Inventory prices aren’t static, and their value can change depending on several factors in the market. When inventory values go down, businesses need to adjust their financial records to reflect the true worth of their stock.

This is where inventory write-downs come in.

For retailers, write-downs aren’t unusual. Stock spread across multiple locations or channels can lose value for many reasons—obsolescence, damage or even sudden market changes. These losses don’t just affect your inventory; they cut into your profitability and cash flow.

Knowing why inventory write-downs happen, how to calculate them, and what they mean for your business is critical. It helps you manage stock strategically and avoid unnecessary financial hits.

- What is an inventory write-down?

- When do inventory write-downs occur?

- How is an inventory write-down calculated?

- Impact of inventory write-down on financial statements

- Managing and minimizing inventory write-downs

How to Manage Inventory Across Multiple Stores: A Complete Guide

Dive into the essential stock management best practices every multi-outlet retailer should know in this free guide.

What is an inventory write-down?

An inventory write-down happens when a business lowers the recorded value of its inventory because its market value has dropped below what it originally cost. This adjustment ensures financial records reflect what the inventory is actually worth—whether it’s damaged, expired, or outdated. Unlike a write-off, which removes inventory value entirely, a write-down only reduces it partially.

Write-downs are often needed when inventory can’t be sold at full price anymore. Maybe it’s seasonal stock that’s past its prime selling window. Or perhaps it’s slightly damaged but still sellable—just at a steep discount. Either way, the reduced value must be accounted for to keep financial records accurate.

This process follows the accounting principle of conservatism, where losses are recorded as soon as they’re identified. Write-downs show up as an expense on the income statement, lowering net income, and reducing inventory value on the balance sheet. On the other hand, inventory with no remaining value—like spoiled goods or completely obsolete products—calls for a write-off instead.

Clear and accurate inventory valuation is essential for staying financially transparent. By understanding the difference between write-downs and write-offs, businesses can handle inventory issues strategically and avoid unnecessary financial strain.

When do inventory write-downs occur?

Inventory write-downs happen when the value of stock drops below what it originally cost. These situations directly affect financial reporting and need quick action to reflect the inventory’s actual value.

Obsolescence due to changes in consumer demand

Consumer preferences change fast, and inventory often can’t keep up. Last season’s fashion trends or older tech products quickly lose their appeal. When items become outdated, their value drops—meaning you need to write them down to match what they’re worth now.

Perishability in industries like food or pharmaceuticals

Some products have a ticking clock—like fresh produce or prescription medications. Once they’re close to or past their expiration dates, their value plummets. A grocer sitting on unsold dairy products, for instance, must adjust the inventory’s book value to avoid overstating assets.

Damage during storage or transportation

Inventory isn’t immune to accidents. Goods can get damaged while stored or during transit—broken glassware, water-damaged fabrics or dented packaging all reduce their value. If the items can’t sell at full price, you’ll need to account for the loss with a write-down.

Market value declines in fast-changing industries

Industries like tech and fashion are especially prone to sudden price drops. Think of a retailer with last year’s smartphones—they’ll face steep discounts as customers move toward newer models. Or consider seasonal items like winter jackets, which are often heavily marked down to clear shelves. In both cases, a write-down ensures your financial records reflect the real value of what you’re holding.

Identifying these triggers early helps you stay ahead, reduce losses and maintain accurate records.

How is an inventory write-down calculated?

An inventory write-down starts with finding its net realizable value (NRV). NRV is the expected selling price of an item—less any costs needed to prepare, ship or sell it. The write-down is simply the gap between the inventory’s original value and its NRV.

Steps to calculate an inventory write-down:

- Evaluate current market value: Look at what the inventory could sell for in its current condition. Consider factors like market trends, damage or obsolescence that might lower its value.

- Subtract costs to sell: Deduct any costs required to make the sale happen. This includes things like packaging, shipping or necessary repairs.

- Compare NRV to original cost: If the NRV is lower than the inventory’s recorded value, the difference is your write-down amount.

Example calculation:

Let’s say you have 100 units of a seasonal product originally valued at $50 each, for a total of $5,000. Due to declining demand, the selling price drops to $40 per unit, and shipping costs are $5 per unit.

- NRV per unit: $40 (new selling price) – $5 (shipping cost) = $35

- Write-down per unit: $50 (original value) – $35 (NRV) = $15

- Total write-down: 100 units x $15 = $1,500

In this case, you’d reduce the inventory value on your balance sheet by $1,500. It would also appear as an expense on your income statement. By staying on top of your inventory’s value, you can keep your financial records accurate and avoid surprises.

