When you run a store, it’s critical to keep a finger on the pulse of your business. Paying attention to metrics like inventory value can reveal a lot about the state of your company’s finances and its operational efficiency.

Although knowledge is power, counting and managing inventory can be a restrictively time-consuming task. In order to quickly ascertain how much your inventory is worth, you either need a retail inventory management system that keeps track of your stock in real time, or a shortcut for manually gauging your inventory’s value. The retail inventory method was created to help you achieve the latter.

In this guide to the retail inventory method, you’ll learn:

- What the retail inventory method is

- Why you should use the retail method for appraising inventory

- How to calculate inventory value using the retail inventory method

- Benefits of the retail inventory method

- Common challenges and solutions

- Alternatives to the retail inventory method

Inventory management made easy

Use our straight-forward inventory management template to streamline inventory tracking, saving you hours of time.

What is the retail inventory method?

The retail inventory method is an accounting strategy for approximating the ending value of your store’s inventory, i.e., the value of the inventory remaining at the end of your accounting period. This method estimates value by comparing how much you, the retailer, paid for the products to how much you sell the products for.

The retail method serves as a shortcut to conducting a physical inventory count, but should not replace it. After all, this method isn’t always accurate because losing or damaging a fraction of your stock is unavoidable.

For best results, use the retail inventory method only when the products you’re appraising have the same markup. For example, this method won’t work if you’re calculating the value of jeans that have a 50% markup and pencils that have a 150% markup. Instead, compare apples to apples.

It’s a versatile tool that simplifies the process of appraising inventory while providing valuable insights into the current state of your stock.

Why you should use the retail inventory method

The retail inventory method is a helpful strategy for valuing inventory for a number of reasons.

Faster than physical inventory counts

First, it’s a faster alternative to conducting physical inventory counts. Counting inventory manually is easy when you sell large, big ticket items, like mattresses or boats. However, it’s more complicated when you run a store with many SKUs, like a boutique or grocery store, for example. This inventory accounting method is a shortcut to estimating your stock’s value.

Better visibility into stock value

The retail method can also help you understand when to replenish your stock. As the value of your inventory decreases, you’ll know that you’re getting closer to yourreorder point.

Easier to manage inventory costs

By using the retail inventory method, you can also gain a better understanding of how to manage inventory costs. When you know how much your inventory is worth, you gain insights into inventory-related expenses, such as holding, ordering and shipping costs. The more you know about your business, the better you’re equipped to make decisions.

Valuable insights into sales performance

Finally, this accounting method reveals insights into sales performance. By calculating inventory value on a regular basis, you can understand how quickly you’re selling products and see how your sales compare to those of previous months. If sales of certain items are stagnant, that could be a sign that you need to better manage overstock inventory or conduct an inventory cleanup.

