Managing inventory is a balancing act for growing businesses, especially those with multiple locations. When products lose value or can’t be sold, it’s not just frustrating—it directly affects profits and disrupts operations. That’s whereinventory management software comes in.

An inventory write-off isn’t just another line on your books—it’s a reality check. Whether caused by damage, theft or aging stock, knowing how to handle write-offs helps keep financial records accurate and limits avoidable losses.

For seasoned retailers, knowing when and how to write off inventory is crucial. It’s about safeguarding profits while making smarter choices for future inventory planning.

In this blog, we’ll go over what you need to know about inventory write-offs:

- What is an inventory write-off?

- Inventory write-off example

- Inventory write-off vs. write-down

- When should inventory be written off?

- 5 steps to write off inventory

- Impact of inventory write-offs

Grow your retail business.

Streamline inventory, suppliers, teams and stores with Lightspeed's all-in-one platform. From intuitive POS and stock management features to powerful reporting, Lightspeed gives you the tools you need to grow.

What is an inventory write-off?

An inventory write-off happens when unsellable stock is removed from your financial records to reflect its lost value. It’s needed when inventory can’t generate revenue anymore—keeping your records accurate and aligned with what’s actually in stock. Write-offs also prevent hidden losses from overstating profits.

Common reasons for inventory write-offs

There are several reasons why businesses write off inventory. Damage is a common one, whether from accidents, natural disasters or improper handling. Theft, both internal and external, is another scenario that renders stock unsellable and requires immediate adjustments to your accounting.

Obsolescence is one more reason. Products may lose their appeal due to market trends, seasonal changes or newer alternatives. When inventory can’t sell at full price—or at all—it’s better to write it off than let it inflate your asset values.

This isn’t just about ticking boxes; it’s about making smarter decisions. Addressing issues like damage or outdated stock quickly gives you the clarity to manage purchasing, storage and inventory planning more effectively.

Inventory write-off example

Imagine you run a shoe store and 10 pairs of boots are damaged in an accident in your warehouse. Those damaged boots can’t be sold, so their value needs to be removed from your financial records through an inventory write-off.

Here’s how that plays out in your books: if each boot costs $20, the total loss is $200. To account for it, you would debit $200 to the “loss on inventory write-off” expense account. At the same time, you would credit $200 to the “inventory” asset account, reducing the recorded inventory value accordingly.

This process does more than just maintain accurate records—it highlights potential issues, like storage failures, that led to the loss. Fixing problems like these not only prevents future write-offs but also helps you maintain healthier profit margins.

Inventory write-off vs. write-down

Write-offs and write-downs both address inventory losses, but they aren’t the same thing. A write-off is used when inventory has no value left—completely unsellable. It’s removed from your books entirely. A write-down, on the other hand, applies when inventory still has some value, just not as much as before. Its worth is adjusted downward in your records to reflect what it’s actually worth now.

| Write-off | Write-down | |

| Definition | Inventory is completely unsellable and removed from financial records. | Inventory still has some value but is reduced in financial records. |

| Impact on financial records | Inventory is erased as it no longer holds value. | Inventory remains on the books but at a lower valuation. |

| Typical use cases | Spoiled perishables, destroyed or stolen goods, obsolete stock with no resale value. | Seasonal products, outdated electronics or slow-moving items that can still be sold at a discount. |

| Revenue recovery | No revenue can be recovered; it’s a total loss. | Some revenue can be recovered by selling at a reduced price. |

| Accounting adjustment | Inventory asset is fully removed and recorded as a loss. | Inventory value is adjusted downward to reflect its new, lower worth. |

| Purpose | Ensures financial statements don’t overstate inventory value when stock is unsellable. | Helps maintain accurate financial records while recovering part of the inventory’s cost. |

You’d use a write-off for inventory that’s a total loss. Thinkspoiled perishable goods, items destroyed beyond repair or stolen stock. Once written off, the inventory is erased from your financial records—it’s no longer an asset.

A write-down works differently. It’s for inventory that can still be sold but at a lower price. For example, seasonal products that didn’t sellcan be discounted to clear them out. Or outdated electronics might still move, but only at a reduced rate. In these cases, the inventory stays on the books, just at its adjusted, lower value.

When deciding between the two, it all comes down to whether the inventory can still bring in any revenue. A write-down offsets some of the loss by recovering partial costs, while a write-off acknowledges the inventory is a complete loss. Both methods keep financial records accurate—and ensure your books reflect what’s actually happening in your inventory.

When should inventory be written off?

