In many ways, Black Friday marks the start of the holiday shopping season for consumers. Fresh off Thanksgiving, consumers flocked online and in droves to malls, outlets, big-box stores and other shops to take advantage of deals, discounts and sales. But how can you ensure your business transitions smoothly from this whirlwind of a holiday shopping season?

That’s what we’re here to talk about.

Starting on Black Friday and Cyber Monday (or even earlier), consumers are inundated with deals both online and offline, and the retail landscape has become more crowded–and competitive–as a result. According to Deloitte, the expected average spend per consumer is set to rise to $650, a 15% year-over-year increase.

After the sales frenzy, it’s crucial for you to prepare your business for the year ahead, most pressingly for the slower winter months. In this article, we’ll discuss how you can transition smoothly from the holiday shopping season and recalibrate your finances along the way.

These are the steps we will cover:

- Review and assess financial outcomes

- Manage your cash flow

- Analyze customer behavior

- Create strategies for refunds and returns

- Evaluate marketing spend

Become more profitable using data

Learn what kind of data drives profitability and how you can start using it to inform your decisions today.

Assess your financial outcomes

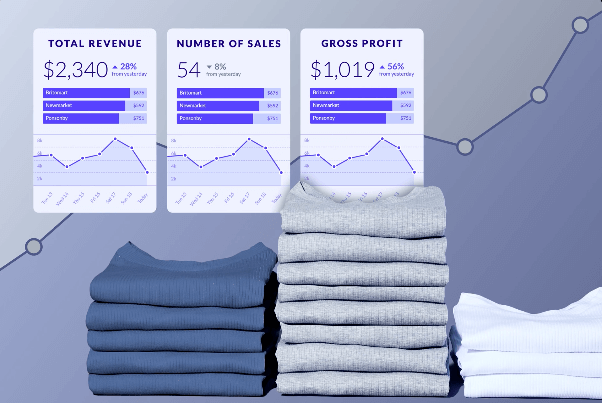

First things first: a thorough review of your sales data, profit margins and impact on inventory.

1. Review sales data

Here’s where you dig into the data you gathered over the course of your holiday season sales. Depending on the bookkeeping software you use, your total revenue should be generated automatically based on the dates you’ve selected. However, the equation is as follows:

Total Revenue = ∑(Price per Unit × Quantity Sold)

Next, review any sales trends that may have contributed to your revenue. Track information by SKU, brand, category and more to gain a clear picture of customer preferences. From there, you can identify top-performing products and services over your holiday shopping sales period. Keep note of the discounts, promotions and ad campaigns you ran associated with these items to provide context for future reports.

2. Evaluate profit margins

Now it’s time to take a look at your profits over the holiday sales period. Using integrated accounting software can save you a lot of time and make the process more efficient. Compare gross sales to net profit to gain an accurate picture of how much your business earned after expenses.

Gross sales represent the total revenue generated from all sales before deducting expenses. Net profit is the profit that remains after deducting all costs and expenses from gross sales.

The equations to compare these two metrics are as follows:

Gross sales

Gross sales = ∑(Price per Unit × Quantity Sold)

Net profits

Net Profit = Gross Sales − (Cost of Goods Sold + Operating Expenses + Taxes + Other Expenses)

Comparison metric

Net profit margin (%) = (Gross sales Net Profit) × 100

During the bookkeeping process, account for all discounts, promotions and operational expenses. This will ensure you gain the most accurate understanding of these crucial numbers.

3. Impact on inventory

Pull up your inventory reports and assess remaining stock levels. This will help you plan accordingly for your future product lines as well. Take note of sold-out items, overstocked items, and other notable metrics. Compare stock levels to the same period last year and note any significant changes.

For comparing items that have the same markup, consider using the retail inventory method. Consult our in-depth guide to learn how.

Manage your cash flow

Cash flow struggles are a primary reason why businesses fail.

With multiple revenue streams–for instance, if you sell in-store, on your ecommerce site and on social media or marketplaces–your cash flow can get a little complicated. As you assess financial outcomes, consider whether there are any factors impeding your cash flow. That can include buy now, pay later (BNPL), where customers pay in installments monthly or biweekly via a service like Klarna or ShopPay.

If your business brought in significant revenue over the holiday sales period, you’re hopefully in a strong spot, cash flow wise.

Delayed payments can also impact your cash flow. Typically, using a third-party payment processor or vendor for your payments can lead to delays during peak selling periods. That can be mitigated before BFCM by using an integrated or embedded payment processor–one that is built-in to your existing POS software. All your transactions and sales data live in one place, recorded in real-time, and you’ll get paid on time as a result.

A solution like Lightspeed Payments even offers same-day payouts.

It’s also important to prioritize making key payments. For instance, paying vendors on time for the year ahead and in advance will not only keep you organized, but you can also save a little on costs. Restock inventory strategically, using your reports and financial data to make decisions based on the sales trends you uncovered during BFCM.

Although you’ve probably been planning for year-end taxes, holiday bonuses or additional marketing campaigns months in advance, account for these expenses and their impact on your cash flow during your post-BFCM planning. Allocate resources for these upcoming expenses.