How to calculate value using the retail inventory method

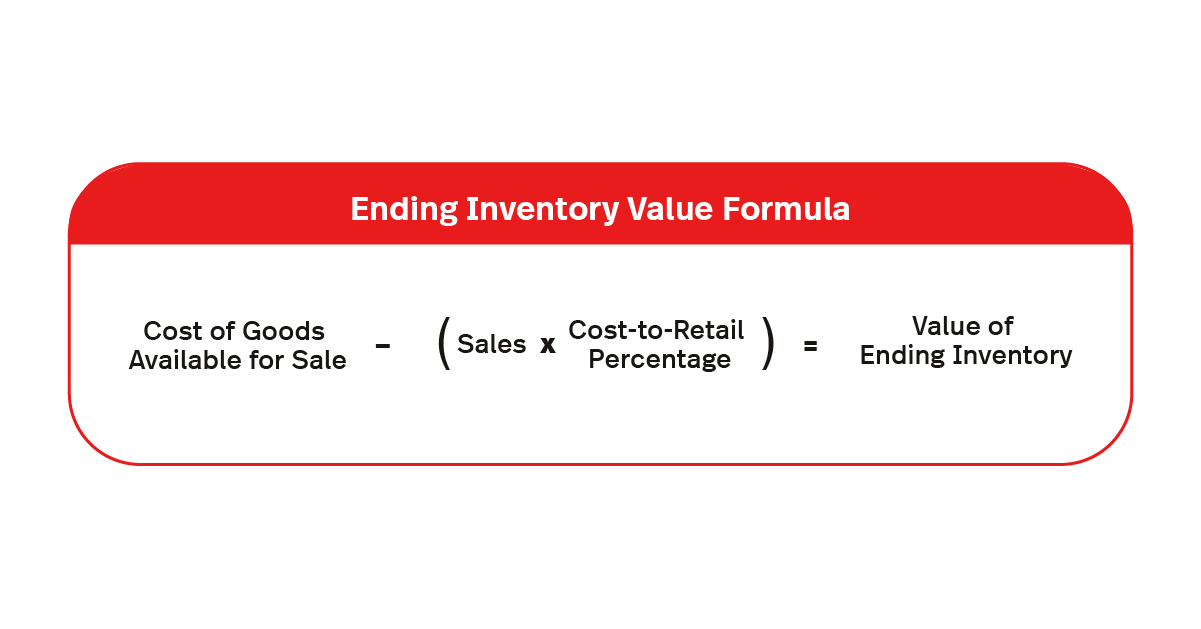

The retail inventory method estimates ending inventory value. The formula for ending inventory value using the retail inventory method is:

Let’s break down that formula further.

Cost of goods available for sale is the cost of goods sold (COGS) for the inventory you already had in stock at the start of the accounting period plus the cost of any new inventory purchased during the accounting period. Remember to use the wholesale price you paid for the inventory, and not the price you’re charging your customers.

By sales we mean the retail value (i.e., price to customers with a markup) of the products you sold during this time.

To find your cost-to-retail percentage, a.k.a. the cost complement percentage, divide the cost of goods sold (how much you paid for the inventory) by the retail prices of those goods (how much you charge customers for those goods). Then, multiply that number by 100 to end up with a percentage.

Example of calculating inventory value through the retail method

Now let’s practice putting the retail inventory method into practice. Let’s say that you run a clothing boutique and want to know the ending value of your jeans inventory at the end of the first quarter of the year.

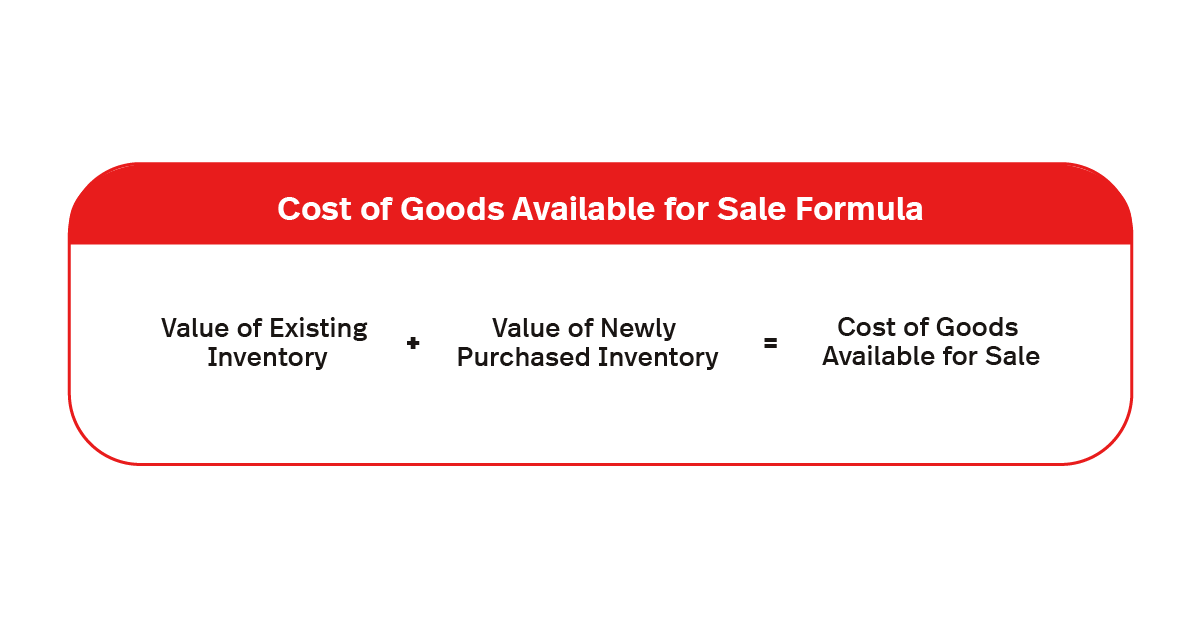

1. Calculate cost of goods available for sale

First you need to find the cost of goods for the jeans available for sale that you had in stock at the start of the quarter. By looking at data from your point-of-sale (POS) system, you see that on January 1, you already had $1,000 worth of jeans in stock. That makes the value of your existing inventory $1,000.