Inventory is written off when it no longer has any value for your business. Writing it off keeps your financial records accurate and prevents inflated asset values.

Spoilage is one of the most frequent causes. Perishable goods like food or temperature-sensitive items such as cosmetics can expire or degrade due to poor storage or environmental issues. Products damaged during transit or mishandled in the warehouse are also unsellable and should be written off to reflect their loss.

Theft—whether internal or external—affects inventory too. Stock lost to theft must be accounted for quickly to keep your physical counts aligned with your financial records. Regular audits are key here. They help catchshrinkage early and reduce the chance of unnoticed losses.

Then there’s obsolescence. Items can lose value due to shifting trends, seasonal changes, or technological advancements. Think outdated electronics or last season’s apparel. If they can’t sell at full price—or at all—it’s better to write them off and free up space for inventory that generates revenue.

Inventory checks are non-negotiable. Routine audits don’t just tell you when a write-off is inevitable; they highlight patterns like recurring theft or frequent damage. Spotting issues early helps you take action to limit future losses and keep operations running smoothly.

5 steps to write-off inventory

1. Assess inventory

The first step is to pinpoint inventory that no longer adds value. Damaged, expired or obsolete items, as well as stock lost to theft, all fall into this category.

You should be conducting regular cycle counts, which will make identifying problematic inventory easier. If you’re not, start scheduling monthly counts for your employees, having them count a portion of your inventory.

