Customer acquisition cost is on the rise—one study says it increased as much as 222% between 2013 and 2022. Research by Ecwid by Lightspeed indicates that the trend is widespread, which means even if your business isn’t currently worried about high customer acquisition cost yet, you probably should be soon.

But it’s not all doom and gloom. Rising costs can be countered if you play your cards right. By making a plan to maximize customer acquisition while minimizing the cost, you can ensure you keep a steady stream of shoppers coming through your doors without feeling as much of the pinch.

In this article, we’ll go over:

- What customer acquisition cost is

- The customer acquisition cost formula

- Customer acquisition cost benchmarks and statistics

- How to decrease your customer acquisition cost

Profit and Loss Template

Examine the financial health of your business by highlighting exactly how much revenue is being generated versus what’s being spent.

What is customer acquisition cost?

Getting traffic through the door is the key to creating a successful retail business, whether it’s getting found online or attracting new customers to your physical store. This might seem easy if you already have a great product or service, but in practice, this goal can be a bit more difficult to obtain.

The old adage about spending money to make money still rings true. In order to get foot traffic, it’s necessary to invest in methods that will attract and retain these customers, with the ultimate goal of increasing ROI.

This effort is generally known as Customer Acquisition Cost (CAC).

While it may seem counterintuitive, a new business will have a relatively easy time luring in new customers without burning through excessive amounts of money. Most businesses enjoy a period of relative prosperity when they’ve just set up shop, but soon enough the business can dry up without a CAC plan.

Regardless of your business model, it costs money to entice customers. This could be the toy store holding an in-store event, a clothing store featuring giveaways or a local watering hole offering a ladies night. The cost of the event is generally much less than the resulting sales.

How to calculate customer acquisition cost: customer acquisition cost formula

CAC is relatively simple to calculate but can be difficult to quantify.

Begin by adding up your marketing expenses and dividing them by the number of new customers acquired through those means.

For example, if you spent $10,000 in marketing last month and you received 1,000 new customers as a direct result of your marketing efforts, then your CAC is $10.

The result is a number that will increase as your retail business becomes more and more successful. If this number becomes higher than your customer lifetime value (CLV), immediate adjustments need to be considered.

Obviously you want the cost of acquisition to be less than the value the customer brings to your business. The ratio should be around three to one—ideally, you should spend one dollar in order to bring in three dollars from each customer.

Sounds pretty simple, but the more your business grows, the more your CAC will increase. The goal is to manage the increasing costs so you don’t pay more than you have to without neglecting customer acquisition.

Customer acquisition cost statistics

Customer acquisition cost benchmarks

Differing industry conditions make for different customer acquisition costs. Some retailers in heavily competitive markets will have to pay more at minimum than others.

While you always want to be focusing on maximum return for minimum spend, if your competitors are going above and beyond, you’ll miss out. Keeping an eye on your customer acquisition costs will help you ensure you’re not spending a disproportionately high or low amount for your industry.

Here are some customer acquisition cost benchmarks for average spend on paid social and pay-per-click advertising in top a few retail industries:

- Automotive: $234

- CBD: $72

- Medical devices: $126

- Ecommerce (as a whole): $68

And, to contrast, their organic customer acquisition cost—the cost of maintaining social media and SEO rankings:

- Automotive: $178

- CBD: $87

- Medical devices: $120

- Ecommerce (as a whole): $64

The average CAC is getting higher

Regardless of your industry’s current benchmark, CAC is growing.

Ecwid by Lightspeed recently surveyed retailers about their evolving CAC costs, and found that over 30% saw significant increases in how much they’re paying for each customer, with 65% reporting some increase overall.

Nearly half (45%) of those we surveyed have raised prices as a result, and even more are considering it.

But without other tweaks to your offering, higher prices may just turn budget-conscious customers away. Over half of survey respondents are putting more focus on customer retention to offset high CAC—a winning strategy, given existing customers generally make up the bulk of your profits.

5 ways to decrease your customer acquisition cost

1. Provide exceptional customer service

While spending can help with customer acquisition, one old, tried-and-true method can also be the most effective: customer service.

While customer service alone is not going to make your business stand out above the rest, it can be a sure-fire way to gain lifetime customers on their first visit, reducing the costs required to keep them coming back until they convert into a paying customer.

Many retail businesses focus on marketing as their main customer acquisition strategy and neglect the customer service aspect. Ask pretty much any retail store and they will tell you how incredible they are at meeting the needs of their customers—when in reality, they could use a little work.

Make it a priority to invest in customer service.