Impact of inventory write-down on financial statements

Inventory write-downs hit the balance sheet first, reducing the value of inventory assets. When stock loses value, its recorded amount drops—shrinking total assets. This change can throw off key financial ratios, like the current ratio, which lenders or investors often watch closely.

On the income statement, the impact shows up as an increase in the cost of goods sold (COGS). Higher COGS cuts into gross profit, which then lowers net income. For larger write-downs, businesses may list the expense separately as an impairment loss to highlight its effect. This separation adds clarity and makes it easier to evaluate how inventory changes affect overall profitability.

There’s also a tax angle. Since write-downs reduce net income, they can lower taxable income, which might mean a smaller tax bill. Of course, local tax rules play a big role here, so it’s smart to consult an accountant to make sure everything checks out. Keep in mind, though, that the financial impact doesn’t stop with the current period—a poorly managed inventory strategy can lead to repeat write-downs in the future.

Tracking how inventory write-downs affect financial statements isn’t just about accuracy. It’s about spotting problems early and keeping your business on solid footing. By keeping a close eye on inventory levels and market trends, you can avoid letting write-downs take a bigger bite out of your bottom line.

Managing and minimizing inventory write-downs

Inventory write-downs don’t have to be a regular part of running your business. With proactiveinventory management and a little planning, you canavoid overstocking and reduce financial losses. It’s all about aligning stock levels with demand and staying on top of your inventory’s condition.

Use demand forecasting and inventory control

To avoid excess stock, focus on accuratedemand forecasting. Look at historical sales data, market trends, and seasonal shifts to plan smarter. Pair forecasting with inventory control methods likeFirst-In, First-Out (FIFO), which ensures older inventory sells first, orJust-In-Time (JIT), which limits stock to what’s immediately needed. Both strategies help prevent products from becoming obsolete or damaged.