Now you need to calculate how much you spent buying additional inventory during Q1. According to inventory reports, in January, you purchased an additional $500 in jeans, then spent $250 on jeans in February, and another $500 on jeans in March. By adding these purchases together, you learn that the value of your newly purchased inventory is $1,250.

Now we plug those figures into the formula for the cost of goods available for sale.

Cost of Goods Available for Sale = Value of Existing Inventory + Value of Newly Purchased Inventory

Cost of Goods Available for Sale = $1,000 + [$500 + $250 + $500] = $1,000 + $1,250 = $2,250

Your cost of goods available for sale is $2,250.

2. Calculate sales

Next, you need to find out how much revenue your store generated from selling jeans during Q1. According to yourretail POS reports, your boutique sold $2,500 worth of jeans from January through March.

3. Calculate cost-to-retail percentage

Now it’s time to calculate your cost-to-retail percentage, which can be found by dividing the cost of goods sold by retail price. Based on your POS reports, the average cost of goods sold for a pair of jeans in your store is $20. These retail analytics reports also inform you that the average retail price at which you sell jeans at your shop is $80.

Therefore, your cost complement percentage is:

Cost-to-Retail Percentage = (Cost of Goods Sold/Retail Price)*100 = $20/$80 = 0.25*100 = 25%

4. Input figures into inventory value formula

Now you have all the figures you need to calculate the value of your inventory at the end of Q1.

Cost of Goods Available for Sale = $2,250

Sales = $2,500

Cost Complement Percentage = 0.25

Let’s plug all of the figures into the formula:

Value of Ending Inventory = Cost of Goods Available for Sale – (Sales*Cost-to-Retail Percentage)

Value of Ending Inventory = $2,250 – ($2,500*25%) = $2,250 – $625 = $1,625

The approximate value of the inventory you have left at the end of Q1 is $1,625.

Benefits of the retail inventory method

Here, we’ll dive deeper into the several advantages of the retail inventory method.

1. It’s simple and efficient

The retail inventory method offers ease of use. It doesn’t require in–depth knowledge of accounting to understand or implement. It’s an accessible tool for businesses of all sizes. In fact, you can easily implement it without the need for extensive training or specialized software.

Not only that, it’s time-saving, which is a significant advantage in today’s fast-paced business landscape. This method is a quick and efficient way to estimate the value of your inventory. That allows you to dedicate more time to integral business processes, including sales and customer service.

2. It’s cost-effective

Unlike methods that require meticulous tracking of each individual item, the retail inventory method reduces the need for extensive record-keeping or auditing. This can lead to significant cost savings when it comes to accounting expenses.

3. It reflects market conditions

Businesses often face the challenge of keeping their inventory values in line with ever-changing market prices. The retail inventory method addresses this issue by using current retail prices, providing a reasonably accurate reflection of market conditions. This can be especially useful in industries where prices fluctuate frequently.

4. It offers consistency across locations

For businesses with multiple locations or stores, maintaining consistency when you’re valuing inventory can be a challenge. The retail inventory method helps overcome this obstacle by offering a standardized approach to valuation, which simplifies financial reporting and analysis.

5. It can help address shrinkage

Shrinkage, which includes factors like theft or damage, can significantly impact the accuracy of inventory valuation. The retail inventory method implicitly accounts for shrinkage, making it easier for businesses to address this issue more effectively.

Further, by highlighting the impact of shrinkage, this method encourages businesses to implement comprehensive inventory control measures. This proactive approach can help reduce shrinkage over time, improving overall inventory accuracy.

6. It leads to more effective inventory management

The retail inventory method can help you maintain optimal stock levels. This is because it provides real-time insights into the value of your inventory. Not only will it help you avoid overstocking or understocking, it may reduce costs and improve overall cash flow.

It’ll also lead to more efficient inventory management because you’ll be better able to identify slow-moving or obsolete stock. That way, you can take corrective action faster, including discounting or discontinuing such products when required.