Some ways to improve your customer service include:

- Investing in employee training

- Opting for a point of sale system (POS) with mobile capabilities (this will help reduce wait times dramatically)

- Personalizing service (think customer loyalty programs)

Investing in customer service, whether that be training or a POS, should be included in your CAC budget.

2. Have a lot of positive customer reviews—and address the negative ones

Reviews can be a double-edged sword. We love them when they’re good, but they can make our lives extremely difficult when they’re not.

Reviews can bring in customers just as easily as they can scare away potential clients.

Approximately 82% of American adults say they read online reviews before a new purchase. With more than two-thirds saying they believe or are influenced by these reviews.

Needless to say, reviews can be extremely valuable for lowering your CAC as they have become one of the go-to ways to discover new businesses.

And the more reviews you have, the better—don’t sweat the negative reviews.

Many reviews are negative and that’s because when customers have a positive experience, they generally don’t let the world know. A negative experience is usually shouted from the rooftops. Take the time to respond to negative reviews. This will give you the chance to turn a negative experience into a positive one.

Tip: By asking for positive reviews when the customer is still riding high from the experience, you can amass a stockpile of great reviews.

3. Offer incentives to keep coming back

Consumers love incentives.

Promotions, giveaways or loyalty programs all have the potential to increase customer engagement. If customers have the incentive to return over and over again, they are more likely to spend more over the lifetime of the relationship.

Everyone loves free stuff. Loyalty programs are a prime example of this type of marketing. For example, coffee shops are known for this type of marketing. Many of them offer loyalty programs that motivate customers to purchase coffee on a regular basis. With each purchase, the customer gets closer to the goal of getting a free coffee.

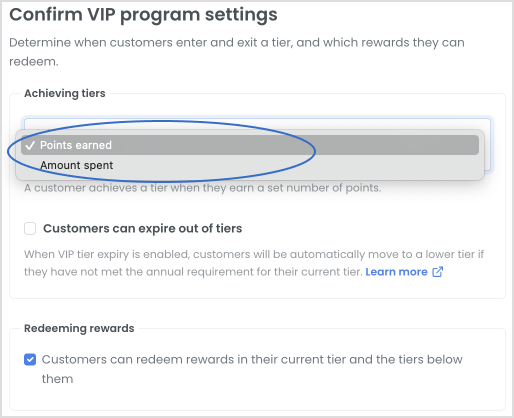

Retailers can benefit from this kind of loyalty incentive as well. Scotty’s Makeup and Beauty uses Lightspeed to power Scotty’s Reward Program, where customers earn a point for every dollar spent… until they hit 1500 points, at which point their earned points double for extra incentive.

Setting up VIP tiers is easy with Lightspeed Advanced Marketing.

Setting up VIP tiers is easy with Lightspeed Advanced Marketing.

Next time the customer needs makeup, they are going to return to Scotty’s for the incentive. This type of incentive-based marketing comes with an inherently low CAC and a high CLV.

4. Prove you can solve their problem right away

When you have a flat tire, you need a tire shop. If your watch battery dies, you need somewhere that replaces watch batteries and when your pregnant partner needs a bowl of ice cream, you find it at all costs.

Every consumer carries with them a problem to be solved, even if they don’t know they need a solution. It is up to you to figure out what that problem is and offer a solution immediately. Retail businesses that understand this concept are the ones that are thriving.

By using data from your POS retail reports or even through your loyalty programs, you’ll be able to get a closer look at what your customers’ needs, wants and struggles are, and figure out how your business can cater to them.

This is truly the holy grail of decreasing your CAC and running a successful business. It is also the most difficult. Make it a priority to work with a POS that has an advanced analytics module to stay ahead of the game.

5. Optimize the payback period

If it costs you $100 to acquire a customer, then the amount of time it takes for them to pay you $100 dollars is the payback period.