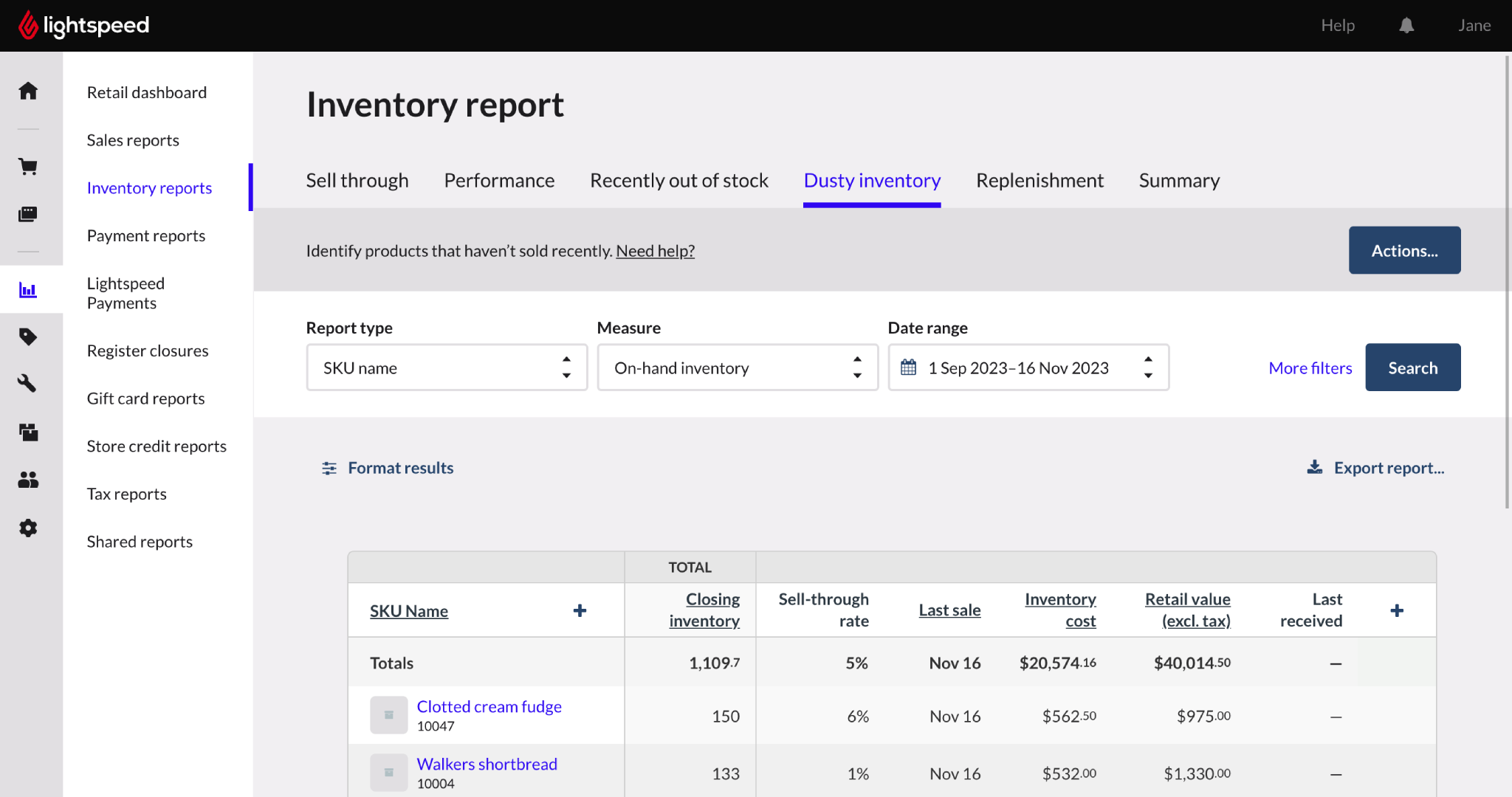

You can also assess obsolete stock by running a report like Lightspeed’s dusty inventory report. It’ll show you what inventory hasn’t sold in a set period—stagnant inventory is ripe for a write-off or write-down.

2. Determine the value to write off

Figure out how much the unsellable inventory is worth. Start with the book value, which is the original cost recorded in your accounting system. If there’s any salvage value—what you might recover from selling or repurposing the item—subtract it. The remaining amount is what you’ll write off.

3. Adjust accounting records

Next, update your financial statements to reflect the loss. Record the write-off by debiting an expense account, like “inventory write-off,” and crediting your inventory asset account. This adjustment ensures your accounting records match the actual value of your inventory.

4. Document the process

Every write-off needs proper documentation. Keep records of inventory counts, reasons for the loss and any supporting evidence like photos or reports. Not only does this help with audits, but it also gives you valuable insights into recurring issues that may need fixing.

5. Dispose or manage inventory

Finally, decide how to handle the written-off inventory. For items that are damaged or expired, follow legal and environmental guidelines for disposal. If the goods still have some value, think about recycling, donating or selling them at a discount to recover part of the loss.

Impact of inventory write-offs

Inventory write-offs hit your income statement where it hurts—profitability. Removing unsellable inventory means recording the loss as an expense, often under cost of goods sold (COGS) or a designated write-off category. When expenses climb, net income drops, making it harder to forecast accurately and straining cash flow. For businesses with slim margins, the impact can be significant.

There’s also the tax piece to consider. Written-off inventory can be a deductible expense, lowering taxable income for the period. But tax authorities don’t take your word for it. They’ll want detailed records, like inventory counts and clear reasons for the write-off, to verify claims. Without proper documentation, you risk penalties or rejected deductions during an audit.

If write-offs are happening too often, it’s a red flag. They’re usually a sign of bigger problems: poor inventory management, bad demand forecasting or inadequate storage practices. Fixing the root causes is key.

Schedule regular inventory checks, use demand planning tools and tighten up turnover policies. It’s far cheaper to prevent losses than to keep writing them off.

“[With Lightspeed,] we’ve grown the business 50% just [by] being able to track our inventory.” Becky Boileau, Marketing Manager, The Plus Factor

Bottom line

Inventory write-offs aren’t just another accounting task—they’re a critical part of keeping your financial records accurate and your profits intact. Ignoring or postponing them can inflate your numbers, throw off your reporting and even create issues during audits. Acting quickly to address losses and keeping clear records ensures your business stays on track and avoids unnecessary risks.

Staying ahead of write-offs starts with good habits. Regular inventory checks, detailed documentation and sound accounting practices make all the difference. When you work with accounting professionals, you can be confident you’re following the right steps and making the most of any tax benefits that come with writing off inventory.

Talk to an expert to learn how better tools can simplify inventory management and help your business grow.

FAQs

Can I write off expired inventory?

You can write off expired inventory since it’s no longer sellable or usable. To do this, record the loss in your financial records to reflect its reduced value. Keep documentation like expiration dates and inventory counts—these details are critical for audits or tax filings.

Is an inventory write-off tax deductible?

Yes, inventory write-offs are usually tax deductible because they count as a business expense tied to lost assets. They lower taxable income, but you’ll need detailed records showing the cause of the loss and the inventory’s original value. A tax professional can guide you on meeting local tax rules while taking full advantage of the deduction.

Is an inventory write-off an expense?

An inventory write-off is an expense—it’s recorded on the income statement and directly affects profitability. It adds to operating costs, often under cost of goods sold (COGS) or a specific write-off category. This ensures your financial records accurately represent your inventory’s actual value.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.