All in all, the retail inventory method offers a user-friendly and cost-effective way to appraise inventory accurately. Its simplicity, along with the ability to reflect market conditions and minimize the impact of shrinkage, makes it a valuable tool for businesses of all sizes. Moreover, it supports trend analysis and effective inventory turnover management, helping businesses stay competitive in a dynamic marketplace.

Common challenges and solutions

While the retail inventory method provides numerous benefits, it’s essential to be aware of potential challenges and know how to address them to ensure accurate inventory valuation. Here, we’ll explore some common challenges and provide solutions to overcome them.

1. Fluctuating gross margin percentages

The first challenge is that seasonal or promotional price changes can cause gross margin percentages to fluctuate, potentially leading to inaccurate valuations.

- Solution: Regularly update gross margin percentages to reflect current market conditions and use historical data and trends to make informed changes. This will ensure that your inventory valuation aligns with your actual profitability.

2. Inaccurate records

You may also notice incorrect or incomplete records of purchases, sales or returns that skew inventory values and lead to discrepancies.

Solution: Implement inventory management systems and procedures to ensure accurate data entry and maintenance. It’s also important to conduct periodic audits to verify the accuracy of inventory records. This helps identify discrepancies early, reducing the chances of undervaluation or overvaluation.

3. High shrinkage rates

When you face excessive shrinkage rates because of factors like theft or damage, that can result in inventory undervaluation.

Solution: Investigate and address the root causes of shrinkage within your organization. Implement security measures, employee training and inventory control practices to reduce shrinkage.

4. Varying markup strategies

Different products may have varying markup strategies, which can complicate the accuracy of your inventory valuation.

Solution: Categorize inventory items based on their markup strategies or pricing structures. This approach allows for a more accurate valuation because it takes into account the unique characteristics of each product group.

5. Market price volatility

Finally, rapid market price changes may make it challenging for you to keep retail prices up-to-date.

Solution: Monitor market prices regularly and adjust retail prices accordingly. Leverage technology and software solutions that automate price updates based on market data. This proactive approach ensures that your inventory reflects the most current market conditions.

You can also analyze historical pricing trends to anticipate market fluctuations and make pricing adjustments accordingly. By staying ahead of market changes, you can maintain accurate inventory valuations.

To summarize, the retail inventory method, while offering numerous benefits, also comes with its set of challenges. By implementing proactive solutions, businesses can maximize the advantages of this method while mitigating potential pitfalls.

Alternatives to the retail inventory method

The retail method to inventory represents just one strategy for calculating your inventory’s value. Alternate approaches include counting inventory, the FIFO (first in, first out) method, the LIFO (last in, first out) method, and the weighted average cost method. Let’s take a closer look at these alternatives to the retail inventory method.

Counting inventory

As noted, the retail inventory method only provides an approximate value for your inventory. It doesn’t account for items that can’t be sold because they’ve been lost, stolen or damaged, so your actual inventory value will probably be less than this estimated value.

The most accurate way to find out how much your inventory is worth is to do a manual count. While the retail method to inventory valuation is a good shortcut when you’re in a pinch, it can’t replace physical inventory counting.

FIFO

The First In, First Out (FIFO) method calculates the value of your inventory based on the COGS of the oldest items in your inventory. Because prices fluctuate in times of economic volatility, it can be advantageous to use an accounting method that acknowledges these changes.

The FIFO method for calculating inventory value involves dividing the COGS for the items that were purchased first by the number of units purchased. Note that this method gives you the average price for one unit of inventory, while the retail inventory method gives you the value of your entire inventory, or the segment of your inventory that you’re looking into.

LIFO

In the Last In, First Out (LIFO) method, inventory is calculated based on COGS for the newest items in your inventory. The formula for inventory value using the LIFO method involves dividing the COGS for items purchased last by the number of units purchased. As with the FIFO method, the LIFO method calculates an average cost per unit.

To explore the advantages and disadvantages of each inventory method in more depth, visit our guide on FIFO vs. LIFO Inventory Methods.

Weighted average cost method

The weighted average cost (WAC) method uses the weighted average cost of items in inventory to calculate their value. That means that unlike LIFO and FIFO, this method isn’t concerned with when the items were purchased. To find inventory value per the WAC method, simply divide your average COGS by the number of units in your inventory.

