Understanding credit card processing fees is one of the more difficult parts of being a business owner. You’re probably already familiar with interchange plus pricing, flat rates and tiered pricing. In this article, we aim to simplify these terms and help you understand which approach is right for your business.

We’ll explain the ins and outs of these pricing models, covering the following topics:

- Credit card processing overview

- Credit card processing fees

- Flat rate pricing

- Interchange plus pricing

- Tiered pricing

- Deciding which structure is right for your business

Everything you need to know about payment service providers

Learn how to negotiate the best rate for your business.

Credit card processing overview

Before comparing interchange plus, flat rate processing and tiered pricing, let’s dive into a basic overview of how credit card processing works.

There are several parties involved in a typical credit card transaction:

- Issuing bank. This is the organization that issues a credit card to a customer. Common examples include Chase, Citibank and Bank of America.

- Credit card networks. These entities work with issuing banks to distribute their credit cards. Examples include Visa, Mastercard and Discover.

- The acquirer. Colloquially referred to as a processor, this is the middle man that communicates with the issuing bank to approve or decline a credit card transaction. These are also called merchant service providers (MSPs) or Independent Sales Organizations (ISOs).

Behind every seemingly simple swipe is a complex chain of communication between these three entities. When a customer swipes or dips their card, the transaction is sent to the issuing bank via the acquiring bank. The issuing bank then approves or declines the transaction and then funds are deposited into the merchant’s bank account. The credit card networks provide the technology and communication infrastructure that facilitates electronic payments.

Credit card processing fees

Now let’s learn about the fees you’ll need to pay to the processor. These fees inform the pricing model used by the credit card processing companies, and are a precursor to the processing rate you’ll pay to both interchange-plus and flat rate processors. They vary based on where you do business.

Wholesale rate

This percentage fee (usually a per transaction percentage) is set by both the issuing banks and the credit card companies like Visa and Discover. Because of this, it’s not possible to negotiate this rate. It’s the same for all merchants.

However, this rate will differ depending on the type of transaction. For example, a keyed-in transaction will always have a higher fee than a swiped one. Wholesale rates are commonly called interchange rates or an interchange fee.

Processor markup

This is a per-transaction fee that processors will add on top of the interchange rate. Usually, it’s around $0.10 per transaction, but this can vary between processors and transaction types. Because this is set by the processor, there’s some room for negotiation. If you transact at a high volume, you can often negotiate a lower markup.

Miscellaneous fees

If you work with a good processor, you shouldn’t have to deal with many more fees than the above, but there are a few you might need to pay. For example, credit card terminal rental fees, PCI compliance fees, payment gateway fees, instant deposit fees, a subscription price that’s a flat fee per month and more. Some of these fees may pay for services you actually want and use, and that’s fine. Just try to minimize unnecessary fees or hidden fees to keep your costs down.

Related: Find out how to spot hidden fees and negotiate with your payment processor.

Interchange plus vs flat rate vs tiered pricing

Consult the table below for a quick breakdown of the pricing models before we get into details.

| Feature | Flat rate pricing | Interchange plus pricing | Tiered pricing |

| Transparency | Medium. Single fixed rate covers all transaction types. | High. Costs are broken down by interchange fees plus a fixed markup. | Low. Rates are grouped into a few tiers, but specifics of categorization can be unclear. |

| Simplicity | High. Easy to understand and predict. | Moderate. More detailed understanding of fees required. | Low to moderate. Simpler than interchange plus but can have confusing tier distinctions. |

| Cost predictability | High. Consistent charge per transaction. | Low. Variable costs depending on card type and transaction details. | Low. Depends on how transactions qualify into tiers. |

| Suitability | Best for small businesses with low transaction volumes. | Best for small or growing businesses with varying transaction types, seeking transparency. | Not suitable for most businesses, but maybe for those with consistent transaction types that mostly qualify for lower rate tiers. |

| Cost effectiveness | Potentially higher overall costs, especially for businesses with larger transaction volumes. | Can be more cost-effective for businesses that manage a large volume of transactions. | Can be cost-effective if most transactions fall into the lowest rate tier, but potentially expensive otherwise. |

| Complexity in management | Low. Very straightforward management and reconciliation. | High. Requires detailed tracking and understanding of fee structures. | High. Need to manage and categorize different transaction types effectively. |

Flat rate pricing

Flat rate pricing is exactly what it sounds like. When you use a flat rate processor, all of your transactions fall under one flat rate. This rate includes both the interchange or wholesale rate plus the processor’s markup.

Most payment providers will offer slightly different rates for card-present (in-present) transactions vs. card-not-present (online) transactions. For instance, Lightspeed’s rate for card-present transactions is 2.6% + 10¢, while the rate for card-not-present transactions is 2.9% + 30¢.

