likely to offer it.

Compared to BNPL, point of sale financing is less flexible and more expensive—because of the interest charges—and requires credit checks more often. Shoppers are less likely to encounter it because of the narrow application.

BNPL vs layaway

Layaway payments were first used in the 1930s to help shoppers stretch budgets impacted by the Great Depression. Shoppers agree to payment terms and make payments in installments while the retailer stores the item until it’s fully paid off.

While popular for decades, Layaways were eventually usurped by credit cards. They’ve seen a slight comeback in popularity in the last decade, as their no-interest terms offer an alternative to credit card debt.

Because shoppers only receive their items after they’ve paid off the purchase in full, BNPL presents a more attractive low-to-no interest alternative to layaways. Buy now, play later plans are also typically less strict about late payments.

BNPL vs credit cards

Credit cards are the most common alternative to buy now, pay later—in fact, they’re the most common way to pay over everything else. Like BNPL, shoppers receive their purchases right away and pay off the owed balance over a period of time instead of all at once. Unlike BNPL, shoppers have credit limits and are subject to higher interest if they don’t pay off their entire balance.

Credit cards are unlikely to lose their importance any time soon. Buy now, pay later plans, with their fixed payment installments, are less flexible than credit cards. As long as shoppers pay their monthly minimum, they can take as much time as they need to pay off a purchase. But the higher interest rates makes credit card debt hard to manage compared to BNPL plans.

BNPL gives shoppers a way to manage their budgets while avoiding excess credit card debt. Over half of BNPL users prefer it to credit cards, and 38% expect it to replace their credit card eventually.

How does buy now, pay later work for retailers?

Let’s extend the credit card comparison briefly. To take credit card payments, retailers sign a contract with a payment processor. They take payments from shoppers, but the processor does the actual work managing the payment.

Buy now, pay later works similarly. A retailer integrates a BNPL tool into their online store so that it’s accessible at checkout, and the service provider manages the payment. Like with a payment processor, the retailer pays a fee to the service provider.

Pros and cons of BNPL for retailers

Buy now, pay later services have become a popular alternative payment option for retailers, offering customers the flexibility to split their purchases into manageable installments.

While this payment method can increase competitive advantage and enhance customer satisfaction, it also comes with challenges that businesses need to consider. Here are some of the key advantages and disadvantages of BNPL for retailers who are considering if it’s the right fit for their business strategy.

Pros of buy now, pay later for retailers

1. Increased sales and average order value

BNPL makes higher-priced items more accessible, encouraging customers to spend more. Plus, many retailers report a noticeable boost in conversions and upselling opportunities when offering BNPL, with a survey finding that nearly 70% of customers spend more when using a BNPL service.

2. Improved customer acquisition

Buy now, pay later can attract price-sensitive customers and those without traditional credit options, thanks to the flexible and accessible nature of the service. Many BNPL providers also operate internationally, enabling online retailers to cater to a broader audience rather than being restricted to their local country.

3. Quick and guaranteed payment

Retailers receive the full purchase amount upfront from the BNPL provider, minimizing cash flow risks. BNPL providers also handle the collection of future payments, so retailers avoid the burden of tracking installments or managing missed payments.

Cons of buy now, pay later for retailers

1. Transaction fees

Like any payment service that allows you to take payments online, BNPL providers charge merchants fees to use their products. Fees can range from 2% to 8% of the transaction amount, which is typically higher than traditional credit card fees.

2. Reduced control over brand and customer relationships

Partnering with the wrong BNPL provider or one with controversial practices may negatively impact a retailer’s brand perception. BNPL providers often take over parts of the customer interaction process, such as payment reminders or dispute handling, reducing retailer control through the customer journey. Some customers may also default on payments, potentially leading to reputational risks if the retailer is perceived as contributing to financial hardship.

When will I get paid with buy now, pay later?

While shoppers pay for their purchases in four (or more) installments, the retailers they’re doing business with get paid in full sooner, typically within three business days. This is because the BNPL service provider pays the retailer, and then the shopper pays the service provider back the money they were loaned.

Essentially, retailers get paid in full almost right away, minus any fees for using the platform. At no point will the retailer be responsible for managing payment plans.

Fees involved with buy now, pay later

Fees vary between service providers and agreements with retailers, but start at a similar average. Sezzle, for example, charges 6% + $0.30 per transaction, but that rate can differ based on industry, retailer risk and business size.

While that fee structure is higher than credit card fees, it’s important to keep in mind just how popular BNPL is. BNPL can increase conversion rates up to 30%, and grow the average transaction size up to 50%. Retailers have a chance to do more business paying the BNPL fees than if they opted against implementing buy now, pay later.

How can I offer buy now, pay later in my online store?

To start offering buy now, pay later, retailers need:

- A transactional website

- A buy now, pay later integration that works with the ecommerce platform

As long as the ecommerce platform and BNPL integration work together, retailers are good to go. They only need to sign a deal with their chosen BNPL service provider and install the integration according to their platform’s instructions.

Lightspeed eCom retailers, for example, can integrate BNPL into their store by heading to the Lightspeed eCom app store and hitting install on the service provider they’ve signed up with, such as:

- Sezzle:Sezzle allows shoppers to split their purchases (up to $1000) into four equal payments collected every two weeks. Shoppers using Sezzle Up can even begin to build good credit through the service, making it an attractive BNPL option that helps retailers increase conversions.