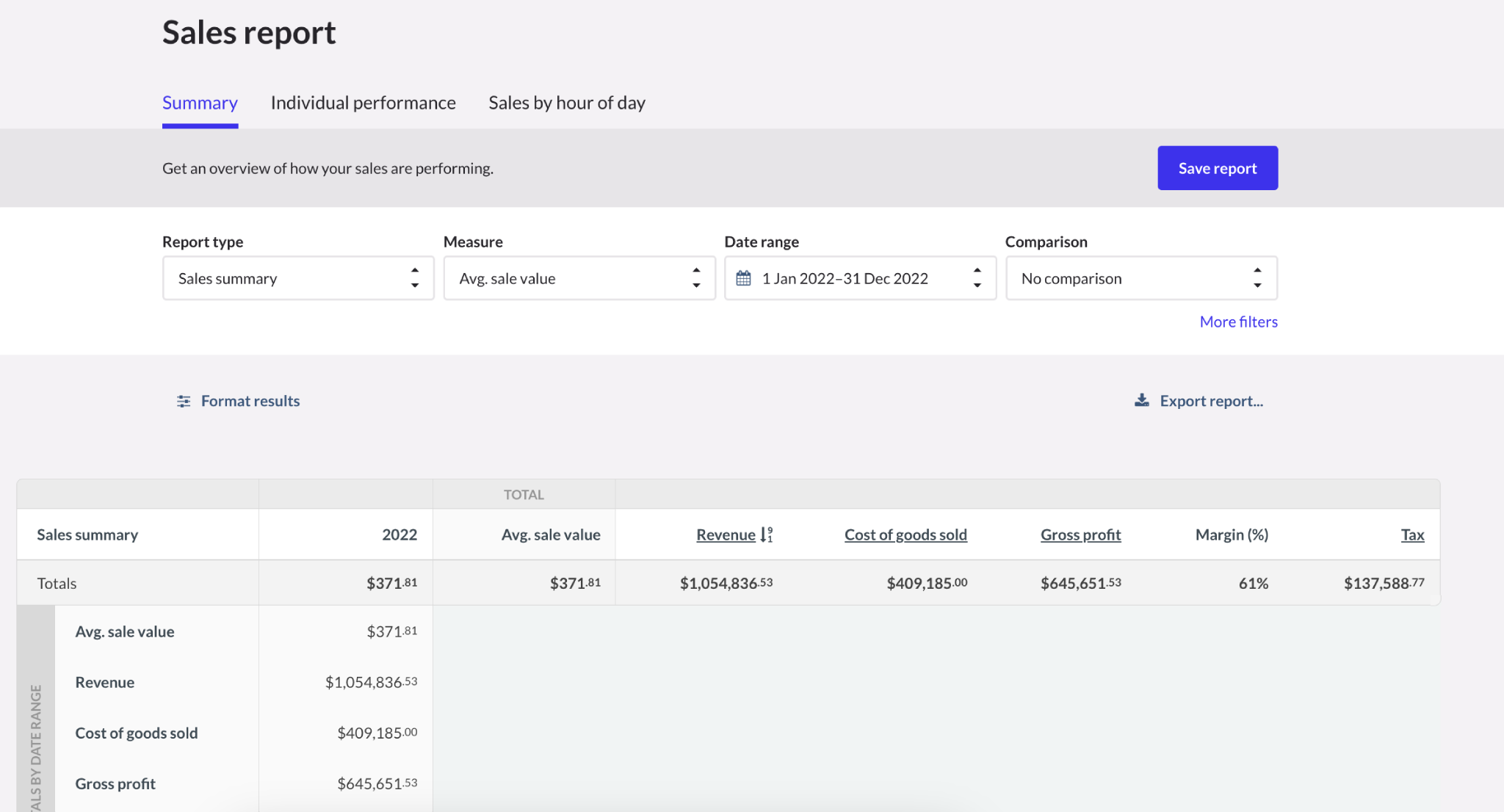

You can judge your average payback period by calculating your customer acquisition cost and contrasting it with your average sale value. If your average sale value is $47, then it’ll take roughly two visits for a customer with a CAC of $100 to move out of the payback period. The higher your CAC, and the less often customers return, the longer your payback period is. You want it to be as short as possible.

Checking on average sale value is easy with Lightspeed Advanced Reporting.

The payback period is both a personal benchmark and an opportunity for improvement.

As a benchmark, it gives you a look into how efficient you’re being with your customer acquisition costs. If you’re spending below your industry’s average, but taking too long to make it back, you’re still not going to break even. You either need to lower your customer acquisition costs (potentially by refocusing the channels you’re using to reach customers) or speed up your payback period—this is where you can look at it as an opportunity for improvement.

Higher value baskets more often will shorten the payback period considerably, so think about how you can make that happen. You could combine some of our other tips, like sending out incentives to come back immediately (potentially tied to giving your business a review after their first visit).

Customer acquisition matters

Customer acquisition costs are rising, but you don’t need to be resigned to tighter margins. Beyond just raising prices to cope, there are tactics you can take to shorten the payback period and increase customer value.

Companies that understand the drive behind their customer’s purchase and what that customer acquisition entails are a step ahead in building long term strategies for their business and long term relationships with their customers.

To find the data you need and then capitalize on it, you need an efficient retail management system powering your business. One that keeps you informed, streamlines sales and helps employees wow potential customers on their first visit.

That system is Lightspeed—watch a demo and see what we’re all about.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.