Pros of flat rate credit card processing

- It’s easy to understand. Credit card processing fees and pricing can be pretty complicated. It’s made worse when processors go out of their way to be as non-transparent as possible. With flat rate processing, you pay the same amount for every transaction, which can be refreshingly simple.

- It’s predictable. As a small business owner, life likely keeps you guessing, but some measure of predictability is the key to staying sane. With a single rate it’s easier to predict your processing expenses month to month, which can help you budget effectively.

- It makes reconciliation simpler. Since each transaction incurs the same predictable fees, the reconciliation process is easier. You’ll save time when it comes to checking statements and managing accounts.

- No hidden fees. Because of its simplicity, flat-rate pricing means fewer fees for business owners, unlike other more complex pricing models. This is great for first-time business owners who want an absolute no-fuss option.

- It allows you to accept elite cards without extra cost. Certain cards (we’re looking at you, American Express) charge higher rates. Those rates often exceed the low, flat processing rates available today from processors.

Cons of flat rate processing

- A lack of transparency. The simplicity and predictability of flat rate pricing can come at a cost. The processor hides both the interchange rate and their markup from you. This makes it impossible to understand why you’re paying what you are. Since you don’t know the details of what you’re paying, it makes it more difficult to shop around to find the best price.

- Some transactions are more expensive. As we mentioned earlier, there are many different types of transactions, and each has a different interchange rate. Some are more expensive and some are less. When all transactions cost you the same amount, you lose out on any cost savings you might get based on the transaction type.

Should you choose a flat-rate payment processor?

As always, you know what’s right for your business. Flat-rate pricing is a very popular method, so you can’t necessarily go wrong. There are plenty of payment processors out there that offer flat-rate pricing, but the type of business you run matters.

If you run multiple store locations or are an omnichannel operator, flat-rate pricing is beneficial because of its predictability. If you’re juggling multiple stores and have a high monthly sales volume, knowing you’re paying the same rate for each transaction gives you one less thing to worry about.

Plus, for medium- and high-volume businesses, you can usually negotiate rates with payment providers to find the deal that best suits your needs. This could result in you paying lower per-transaction fees. Plus, for a larger business, being able to accept all types of cards without paying extra is a huge plus—a bigger customer base means you’re more likely to see a variety of credit cards.

Small businesses can also negotiate processing rates, so this pricing model offers plenty of flexibility.

For reference, companies like Lightspeed and PayPal use a flat-rate pricing model.

Interchange plus pricing

The alternative to flat rate processing is interchange plus processing. Similarly, the name describes this type of pricing as well. You pay the interchange rate plus the processor’s markup. The biggest difference is that your monthly credit card statement will show you the exact fees that make up each transaction.

Pros of interchange plus pricing

- Transparency. While it has the potential to make your credit card statement more complex than you might like, with interchange plus you’ll always see the fees you’re paying for each transaction. Not only does this help you know if you’re paying a fair price, it helps you shop around to find the best price.

- It can be good for growing businesses. As your transaction volume grows, this pricing model can become increasingly economical. This is because the consistent markup doesn’t change.

- Benefit from lower interchange fees. If card networks decrease these fees, these savings are directly passed on to business owners. This is unique to interchange plus pricing.

- Some transactions are more affordable. For example, debit card transactions are typically less expensive than credit.

- Good for bookkeeping. There’s a flipside to this that we’ll discuss below, but the detailed statements and breakdown of costs with this pricing model allow for more precise financial analysis.

Cons of interchange plus pricing

- It’s more complex. Because each transaction has a different price associated with it, and you can’t predict the exact number and type of transactions you’ll get each month, your costs may become harder to predict.

- Costs can vary. Speaking of predictability, interchange plus pricing can sometimes be the opposite. Since the fees vary based on the type of card used and transaction details, budgeting may be a little more time consuming.

- Some payments are more expensive. Certain charges, like those from elite cards, have high interchange rates associated with them. When processor fees are added to those high rates, the resulting fee might be more expensive than a flat rate pricing model.

- May require more work to reduce costs. Being aware of all the costs associated with transactions can actually be a double-edged sword for some businesses. You may feel the need to ask customers to use debit cards or steer them away from using more expensive credit cards to help reduce costs.

The interchange fees of some card networks

Here are some of the interchange costs of various card networks.

| Card network | Fee range |

| Visa | 0.05% + $0.22 to 2.40% + $0.101 |

| Mastercard | 0.05% + $0.21 to 1.76% + $0.2011 |

| American Express | 1.35% + $0.10 to 3.15% + $0.102,3 |

Debit card interchange fees are usually lower than credit card fees. Either way, there’s a wide range of fees depending on the card network—something to keep in mind when you’re considering which pricing model to go with.