Analyze customer behavior

Pull customer reports to assess customer purchasing patterns and demographics.

1. Customer insights

While you may already feel confident in your understanding of your customer demographics, reviewing metrics during crucial sales periods can ensure more precise inventory planning. Not to mention, you get greater insights into customer preferences, allowing you to improve the overall buying experience for your shoppers next year.

Furthermore, using these analytics, you can identify new vs. returning customers. Again, this information will inform future marketing campaigns, loyalty programs and inventory planning, and your overall strategy for customer retention.

Did you know? With Lightspeed, you can generate reports on sales, inventory and customer data, generated to your unique needs. You’ll find in-depth information that you can use to make high-level business decisions that boost growth.

2. Leverage loyalty opportunities

As you evaluate your post-holiday sales finances and evaluate areas of opportunity, it’s a good time to plan strategies to convert first-time buyers into repeat customers. That includes marketing planning, loyalty programs and customer outreach.

Consider creating personalized marketing campaigns using the tools and automations at your disposal. Customer segmentation is super useful, allowing you to target exact customer preferences and capitalize on purchasing patterns specific to each segment.

Customers who feel valued are more likely to become loyal. To perfect your customer experience, consider planning the following strategies for the new year:

- Ensuring seamless transactions with embedded payments

- Personalized marketing campaigns

- Loyalty programs that offer rewards and perks

- Upselling products that align with customer interests

Lightspeed retailer Opulence of Southern Times can attest to the importance of loyalty programs. The luxury, multilocation bed-and-bath retailer switched to Lightspeed for its “intuitive and user-friendly” platform, owner Tanda Jarest says.

Tanda cites the ease of accessing and engaging with her customer base through Lightspeed, specifically with Loyalty–“in the click of a button,” to be specific. She also launched a loyalty program that has helped her foster deep customer relationships, boosting repeat business and improving customer satisfaction.

Read the full case study here.

Implement strategies for refunds and returns

Refunds are an inevitable fact of busy sales periods. In fact, December sees the highest volume of returns on average.

Whether gifts don’t work out, customers’ minds change or a product is defective, there are plenty of reasons why shoppers may initiate returns. That’s why it’s important to set aside funds for potential returns or exchanges, ensuring that your cash flow won’t take a dent, since the expenses will have been planned for.

One thing to consider prior to big sales is providing flexibility and variety in your return policy. Providing multiple return options can help recapture revenue, according to AfterShip data. They point out that including an exchange policy can improve revenue.

For more details on creating a return policy, refer to our guide.

Evaluate marketing spend

It’s time to review the effectiveness of your holiday campaigns, promotions and ads, plus refine future campaigns.

Calculate ROI on paid ads, social media promotions and email campaigns. To accurately gauge the profitability of these campaigns, compare your sales from the holiday sales period to the months prior.

Firstly, track revenue directly from campaigns using the software you used to deploy campaigns. For paid ads, UTM tracking, ad platform reports and analytics tools should give you information related to measuring sales conversion.

For email campaigns, software like MailChimp (or similar) should track clicks and purchases. Social media platforms have similar analytic capabilities, including tracking revenue attributed to clicks and promotions.

Next, summate all campaign-related expenses to calculate costs. That includes:

- Ad spend

- Creative production costs

- Marketing tools

- Employee hours

Now that you have the relevant information, apply the following formula:

ROI (%) = (Cost Revenue − Cost) × 100

After you’ve calculated your ROI from campaigns, apply your findings and data to future campaigns. Track areas of growth, compared to similar campaigns you held this time last year (if applicable), as well as potential areas of improvement. That could mean optimizing your emails, refining your links and more, to maximize ROI on future campaigns.

Plan for your next sales cycle

With the information you have gleaned from your BFCM and other holiday sales, you can forecast inventory with confidence. Inventory forecasting uses historical data and information on your past sales cycles to give you a precise idea of optimal future inventory levels. This will help prevent overstocking, as well as stockouts. With refined inventory levels, you can maximize sales and boost inventory turnover.

Consider using a solution with built-in inventory forecasting capabilities. Lightspeed Insights, for example, does that and more, including forecasting for non-seasonal replenishment, automatic purchase orders and reports generated to meet your unique needs.

Further, planning a financial buffer–essentially building reserves to handle your next major sales event–can help with operational efficiency. You can define this while you work out your long-term budget for the upcoming quarter based on your performance in Q4.

Position yourself for the year ahead with confidence

The busy holiday shopping season is always an opportunity for growth for retailers. For retailers looking to grow their business at an even faster pace, consider using Lightspeed Retail, an all-in-one POS and payments platform.

To find out how Lightspeed can power your business, watch a demo today.

Editor’s note: Nothing in this blog post should be construed as advice of any kind. Any legal, financial or tax-related content is provided for informational purposes only and is not a substitute for obtaining advice from a qualified legal or accounting professional. Where available, we’ve included primary sources. While we work hard to publish accurate content, we cannot be held responsible for any actions or omissions based on that content. Lightspeed does not undertake to complete further verifications or keep this blog post updated over time.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.