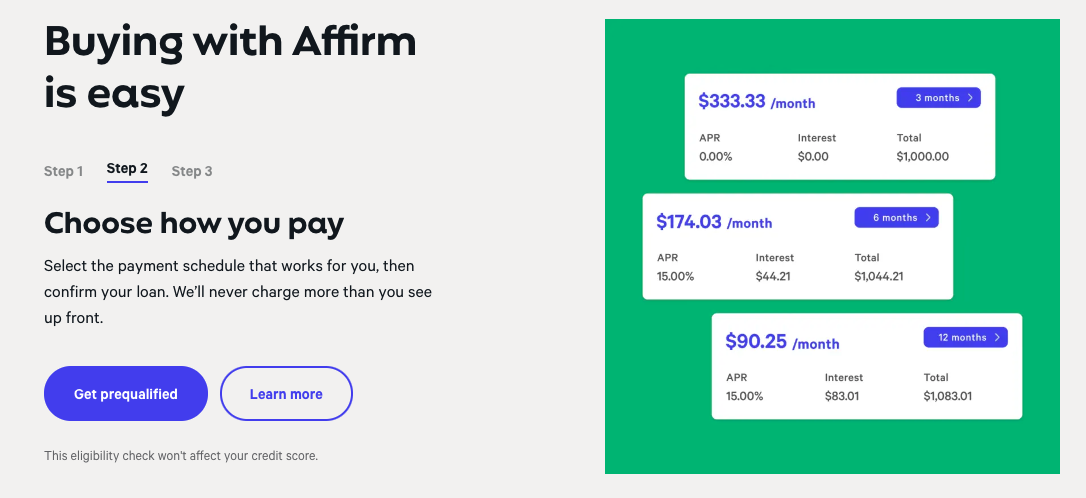

- Affirm:Affirm’s installment plans are free from compound interest and allow shoppers to choose how quickly they’d like to pay off their purchase. Retailers can offer flexibility in exchange for an average of 10% revenue growth per site visitor.

- PayBright:PayBright is a BNPL tool available for Canadian retailers. Shoppers can pay back their purchases in 6, 12 or 24 months with virtual credit accounts that can be used for multiple transactions, increasing the likelihood of repeat purchases.

Your customers are looking for buy now, pay later options

The buy now, pay later trend isn’t slowing down any time soon. In exchange for better control over their budgets, shoppers have been giving retailers more frequent conversions with higher average order sizes.

Not only does BNPL offer retailers a powerful tool to drive sales, but it also enhances customer satisfaction and attracts new audiences. However, it’s not without challenges like higher transaction fees and potential reputational risks.

By carefully evaluating the needs of their customers and the costs of partnering with BNPL providers, retailers can determine whether this payment solution aligns with their goals. When implemented strategically, BNPL can be a valuable addition to a retailer’s payment strategy, creating opportunities for growth while providing customers with greater flexibility and convenience.

Want to talk to someone about how you can offer BNPL and other features shoppers love? Get in touch with one of our experts.

Frequently asked questions

What is buy now, pay later?

BNPL is a type of short-term financing that allows consumers to make a purchase and pay for it over time in installments rather than paying the full amount upfront. It is a popular payment option offered by many retailers, both online and in-store, to make shopping more convenient and flexible for customers.

Typically, shoppers will pay a down payment (usually 25%) for their purchase and pay the remaining balance in installments over the next few weeks or months, with no interest or fees, as long as payments are made on time.

How does buy now, pay later work?

BNPL is a financing option that allows consumers to make purchases and pay for them over time in installments instead of paying the full amount upfront.

When shopping online or in-store, customers select a BNPL provider (e.g., Afterpay, Klarna, Zip) as their desired payment method during checkout. The BNPL provider may perform a soft credit check (which doesn’t impact credit scores) to assess the customer’s eligibility, and approval is usually instant for small to medium purchase amounts.

The purchase cost is usually split into smaller, equal installments, such as four equal payments made biweekly or monthly. Longer-term financing may include monthly payments over several months or years. Many BNPL providers require an initial payment (e.g., 25% of the total purchase) at the time of checkout.

BNPL plans are typically interest-free if payments are made on time. However, late fees, interest, or other charges may apply if a payment is missed or delayed.

What are buy now, pay later methods?

BNPL methods are typically offered by specialized BNPL providers, such as AfterPay, or integrated directly by merchants. Here are some of the most common BNPL methods:

- Pay-in-4 installments: Split the total purchase into four equal payments. The first payment is paid at checkout and the remaining payments are typically due every two weeks.

- Monthly installment plans: Payments are spread out over several months (e.g., 6, 12, or 24 months).

- No-interest deferred payment: Customers can delay payments for a specified period (e.g., 30 or 60 days).

- Longer-term financing with interest: Larger purchases are paid off over several months or years.

- Point-of-sale financing: Financing is integrated directly into the checkout process, online or in-store.

- Subscription-based BNPL: Customers pay in regular installments for subscription-based products or services.

Editor’s note: Nothing in this blog post should be construed as advice of any kind. Any legal, financial or tax-related content is provided for informational purposes only and is not a substitute for obtaining advice from a qualified legal or accounting professional. Where available, we’ve included primary sources. While we work hard to publish accurate content, we cannot be held responsible for any actions or omissions based on that content. Lightspeed does not undertake to complete further verifications or keep this blog post updated over time.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.