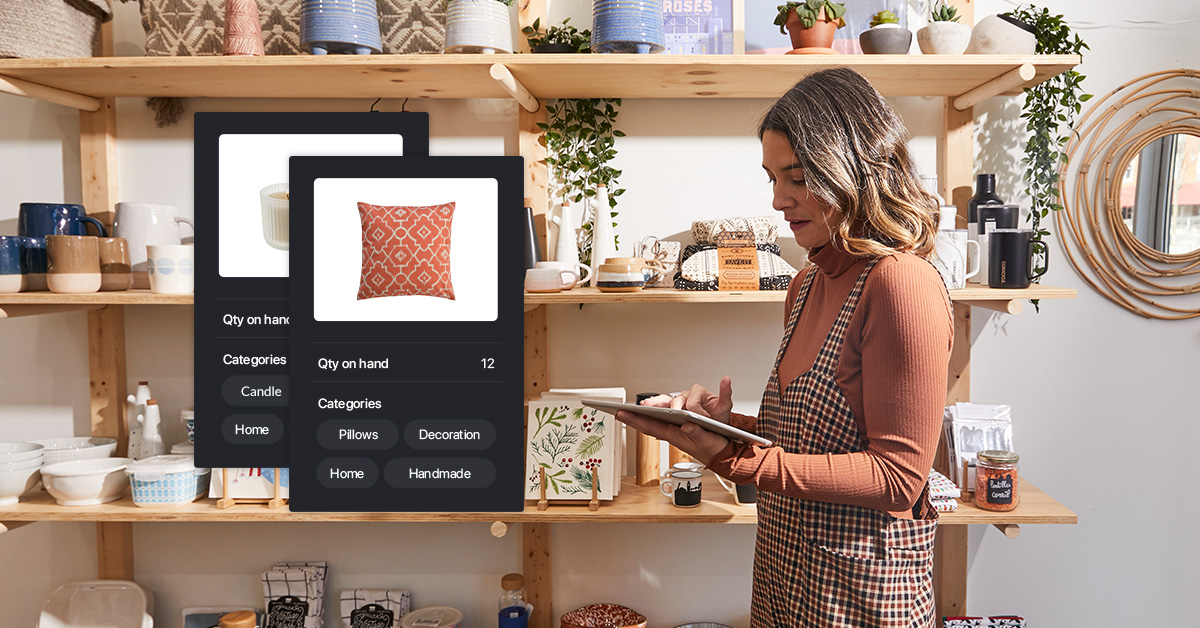

Retail inventory management system

When you equip your store with aretail inventory management system, you can skip counting and calculating altogether. When your POS has comprehensive inventory features built in, you’ll always know exactly how much your inventory is worth, in real time.

So what does a good inventory management system look like in action?

When retailer Borrego Outfitters needed a new POS solution that could scale with their operations, they turned to Lightspeed. With Lightspeed’s intuitive inventory management solution, they can manage their vast product catalog much more efficiently.

“Across the board, what we really like about it is the fact that we’re able to arrange our products and organize our products nicely in Lightspeed,” co-owner Ben Nourse says.

Calculating inventory value through the retail inventory method

Knowing how much your inventory is worth gives you valuable information about your business. With this insight, you can understand sales performance, better manage costs, know when to reorder inventory, and more. Although the retail inventory method doesn’t replace physical inventory counts, it provides a quick estimate that can help power business decisions.

Skip the calculations and equip your store with Lightspeed POS. Watch a demo today.

FAQ

1. Is the retail inventory method LIFO or FIFO?

The retail inventory method can be used with both LIFO (last-in, first-out) and FIFO (first-In, first-out) inventory costing methods, depending on a company’s preference and accounting practices.

2. What is the retail inventory method also called?

The retail inventory method is also commonly referred to as the “retail method” or “retail inventory accounting.”

3. How do you calculate ending inventory using the retail method?

To calculate ending inventory using the retail method, subtract the total sales at retail price and the cost of goods sold at retail price from the beginning inventory at retail price.

4. What is the most commonly used inventory method?

The most commonly used inventory method is the FIFO (First-In, First-Out) method, especially in industries where it’s essential to account for inventory in the order it was acquired or produced, like the food and beverage industry.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.