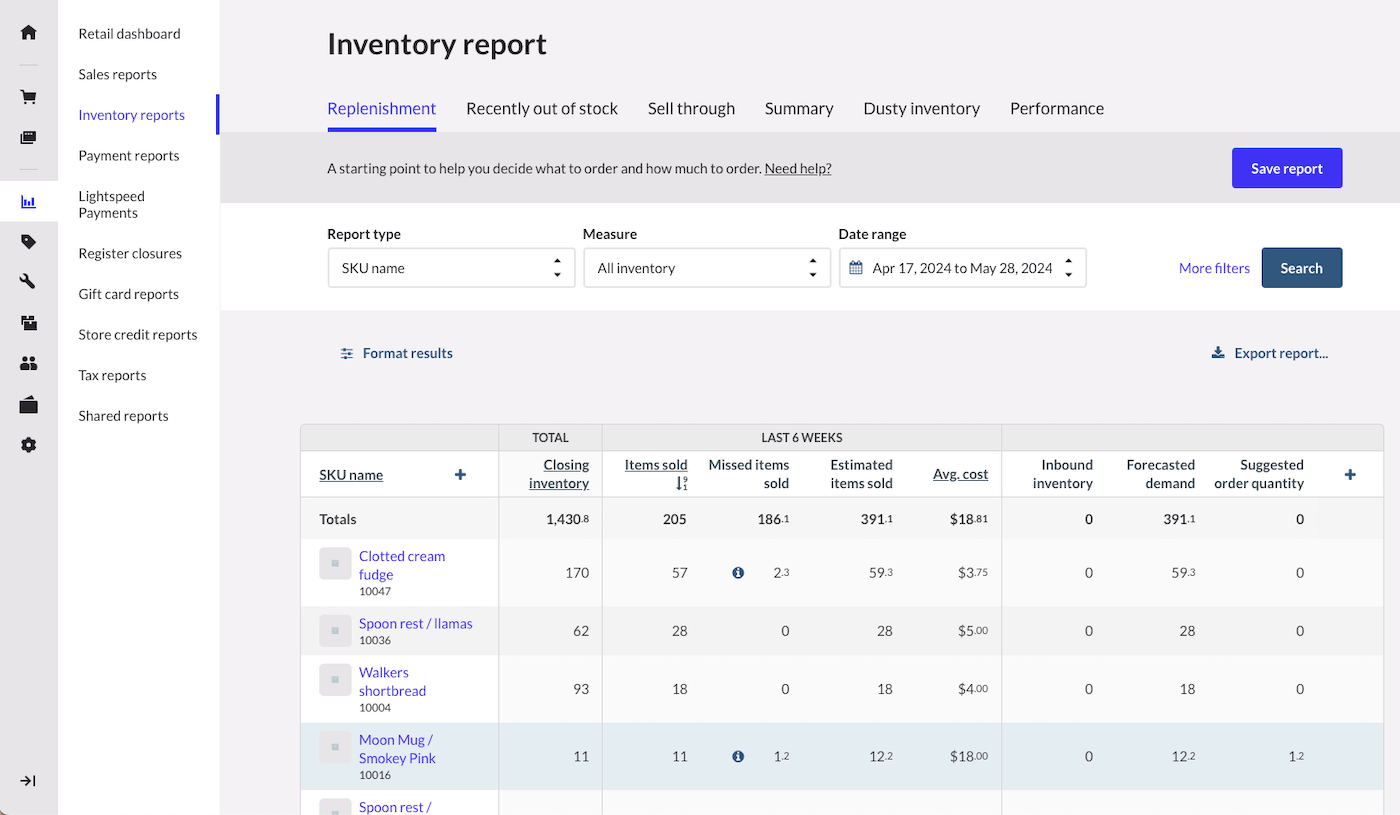

Pro tip: Lightspeed Insights empowers you with actionable data so you can avoid surplus inventory and inventory write-downs. Lightspeed can analyze your inventory data and based on sales trends, our software can forecast demand for you and recommend order quantities. This ensures that you order the optimal amount of inventory, reduce waste and minimize carrying costs.

Conduct regular audits and quality checks

Auditing your inventory regularly is key to catching problems early. Damaged or aging items can be identified and addressed before they lose value. Quality checks during storage also ensure your stock remains in good condition, so you’re not stuck writing down items that could’ve been sold.

Pro tip: If you’re using Lightspeed, equip yourself and your team with Lightspeed Scanner, a mobile app that turns your phone or tablet into a power stock counting device.

With Lightspeed Scanner, you can conduct full and partial inventory counts easily, enabling team members to count items simultaneously from anywhere in the store. Simply scan barcodes into the app to update the quantities. Once you have finished counting all your products, you can click Done. Your count will now be ready for review and approval in Retail POS.

Retailers like Neal’s Yards Remedies use Scanner to stay on top of inventory counts and audits.

“The stocktake process for us used to involve a lot of spreadsheets, and this wasn’t ideal because it leads to mistakes. Now with Lightspeed, people can use devices to scan easily and update the stock record,” says Paul Stephens, Head of Data & Technology, Neal’s Yard Remedies.

Act on slow-moving inventory

Slow-moving inventory sends a clear message: it’s time to act. Discounting or bundling items can help clear them out before they lose even more value. Bundling, especially, creates perceived value for customers and makes it easier to move unsold stock off your shelves.

Protect inventory storage conditions

Where and how you store inventory matters. Climate-controlled and secure storage prevents damage from humidity, temperature changes, or theft. This is especially critical for perishable or delicate goods that lose value quickly when mishandled.

A strategic approach to inventory minimizes write-downs while improving profitability. It’s about keeping stock levels lean, organized, and ready to sell.

Bottom line

Inventory write-downs are part of running a business—they keep your financial records accurate when stock loses value. They can hurt short-term financial performance, but the right strategies make them less frequent. Strong inventory management and forecasting are key to protecting your margins and cutting down on waste.

Staying on top of demand, conducting regular audits and keeping stock levels balanced turn inventory into an asset instead of a liability. Tackling issues like obsolescence, excess stock or damage early reduces losses and strengthens your business. It’s not just about avoiding financial hits—it’s about running a smarter, more resilient operation.

Watch a demo to see how the right tools can help you streamline inventory and drive growth.

FAQs

Can I write off expired inventory?

You can write off expired inventory if it no longer has resale value. This adjustment removes the inventory from your accounting records by recording the loss as an expense. To stay compliant with accounting standards, keep detailed documentation—like inventory counts and expiration records.

Is an inventory write-off tax deductible?

Yes, inventory write-offs are usually tax deductible because they’re treated as business expenses. They lower your taxable income for the period when the write-off happens. Just make sure your records are thorough and align with local tax rules in case they’re ever reviewed.

Is an inventory write-off an expense?

An inventory write-off is always recorded as an expense on your income statement. Smaller write-offs are often included in the cost of goods sold (COGS). Larger write-offs, however, may appear as their own line item to clearly show their impact on your financials.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.