Should you choose an interchange plus model?

For smaller business operations, interchange plus pricing might be useful because it provides a breakdown of the exact fees per transaction. This can provide valuable insight into where you can cut costs, monthly fee breakdowns and more. Ultimately, if you want eyes on the details of every single transaction, interchange plus could be the way for you.

However, if your business has a high sales volume or multiple locations, interchange plus pricing could become unnecessarily complicated. We talked about the potential of cutting costs using this model, but that may not be worth the complexities of this model.

You probably already have accounting processes in place to provide detailed overviews of your sales history and transactions. Plus, if you’re not paying close attention, its unpredictability may lead to you paying higher fees overall, compared to flat-rate pricing, where the fees per transaction are always consistent.

Tiered pricing

Processors that use a tiered pricing model or bundled pricing are hands down the least transparent type of provider and you’ll typically end up paying more than necessary.

But, it’s useful to understand what tiered pricing is so you know which processors to avoid.

Tiered pricing consists of a transaction fee and processing fee. Transactions are separated into three categories: qualified, mid-qualified or non-qualified. The fixed rate varies based on the tier the transaction falls under.

Processors who use tiered pricing don’t usually disclose how transactions will be categorized. This makes it inherently untransparent, because you may be misled into thinking that you’re getting a good deal, when really the payment processor just quoted you the cheapest tier.

After you’re locked in to a contract, you’ll get charged more because the provider will categorize transactions into pricier tiers.

This is commonly known as a bait-and-switch tactic. Processors will advertise low rates for their qualified tier to attract businesses, but then classify most transactions under the more expensive tiers (mid-qualified and non-qualified).

The deceptive nature of tiered pricing models makes them a bad option for any business owner—we recommend staying far from providers that offer this model, no matter how good they make the terms sound.

Which is right for your business?

As a side note, we encourage you to avoid processors that use a tiered pricing model or bundled pricing at all costs. These are hands down the least transparent type of provider and you’ll almost always end up paying more than necessary.

Choosing between flat rate pricing and interchange plus pricing isn’t always an easy decision. Payment processing is an integral part of most businesses. And as such, you’ll want to take the time to do the appropriate research, model out processing fees based on your average transaction value, and fully understand the pricing plan for each of the processing companies.

Most modern processors, like Lightspeed, use a flat rate model, because it’s generally simpler for all involved parties.

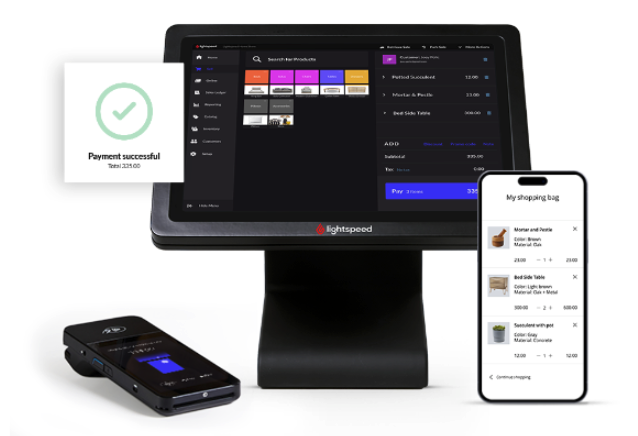

Transparent pricing in action

Lightspeed retailer Melissa Joy Manning switched to Lightspeed partly because of her old processor’s lack of transparency.

“There was very little transparency in fees, and it was difficult to figure anything out,” owner Melissa Joy Manning said about the situation.

That paired with her inflexible POS system ultimately led her to Lightspeed. “With Lightspeed, we’re saving a lot of time in the reconciliation process. We’re also saving a lot of money in fees, and it’s made the business much faster, much easier and so much cheaper to operate on that end.”

Using a fully embedded payment solution–one that is natively built into a software company’s existing suite of products–goes a long way.

Your POS and payments systems are fully connected (going one step further than an integrated processor), and if you have questions you can interact with the same support team.

Reconciliation is much easier, and there’s less chance for human entry error, since the entire payment from beginning to end is managed by the same provider.

Related: Read more about embedded payments in our in-depth article.

We at Lightspeed offer a low flat rate and a customized rate for businesses that process more than $250k. Talk to an expert to learn more about Lightspeed POS and Payments.

Editor’s note: Nothing in this blog post should be construed as advice of any kind. Any legal, financial or tax-related content is provided for informational purposes only and is not a substitute for obtaining advice from a qualified legal or accounting professional. Where available, we’ve included primary sources. While we work hard to publish accurate content, we cannot be held responsible for any actions or omissions based on that content. Lightspeed does not undertake to complete further verifications or keep this blog post updated over time.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.